Ethereum is going to the spotlight again, not only because of the market, but due to actions at an institutional intensity by entities such as BlackRock. With over $560 million in ETH accumulated since May 11 and a gargantuan 5,362 BTC earnings, the question arises: Is Ethereum preparing for a major breakout over the $3,500 mark?

This article investigates BlackRock's ETH accumulation, whale transactions involving ConsenSys, and exactly what technical analysts anticipate for ETH's next major trajectory. Could we be on the brink of the next bull run?

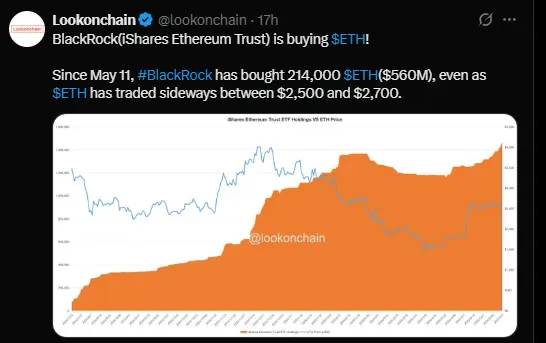

A change of strategy witnessed BlackRock making drastic rebalances in its crypto portfolio, moving away from Bitcoin towards Ethereum. From May 11 to the beginning of June, BlackRock's iShares Ethereum Trust added 214,000 ETH (worth around $560 million), while BTC holdings were heavily slashed.

The data from Lookonchain shows BlackRock unloaded 5,362 BTC, worth around $561 million, in a series of sizeable transactions to Coinbase Prime. Simultaneously, the asset manager pulled out 27,241 ETH (approx. $69.25 million) from Coinbase, strongly signaling that institutional preference is shifting in favor of the second largest crypto currency.

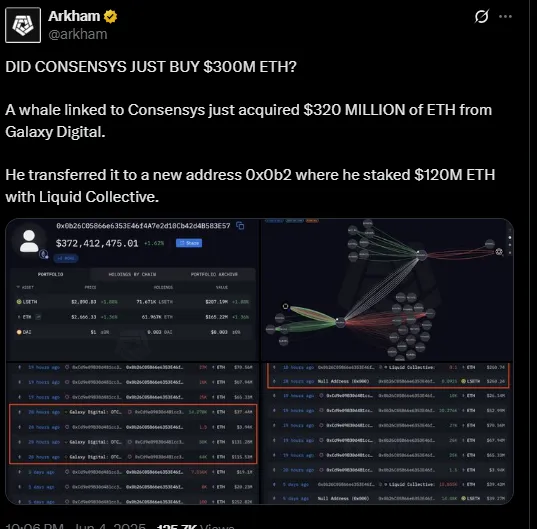

As per Arkham intelligence, Adding to the bullish sentiment is the tracking of a whale wallet, purportedly belonging to ConsenSys, which acquired $320 million worth of ETH from Galaxy Digital. Of this, $120 million was staked via Liquid Collective, deepening the idea that long-term adoption and confidence are rapidly growing within institutional circles.

Such a staking activity screams that the altcoin is not merely being bought; it is being locked in and committed to, being bonded with the trust in the network's future and staking rewards.

The famous crypto analyst Captain Faibik has pointed out that the altcoin is currently trading within a multi-year symmetric triangle, a technical pattern that has been forming since early 2021. With the altcoin approaching the apex, the next one or two months could be crucial as to where the altcoin heads finally.

Faibik sees the potential breakout being given technical confirmation if a monthly close above $3,500, which would then possibly set this crypto for a long, sustained rally. Until that confirmation happens, though, he sees this zone as an optimum entry point for long-term accumulation.

If the price breaks above the $2,700–$2,850 range with strong volume—and especially if it clears the $3,000 mark—a sharp rally toward $3,500 becomes highly probable. Once that barrier is breached, a move toward $4,000 by Q3 2025 is on the table.

Conversely, any breakdown of $2,500 as a support could bring down prices to $2,200 or even to $2,000. While such a drop may induce short-term turmoil, it might also provide yet another exciting entry point down the line before the major rally.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.