In 2024, cryptocurrency holding patterns have shifted, with Ethereum (ETH) gaining momentum as Bitcoin (BTC) sees a decline. By Dec. 30, 75.06% of ETH holders have held their assets for over a year, up from 59% in January. Meanwhile, Bitcoin’s long-term holder base dropped from 70% to 62.31%, reflecting changing investor confidence.

Ethereum’s growth is fueled by staking rewards, network upgrades, and its role as a store of value. Bitcoin’s decline suggests increased trading or diversification into assets like ETH.

Looking ahead to 2025, Ethereum’s strong holding rates could limit supply and support price growth, while Bitcoin may face volatility unless its holder base stabilizes. ETH’s roadmap and investor interest may further strengthen its position, while Bitcoin’s future depends on retaining its market leadership.

With cumulative net flows double to $2.1 billion from November’s $1 billion, December has turned out to be a landmark month for Ethereum ETFs. Despite holiday season illiquidity, this increase in institutional interest for ETH exposure through conventional financial instruments points to strong underlying demand.

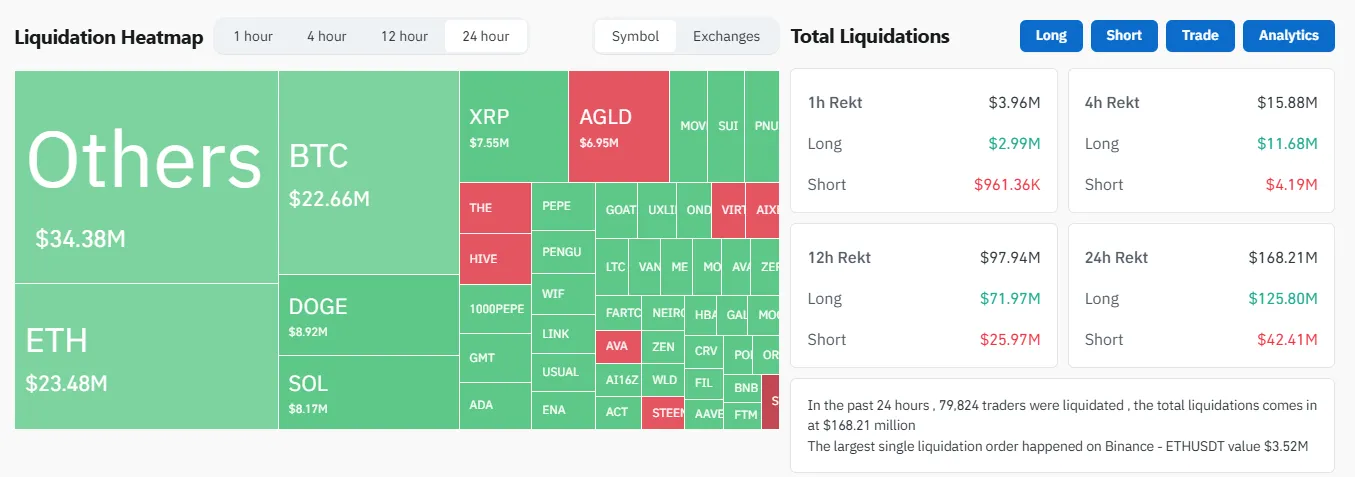

Coinglass Data shows that in the past 24 hours, In the past 24 hours , 79,878 traders were liquidated, the entire network has liquidated $168.21 million, of which long orders have liquidated $125.88 million and short orders have liquidated $42.41 million. BTC liquidated $22.66 million and ETH liquidated $23.48 million. The largest single liquidation order happened on Binance - ETHUSDT value $3.52M.

Ethereum (ETH) could experience a significant price surge in the first quarter (Q1) of 2025. Drawing on historical patterns from past Bitcoin Halving years, such as 2017 and 2021, he highlights substantial ETH growth during the January-to-March period.

In 2017, Ethereum saw notable monthly gains, with January delivering a 31.9% increase, February rising by 48%, and March skyrocketing by 214%. Similarly, in 2021, ETH posted gains of 78.5% in January, 8.4% in February, and 34.7% in March. Rover’s analysis suggests that if Ethereum holds its current price levels through the remainder of this year, it could follow a similar trajectory in 2025.

Based on these historical trends, Ethereum (ETH) could potentially rise to about $5,000 in January, advance to roughly $6,400 in February, and possibly reach an extraordinary $14,000 by March, according to the expert’s projections.

Ethereum's price action is signaling a potential breakout, as an inverted head and shoulders pattern emerges on its 6-month long-term chart. This bullish technical indicator has fueled forecasts of a rally that could see Ethereum reaching $12,000 in the near future.

Analyzing the chart, the gap between the head and neckline is approximately 265.84%. If the pattern unfolds as anticipated, Ethereum’s price could surge to a range of $10,000 to $12,000, aligning with the bullish momentum suggested by this formation.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.