Dogecoin price rose 18.96% in the past week and gained 6.13% in the last 24 hours, trading at $0.2372.

At press time, Open interest rose 2.4% to $197.84 billion, while the Fear & Greed Index was at 68, indicating greed in the wider crypto market.

The 1-hour chart from CW shows DOGE price pressing against resistance at $0.24, with a concentrated sell wall at $0.25.

Buy support is strong at the $0.20-$0.21 range, which indicates an accumulation of price on dips.

Source : X

CW observed that a break above the $0.25 was likely to trigger a powerful rally, since that level has been limiting the recent rallies.

Such a breakout can be supported by favourable macro conditions as Bitcoin dominance dropped 1% to 59.25% and the U.S. Dollar Index was down 0.22% at 98.01.

The balance of Bitcoin on exchanges also went down by 0.17% to 2.26 million BTC, indicating less selling supply in the wider crypto market.

Trader Tardigrade’s monthly analysis reveals an ascending broadening wedge pattern that corresponds to the pattern that preceded rallies in 2017 and 2021.

Dogecoin monthly ascending broadening wedge : Source : X

Meanwhile, a descending wedge has been retested with a 2-week chart, where the stochastic indicator is rising up out of oversold.

Dogecoin 2-week descending wedge | Source : X

Wedge support has been hit a few times without a lower break, just as it has done in the past just prior to major price breakouts.

Highlighted “magnet” levels near previous highs mark potential target points if current conditions hold.

Crypto Patel supports this perspective, identifying the $0.150 level as high support and the Dogecoin price action in an ascending channel since the middle of 2022.

According to Patel, accumulation in the range of 0.23 to 0.18 can drive a push toward 0.50, 1.00, and 2.00 in case the market momentum gains pace in the current bull run.

The bullish tilt is confirmed by the monthly multi-indicator setup of Kev Capital, which depicts a new Stochastic RSI cross out of an oversold region and an RSI level of 56.09, which indicates moderate market strength.

The MACD histogram has gone positive, which is another point in favour of the continuation.

Source : X

Based on the analysis, Dogecoin price is yet to make its biggest swing of this cycle, as with other altcoins in the previous bull markets at an early stage.

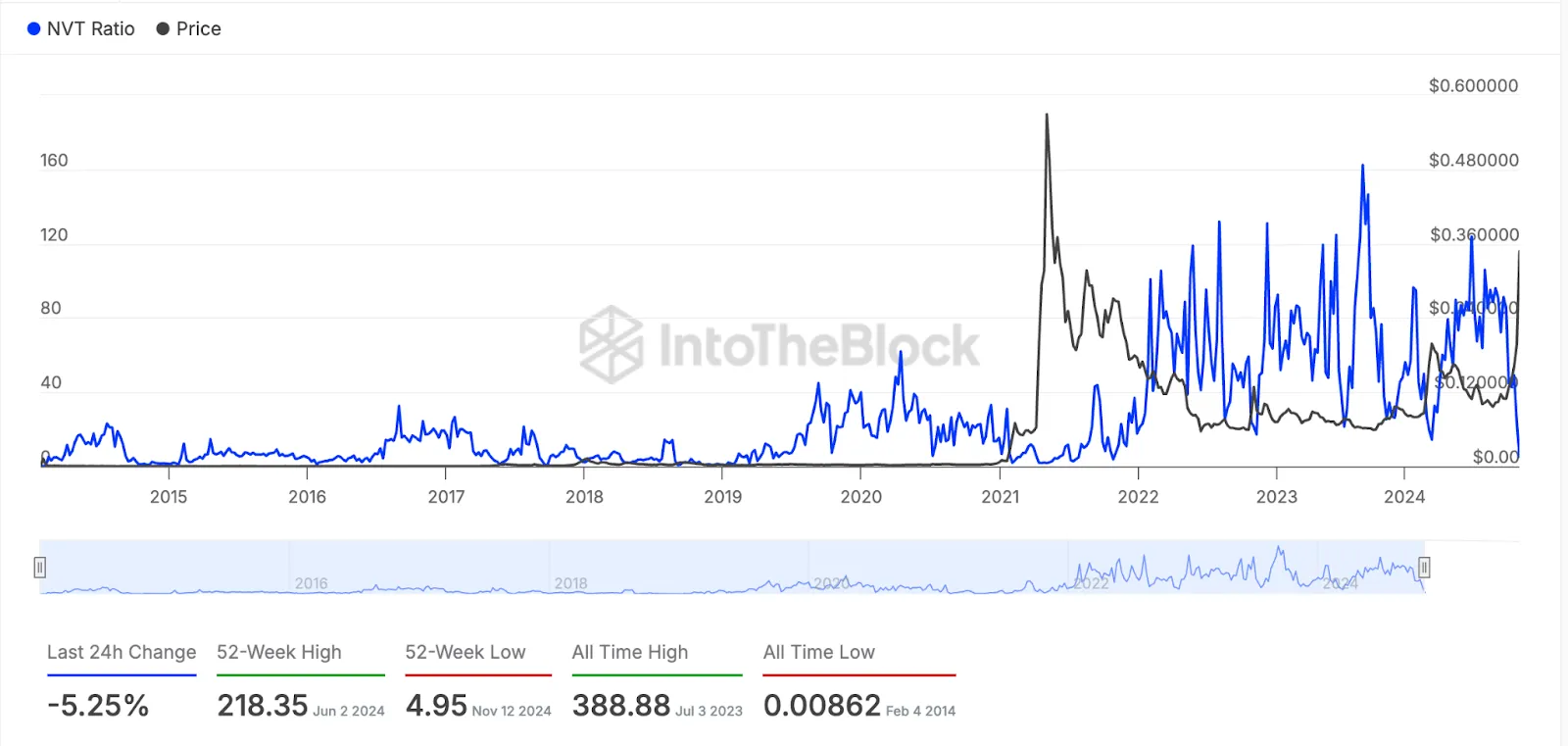

The technical readings are backed by IntoTheBlock data. NVT ratio is not at abnormally high historical levels, this shows the value of the network is in sync with the volume of transactions and not in a speculative state.

