Ethereum price has surged 50% over the past month, sparking speculation of a potential rally toward the $4,000 level. This momentum follows tightening supply conditions, robust inflows into ETH ETFs, and a bullish technical setup. Despite recent gains, ETH still trades 23% below its all-time high from November 2021.

This gap suggests further upside may remain if investor interest shifts from Bitcoin to altcoins. Meanwhile, Bitcoin is holding above $110,000 after touching a new record high last week. With BTC possibly targeting $120,000, the crypto market’s bullish momentum could help propel Ethereums price past the $4,000 threshold in the coming sessions.

In a recent market update shared on X, the analyst noted that a deeper decline in ETH’s price never materialized. The analyst pointed out that ETH has tested its resistance zone four times. He believes this pattern may signal an impending breakout rather than weakness.

Source: CryptoMichNL on X

Crypto expert suggests that if the Bitcoin price climbs past $120,000, Ethereum could rally to $4,000. Such a possible increase would most probably catalyze a wider rally in the altcoin sector. In this case, he anticipates most of the altcoins to earn in excess of 10 percent.

A technical chart attached to the post also indicates the repetitive resistance test zone around the prices of $3,700-$3,800. It also draws a liquidity zone well below the current price, which reveals of interest areas to make the future moves.

In spite of the fluctuation in crypto markets, there seems to be a change of sentiment towards bullish. The flow of Bitcoin remains under the radar of analysts and traders as one of the first indicators of Ethereum and the altcoin industry.

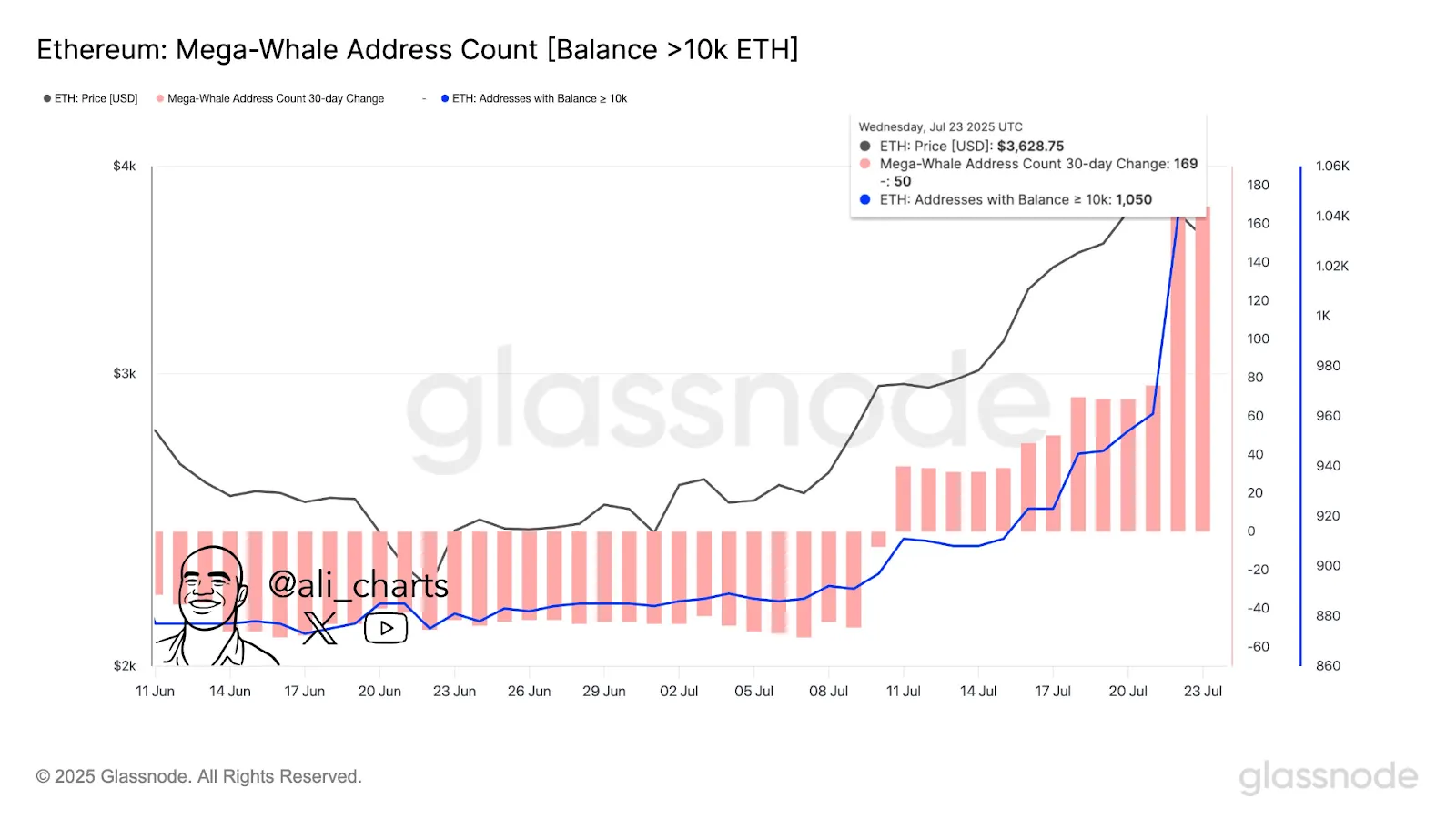

In the last month, data from Glassnode shows that 170 new wallets of more than 10,000 ETH entered the Ethereum network. This growth in mega-holdings is an indication of growing attention by institutional investors, as well as high-net-worth individuals.

According to the Glassnode chart posted by analyst Ali on the social platform X, there was a steep increase in the number of mega-whale wallets. These wallets contain more than 10,000 Ether which is a typical opportunity limit that is attributed to players who can effect significant market shifts.

Source: Tweet

Source: Tweet

As shown on the graph, the growth of this number of such addresses is gaining pace quite fast, which is in line with the current activities of the Ethereum price. Such an action can be an indication of forward positioning in anticipation of future market changes or the future of the Ethereum space.

The Ether price hovered at $3,733, with 4% surge over the past 24-hours, showing resilience near a crucial resistance zone between $3,800 and $4,000.

Source: Tradingview

The Relative Strength Index (RSI) is at 78.74, which indicates an overbought situation. The Moving Average Convergence Divergence (MACD) is a bullish indicator that enhances the bullish momentum. The MACD line of 298.98 is trading above the signal line at 275.72, but the histogram is telling that the rate at which the buyer is purchasing this commodity might be slowing down.

If bulls manage to break this barrier convincingly, the next upside target lies at $4,200, followed by $4,400.

On the downside, initial support is seen at $3,500. A dip below this level could open the door to a correction toward $3,200

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.