Will $BLUM be the next big utility token in the DeFi space, or is it yet another hyped launch? Having the official AMA session concluded and the team dropping the bomb about airdrop, TGE, and token utilities, the token is now entering a triple-x phase of excitement. Being backed by a focused roadmap and a Telegram-native trading mini-app, Blum headlines precede the upcoming airdrop snapshot of June 7, 2025.

So, let's break down the airdrop, product roadmap, and the long-term price potential while trying to assess if the coin can hold any value beyond the initial hype.

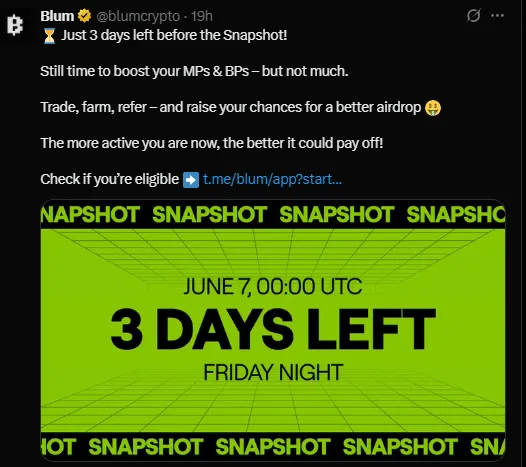

The co-founders of Blum—CEO, CTO, and Design VP—had a high-anticipated AMA with the community, confirming that the airdrop snapshot will run from Friday into Saturday night (June 7). To favor fairness, the team also stressed the use of sybil detection mechanisms so manipulation can be avoided: a fully transparent and community-first distribution model.

Source: Blumcrypto X

Afterward, the launch is interested in kicking off on DEXs and Blum's native Telegram mini-app, before possibly making its way onto CEXs, a road currently under discussions.

What really separates $BLUM in a worldwide crowd of token launches? According to the AMA, the Blum ecosystem is not fixated upon virality or hype, but rather on building a Telegram-native trading infrastructure-more oriented towards AI-tools and features for perpetual trading. Such a scenario indicates a real-world use case and continuous relevance in the DeFi space.

The token, edging for staking, will fuel a variety of transactions alongside trading and governance within the ecosystem. It will be one of the fuels for transactions, trading, and governance within the ecosystem. With tokenomics still to be revealed next week, one can safely say that the team is really setting it for actual utility as against short-term speculation.

TGE is expected to be held pretty much immediately after the execution of the airdrop snapshot event. Due to strong community engagement, native Telegram product integration, and CEX interest, initial trading price is forecast by analysts to be somewhere between $0.02 and $0.05 on launch day.

If trading volumes also support with community expectations and adoption based on utility sets in, the token is looking at growing to perhaps as much as 20-30 times the launch price, particularly if it ends up getting listed on a CEX by Q3 2025.

Short-term prices will depend on initial DEX liquidity, airdrop demand, and early staking incentives. Assuming well-coordinated listing and no major sell-offs, the coin could reach $0.10 as early as 2-3 weeks with all momentum being created from community level.

However, Delays into the CEX listings and vague tokenomics details may lead to price corrections thus an investor should be constantly updated.

For the long-term scenario, the success of Blum’s ecosystem will be key. If the Telegram mini-app goes on to implement AI-powered trading bots, perpetual markets, and innovative DeFi integrations, $BLUM hence would turn into a household name for crypto trading on Telegram.

In Q4 2025, with trading between $0.25 and $0.40 and possibly more with a bullish macro condition in the crypto market, the token will be positioned to be one of the mid-cap in DeFi.

With the airdrop on June 7 and the TGE just around, all eyes will be on the coin. Is it going to rise as a DeFi disruptor, or is it going fast like so many before it? These are the next few weeks in which we will find out.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.