Ethereum has witnessed a dramatic price surge, skyrocketing from approximately $2,150 to over $2,900 in less than 24 hours. This remarkable movement comes amid ongoing drama among Ethereum factions and growing speculation that the token may be losing market dominance to Solana. Despite the fluctuations, recent price action suggests signs of recovery, especially as macroeconomic factors continue to shift.

Crypto markets have responded positively to the temporary suspension of newly announced import tariffs by U.S. President Donald Trump on Canada and Mexico. This development has provided relief to investors, contributing to improved sentiment across risk-on assets, including Ethereum. As the regulatory landscape continues to evolve, such macroeconomic decisions can play a crucial role in shaping Ethereum’s trajectory in the near term.

According to Lookonchain data, institutional activity around Ethereum remains strong. Trump's World Liberty (@worldlibertyfi) has aggressively accumulated Ethereum, purchasing another 1,826 ETH (worth $5 million) today. This brings their total Ethereum holdings to 61,114 ETH (valued at $205 million), acquired at an average price of $3,354. However, due to recent price movements, this portfolio is currently facing an unrealized loss of $31 million.

Additionally, substantial crypto asset transfers to #CoinbasePrime indicate that institutional investors are making strategic portfolio adjustments. This large-scale accumulation underscores Ethereum’s importance among major investors, reinforcing its potential for long-term growth despite short-term volatility.

After years of price movements, Ethereum has now touched the lower boundary of the logarithmic regression trend line, a key technical milestone noted by analyst Benjamin Cowen. Historically, this level has acted as a strong support zone, hinting at a potential bottom before the next upward cycle. This reinforces the argument that Ethereum could be in an accumulation phase, setting the stage for a bullish breakout.

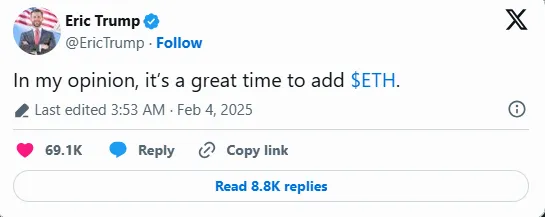

In a surprising turn of events, Eric Trump recently took to X (formerly Twitter) to suggest that now is a great time to buy Ethereum. His statement has further fueled speculation and excitement in the market. With institutional interest increasing and mainstream figures voicing support, investor sentiment around Ethereum appears to be strengthening. Such endorsements could contribute to growing confidence among retail and institutional investors alike.

As per Rose Premium Signals, Ethereum recently experienced a liquidity grab, briefly dipping below $2.7K before swiftly rebounding. Despite the short-term decline, the broader bullish structure remains intact. Levels under $2.7K have presented a strong accumulation opportunity, and a recovery wick forming from key support suggests a possible trend reversal. Given this setup, Ethereum could be a prime short-term and long-term opportunity for traders seeking to capitalize on volatility.

If institutional accumulation continues and macroeconomic conditions remain favorable, Ethereum price has the potential to reclaim its previous highs. The combination of:

Large-scale institutional buying

Favorable regulatory developments

Strong technical support at key levels

Growing mainstream endorsements

all point toward a possible recovery for Ethereum in the near term. While market fluctuations are inevitable, the overall structure suggests a bullish outlook. Traders and investors should monitor Ethereum’s price action closely, as continued accumulation and positive macroeconomic shifts could drive ETH towards new highs.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

7 months ago

Great