Ethereum price has climbed above $4,200 for the first time this year, signaling renewed market optimism. The rally, which has carried ETH close to $4,500, comes amid strong buying pressure and positive institutional developments.

Over the past month, ETH has surged more than 60%, marking its most significant rally since late 2021. The second-largest cryptocurrency has gained over 180% since its 2024 low of $1,385. Analysts attribute this momentum to both corporate accumulation and favorable regulatory signals. Treasury-focused companies have collectively purchased nearly 2 million Altcoin since June, adding to the asset’s demand.

Market data shows that the global cryptocurrency market cap rose 2.04% to $3.94 trillion, extending a 7% weekly gain. Ethereum’s rise has been a key driver, alongside increased altcoin activity as Bitcoin’s dominance slipped to 59.24%. ETF inflows for Ethereums have also surged, with assets under management now totaling $18.4 billion.

From a technical perspective, breaking the $4,000 resistance was a major achievement for bulls. The next key barrier was $4,100, and surpassing it could trigger a large short squeeze. Analysts suggest such a move might push Altcoin rapidly toward $4,400–$4,500. Some projections, referencing the 2021 bull run, indicate that if monthly gains reach 45.94%, ETH could approach $6,000.

Ethereums all-time high remains at $4,891.70, set in November 2021. The current price is still about 13.7% below that peak. However, with trading volume exceeding $49.45 billion in the past 24 hours and institutional inflows accelerating, the market outlook appears strong.

While short-term targets focus on breaking $4,500, speculation is growing about whether ETH could hit $10,000 in 2025.

BlackRock Boosts Holdings with Major Ethereum Purchase

BlackRock has acquired approximately 65,167.33 Ethereums at around $271.8 million. This major purchase further shows the asset manager increasing interest in digital currencies and the rising popularity of Ethereum among large institutional investors.

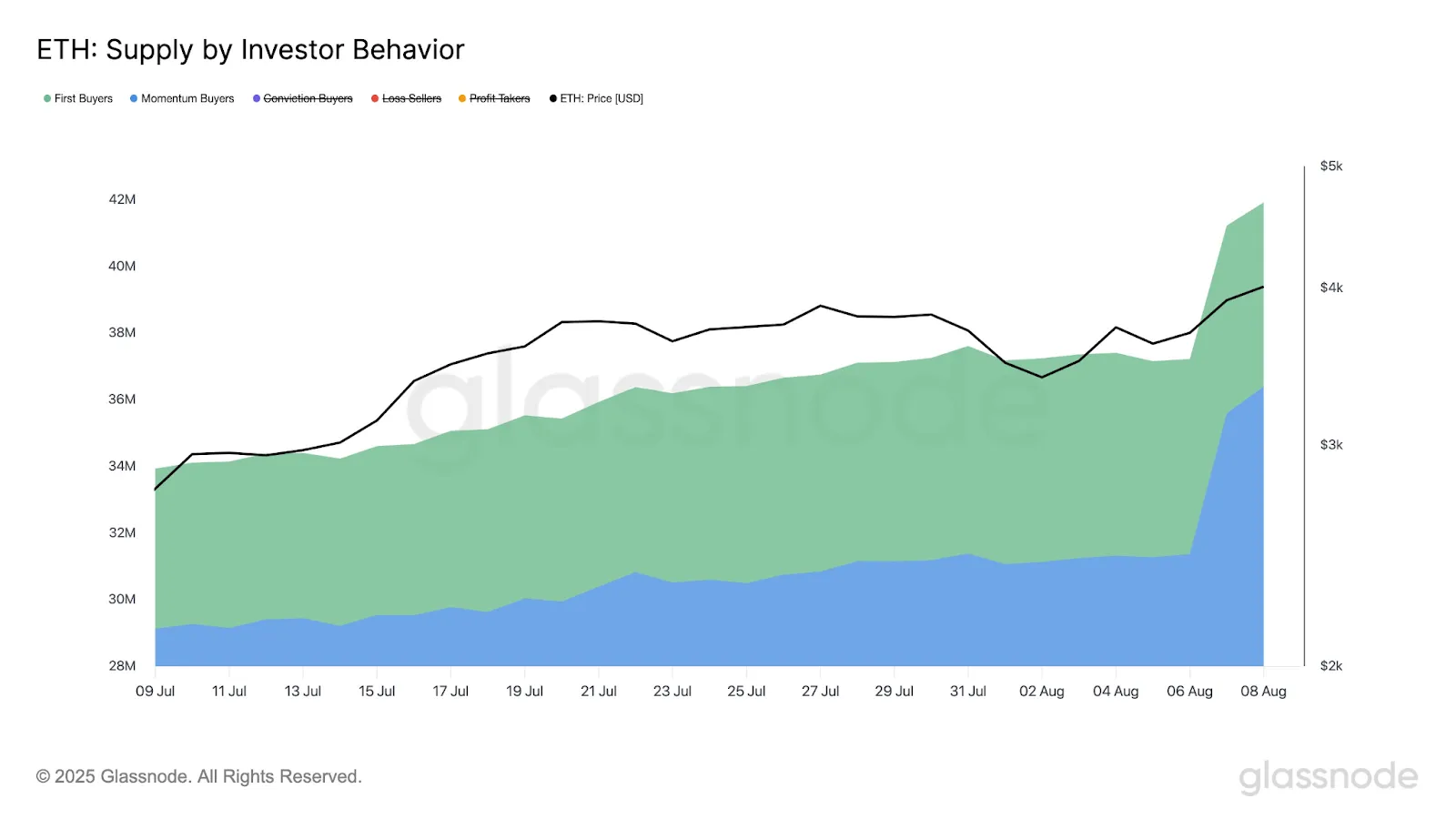

The recent blockchain data compiled by Glassnode suggests that demand in Ethereums has spiked up over the course of the last several days. There are first-time investors, momentum buyers, as well as the existing holders who are going long. This re-emerging enthusiasm has pushed the Altcoin prices to high, which indicates a rampant optimistic mood in the market and the increasing institutional interests.

As of the reporting, the Ether price is trading at $4,226, reflecting an 8% gain over the past 24-hours. The cryptocurrency had shown a positive trend in an ascending channel indicating a robust bullish trend. The Relative Strength Index (RSI) has reached 79.68 and this signals that the stock looks overbought and buyers could be apprehensive.

Source: Tradingview

The Moving Average Convergence Divergence (MACD) indicates a still positive signal where the MACD line is far above the signal line. This underlies the current price rally seen in Ethereum that has led to the cryptocurrency reaching new heights in weeks.

Annah Mugoiri is an emerging voice in the crypto content space With More than 5 years of experience, with a growing passion for blockchain technology and digital finance. She possesses a sharp grasp of market dynamics and the broader cryptocurrency landscape, skillfully simplifying complex topics like Bitcoin, altcoins, DeFi, and NFTs into reader-friendly, engaging articles. Annah combines in-depth research with a clear and concise writing style that appeals to both beginners and seasoned crypto investors. Dedicated to monitoring price trends, project launches, and regulatory changes, she keeps her audience updated on the rapidly evolving crypto scene. Annah is a firm believer in blockchain’s transformative power to foster innovation and expand financial access worldwide.