Dogecoin NVT ratio | Source : IntoTheBlock

The NVT ratio hit a high of 218.35 in June 2024 and a low of 4.95 in November 2024 with all time highs of 388.88 in July 2023 and 0.00862 in February 2014.

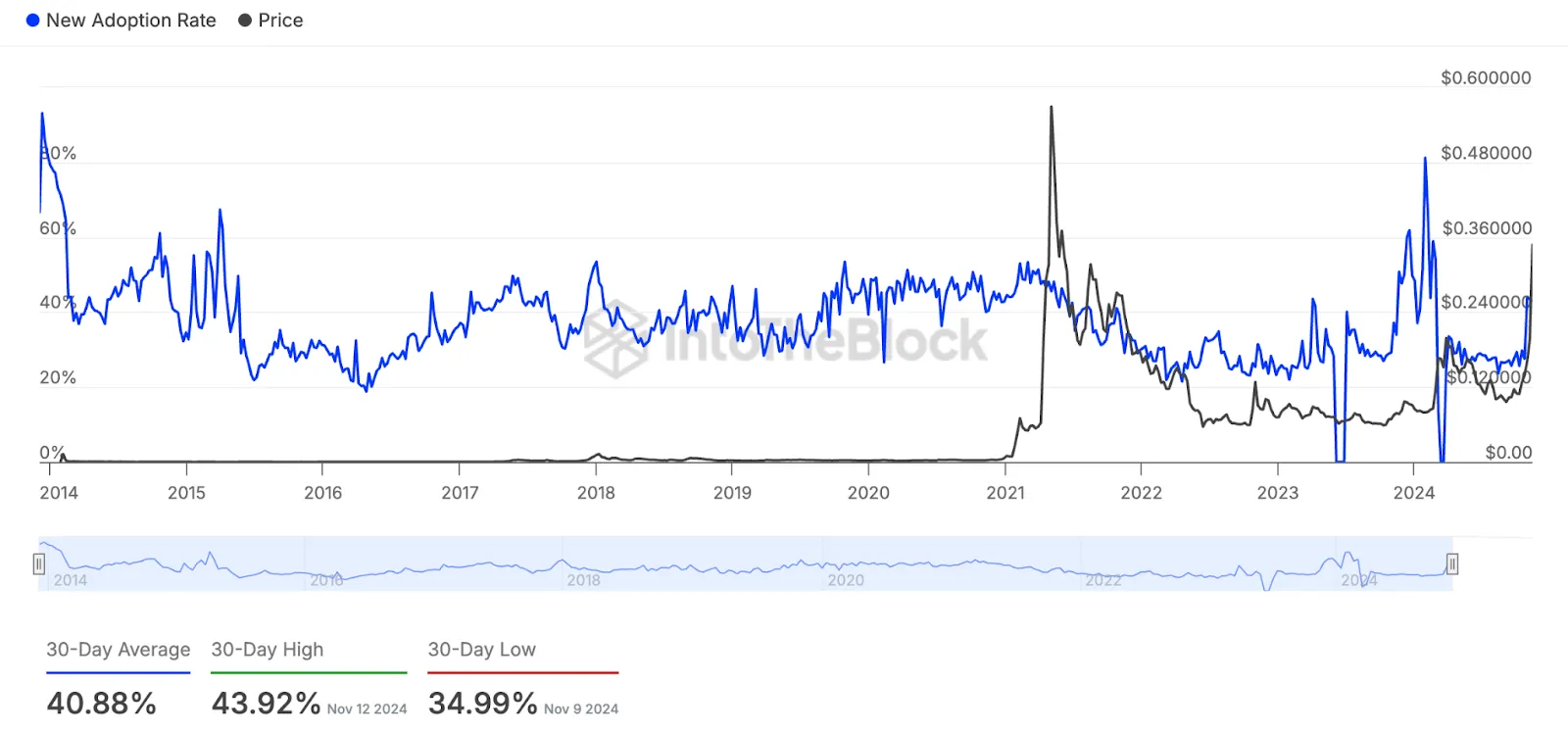

The network adoption rates are steady with the 30-day average at 40.88%. The most recent high was 43.92% in November 2024 and the low 34.99% in the same month.

Dogecoin new adoption rate | Source : IntoTheBlock

In the past, adoption spikes have been associated with large bull runs and the present levels indicate a solid foundation of active adoption.

Furthermore, IntoTheBlock positioning data indicates that there is an equal number of bullish and bearish traders in the last week, with 127 positions each.

This balance indicates a market that is ready to break decisively, with short-term resistance and long term bullish structures merging around the $0.25 level.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.