Ondo price has soared by more than 40% in the past month, following a strong bullish breakout. After consolidating near the $0.90 mark, ONDO spiked to over $1.11, breaching a crucial resistance zone. The rally intensified after regulatory developments and increased investor confidence in real-world asset (RWA) tokenization.

A recent SEC meeting provided clearer regulatory guidance, which helped reinforce bullish sentiment. Shortly after, 21Shares submitted an ETF filing for the Altcoin Trust on July 22. The move is seen as a step toward greater institutional adoption.

Coinbase Custody was named as custodian, adding credibility to the proposal. While approval remains uncertain, the filing has sparked renewed enthusiasm for Altcoin regulatory positioning.

Over the past week, the token has gained 20%, bolstered by ETF optimism and technical breakout patterns. Daily trading volume surged to $203.67 million, up by over 41%, reflecting strong market interest. Korean retail traders have also shown heightened activity, contributing to Altcoin short-term momentum.

Additionally, algorithmic trading has reportedly intensified following the breakout past key technical levels. Exchange outflows reached $1.7 million within 24 hours, indicating growing institutional accumulation. Altcoin trajectory now hinges on ETF progress and sustained market enthusiasm.

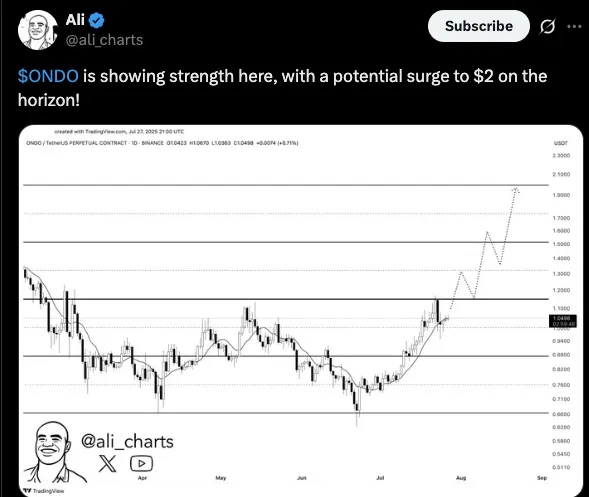

Cryptocurrency analyst Ali has highlighted growing momentum in Altcoins, suggesting a possible climb to the $2 mark.

The digital asset recently displayed bullish strength, moving beyond key resistance levels in recent sessions. Analysts are now watching for a continued rally that could push prices significantly higher in the near term.

Source: Ali chart, tweet

According to the chart shared by Ali on X, Altcoin is forming a consistent uptrend pattern. If the trend continues, the next resistance levels are projected near $1.25, $1.50, and possibly as high as $2.

This analysis comes as the crypto market shows renewed optimism after months of sideways movement and consolidation. Altcoin appears to be gaining traction, with rising demand and a technical setup that supports a breakout.

The ONDO price is trading at $1.05, with a surge of bullish momentum sustaining above the psychological $1.00 level.

The trend is still up after a steep uptrend in the range of $0.70. This week Altcoin was trading at highs above $1.10 and this indicates strong buyer demand.

Relative Strength Index (RSI) is at 61.85, and it is tending to enter the overbought territory. This is an indication of further bullish momentum.

Source: ONDO/USD daily chart: Tradingview

The MACD indicator in the meanwhile indicates that, the blue line is at 0.0607, and is heavy on the signal line which is at 0.0609. The bearish crossover is not confirmed at all despite the spotting of convergence. The histogram continues to indicate a positive course even though the volume of purchases has been lowered.

The latest price formation looked on ONDO is pointing toward increased lows and sequential bulls. Should buyers recover to $1.08, there is the possibility of retesting the zone of $1.10. A technical break above may perhaps open way to near term target of $1.15.

There is solid support of $1.00 and $0.98. As long as these levels maintain, the bulls control the short-term direction of the market.

Annah Mugoiri is an emerging voice in the crypto content space With More than 5 years of experience, with a growing passion for blockchain technology and digital finance. She possesses a sharp grasp of market dynamics and the broader cryptocurrency landscape, skillfully simplifying complex topics like Bitcoin, altcoins, DeFi, and NFTs into reader-friendly, engaging articles. Annah combines in-depth research with a clear and concise writing style that appeals to both beginners and seasoned crypto investors. Dedicated to monitoring price trends, project launches, and regulatory changes, she keeps her audience updated on the rapidly evolving crypto scene. Annah is a firm believer in blockchain’s transformative power to foster innovation and expand financial access worldwide.