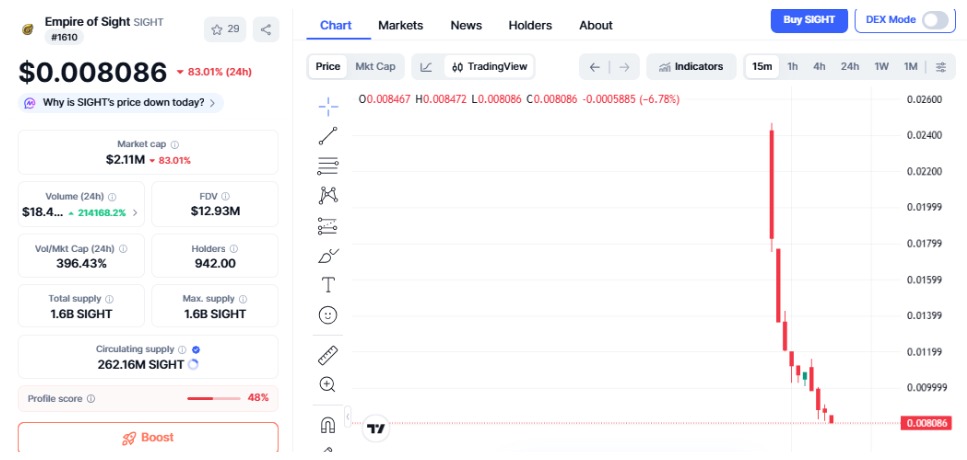

The Empire of Sight (SIGHT) crash just after its listing on major exchanges, such as Binance Alpha, KuCoin, and MEXC, raises the question of whether this panic selling is the end or the beginning of a recovery. Let’s explain it clearly and simply.

SIGHT's launch produced a lot of buzz, but the market was very harsh in its reaction just a few hours after. The huge sell-off has raised serious investors' doubts, especially as no official tokenomics have been revealed so far. The situation is now causing more volatility in the market and is fear-driven.

The most important reason for today’s price crash is the ambiguity surrounding tokenomics. When a startup does not make its supply, vesting, or allocation details public, the traders adopt the attitude of selling first and asking questions later.

On the other hand, early buyers may have realized their profits quickly after the price hike approached the $0.025–$0.026 level, subsequently leading to panic selling. This scenario caused the potential buyers to retreat, and the pressure of selling to take over completely.

Market Data Snapshot

Current Market Cap: $2.11 million

Trading Volume: 214,168.20%

Trend: Strong bearish momentum

The high volume, coupled with the declining prices, indicates distribution rather than accumulation. It implies that currently, the market has more sellers than buyers.

At the time of writing, the price is trading near $0.008086, down by 83.01%, forming a lower low. The price chart indicates a series of long consecutive red candles, which is a typical indication of post-listing capitulation. This situation generally occurs after new exchange listings when the hype disappears very quickly.

Currently, the token is in the situation of a falling knife, where taking a risk to catch a bottom is only possible until the selling pressure is reduced.

Key Support and Resistance Levels

Immediate Support Zone

$0.007–$0.0006

This area may provide short-term support, and if the selling trend weakens, a price hike might happen.

Lower Support (If Breakdown Happens)

$0.005

SIGHT is likely to visit this area first and later float back up if the existing support is broken.

Resistance Levels to Watch

$0.010–$0.012: Possible relief bounce area

$0.016: Breakout level needed for trend reversal

If the selling pressure in the $0.008–$0.0090 range disappears, the $0.013–$0.015 zone could be a dead-cat bounce of SIGHT's. The movement will be driven by short-term traders and not long-term investors, though.

On the other hand, a confirmed bullish reversal will take place only when the price holds, and then it breaks through the $0.016 resistance, accompanied by volume. Until that time, the general trend will still be bearish, and high volatility is to be expected.

For confidence to return, the project must:

Release precise tokenomics

Enhance transparency and communication

Bring in organic buying demand, not just speculation

If these conditions are not met, a bounce might still be short-lived.

Disclaimer: This content is for informational purposes only and is not financial advice. Always do your own research before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.