Chainlink (LINK) has experienced a noticeable decline over the past 24 hours, with its price dropping from above $25.50 to below $24.00. The crypto saw a drop of approximately 6.7% during this period, reflecting a short-term correction.

Being pulled to the downside, the sell-side pressure has taken over at the expense of buying interest. Despite this temporary pullback, LINK has still exhibited strong price action in the last week and month, with gains of 8.9% and 28%, respectively.

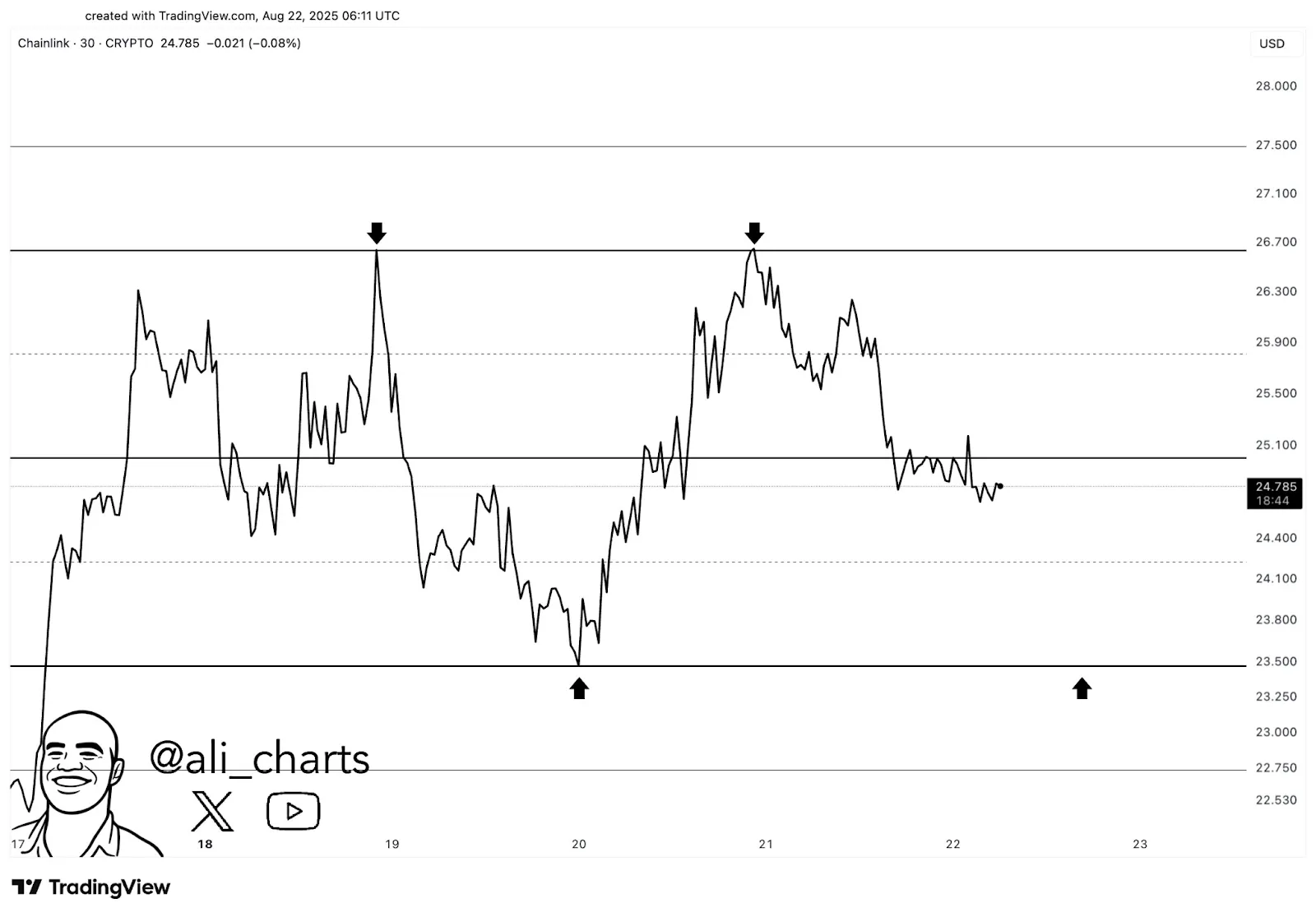

In the past day, Chainlink exhibited very high price volatility, reaching a high near $26.7 before retreating from that level. The presence of this volatility indicates that the crypto is consolidating around resistance and support levels.

Thus, resistance zones seem to be forming around $26.7 and $25.9. These levels are historically strong zones where LINK has been rejected many times before. Any recovery from here upward will require rejection of these resistance zones.

On the other hand, there are key support levels to monitor. According to analyst Ali Martinez, a critical support zone lies around $23.5, where LINK has previously found stability. If the price bounces from this area, it may signal potential upside.

Source: X

There are minor levels of support between $24.1 and $24.4, which were met in the past, although temporarily. This price fluctuation tends to suggest that the consolidation is happening, with LINK facing resistance and support one after another.

Alongside the price movement, there has been a considerable decrease in movement stretches on the derivatives space. Chainlink's derivatives volume has nosedived by 37.14% to $4.05 billion. This insight suggests a decline in interest and participation. Also dropping are the open interest numbers, down 8.27% to $1.56 billion. This drop could be impeding investor participation in market momentum.

Source: Coinglass

Speaking of sentiment, the long-to-short ratio on Binance shows more traders gambling on Chainlink as a long. In numbers, the accounts' long-to-short ratio is 2.06, whereas in positions, it is 2.57, standing for a bullish short-term view.

This vast disparity between long and short positions can also be a risk: if everyone's too optimistic too soon, that's when the market corrects just as fast. Liquidation data further reveals that a significant amount of capital is at risk, with $671.21K in long positions liquidated in the past hour, mainly contributing to recent price fluctuations.

This volatility in the LINK funding rate on the derivatives space is seen as investor sentiment change. Thus, a neutral outlook is marked by the funding rate moving around 0.01%. However, when spikes occur in this rate, such as in early July, very pronounced price movements also occur.

These spikes represent times of relative turbulence for the crypto space. As the market further morphs, these funding rate fluctuations could serve as key markers claiming future price trend directions for the traders.

Kelvin Munene is an experienced crypto and finance journalist with over five years in the industry, known for delivering detailed market insights and expert analysis. Holding a Bachelor’s degree in Journalism and Actuarial Science from Mount Kenya University, he is recognized for his thorough research and strong writing abilities, especially in cryptocurrency, blockchain, and financial markets. Kelvin consistently offers timely, accurate updates and data-driven perspectives, helping readers navigate the complex world of digital assets. His work focuses on identifying emerging trends, analyzing market cycles, exploring technological advancements, and monitoring regulatory changes that influence the crypto sector. Outside of journalism, Kelvin enjoys chess, traveling, and embracing new adventures.