Why did Ethereum suddenly bounce back after crashing to $2,725? And can the upcoming Fusaka upgrade turn this rebound into a full-scale Ethereum price rally? These questions are now dominating the market as ETH trades confidently above $3,000 ahead of one of its most important technological shifts.

The digital asset shocked traders on December 1 after plunging to $2,725, but the market quickly flipped as ETH recorded an 8% surge within 24 hours. At the time of writing, it is trading around $3,031, with a market cap of $365.91B, climbing from $2,788 to $3,045 before settling near current levels.

Source: CoinMarketCap

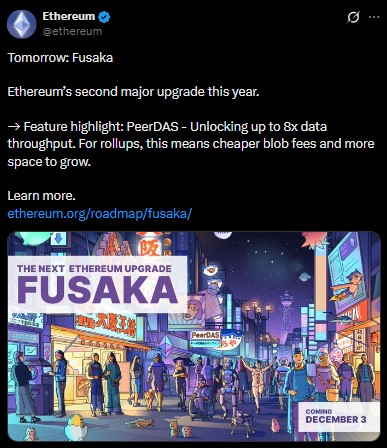

The sudden momentum aligns perfectly with today’s Fusaka upgrade, scheduled for December 3, 2025, at 21:49 UTC. The new process deploys PeerDAS, a breakthrough data-availability solution allowing nodes to store just one-eighth of blob data while enabling up to 8x scalability for Layer 2 rollups.

Source: X

This upgrade is drawing massive interest because it hasn’t seen such an impactful enhancement since the Pectra fork in May 2025, which triggered a 29% rally and improved validator operations across the network.

Another catalyst behind its recovery is visible whale accumulation. According to Lookonchain, Tom Lee’s Bitmine recently bought 18,345 coins worth $54.94M just hours before the upgrade.

Source: X

In parallel, whale wallet 0x26b5 has been aggressively accumulating EDEL tokens, buying 1.32M last week and another 1.83M today after bridging it to Base—raising his total holdings to 3.15M EDEL.

Whale confidence often precedes major moves, strengthening the bullish Ethereum price prediction narrative.

From a chart structure perspective, it reclaiming the $3,000 psychological level is crucial. After bouncing from oversold RSI levels (36 → 46), It is showing healthy recovery without entering overbought territory.

Immediate resistance lies at $3,220, followed by a stronger supply zone at $3,450—a level that rejected it during the last distribution phase. If it maintains its current momentum, the next test of these zones seems increasingly likely.

Source: TradingView

A 30% rally from $3,030 would push it near $3,939, aligning with the historical $4,000–$4,100 resistance band. The only time it has rallied similarly this year was after Pectra, when the market priced in strong utility improvements.

As the new process introduces cheaper rollups, higher throughput, and optimized node operations, investors are already asking: Will ETH hit a new ATH?

It is likely to trade between $3,180 and $3,350 as the market digests Fusaka’s impact.

If adoption rises and fees fall on L2s, it may target $3,450–$4,000.

With network modification, ETF inflows, and EIP-1559-driven deflation, it could attempt a fresh cycle high in the $5,200–$5,800 range.

Ethereum’s rebound above $3,000 ahead of the Fusaka upgrade signals renewed confidence. With PeerDAS boosting scalability and whales buying aggressively, bullish momentum is building. If Fusaka delivers results similar to Pectra, Ethereum could soon test $4,000 and may even approach new highs moving into 2026.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.