That’s the question many crypto investors are asking as FOGO gets ready for its launch on Binance Spot on January 15, 2026, with Seed Tag. The project is attracting serious interest already, with strong excitement, substantial exchange backing, and a well-defined tokenomics plan.

Let us simplify the price prediction and find out the future possibilities.

This cutting-edge blockchain technology was made with Layer 1 in mind, which is famous for its massive number of transactions and scalability. With the major exchange listings such as Binance, LBank, and Bybit Spot, the project is finding its way to be one of the fastest L1 blockchains.

Binance has made an announcement that the token will commence its trading on January 15, 2026, at 14:00 UTC.

Moreover, the token will be a part of the 3rd Pre-TGE Prime Sale Edition on Binance Wallet from 08:00–10:00 UTC on January 13, 2026, which will further increase the initial demand.

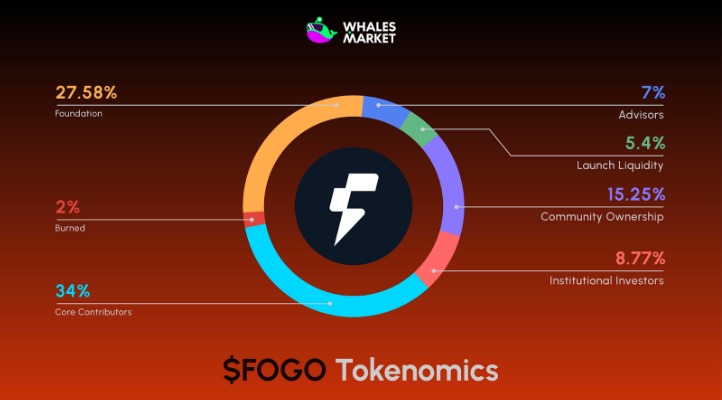

The ecosystem of the tokens is created to maintain the balance among growth, liquidity, and community involvement. The total number in circulation is 3,754,837,974, which is allocated as shown below:

Core Contributors – 34%

For the developers and main contributors who are responsible for building and maintaining the protocol.

Foundation – 27.58%

For the activities related to the ecosystem, partnerships, grants, and long-term strategy.

Community Ownership – 15.25%

For participation in rewards, incentives, and governance by the community.

Institutional Investors – 8.77%

Given to the investors who are strategically chosen, and they support the funding and expansion.

Advisors – 7%

For the incentives of the early technical, financial, and strategic advisors.

Launch Liquidity – 5.4%

Provides for trading to be smooth and for the initial liquidity to be healthy.

Burned – 2%

Permanently gone to support the long-term deflation.

The balanced arrangement of these forces provides both short-term stability and long-term value.

Analyzing the circulating supply, tokenomics, and Binance launch conditions, the analysts are expecting the listing price to be between $0.15 and $0.20.

This means that the initial market capitalization would be between $563 million and $751 million, which is equal to 1.5 times to 2 times the gain from the sale price of the token. The limited liquidity in the launch and the burning of tokens in the early stages could also be in favor of this range.

After the listing, the token would face very strong buying pressure from retail traders and community members. On the other hand, some early investors might take their profits, creating a volatile situation.

The price range for the short term is $0.22 to $0.30

If the trading volume continues to be high and the sentiment remains positive, it might go up a little bit more and then come to rest at that level.

In the future, FOGO’s long-term price will be determined by its adoption, usefulness, and growth of the network. It is going to have strong foundation funding and a deflationary element, so the long-term potential looks bright.

The long-term price target is $0.60 to $1.00+

Sustained development, partnerships, and the growing use of the blockchain could push demand through the roof to well beyond its launch stage.

The Binance and Bybit listings, the Pre-TGE sale, and the well-defined roadmap are all aspects that contribute to the positive market position. If the team manages to perform and attract users, the project could very well be a robust Layer 1 competitor.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.