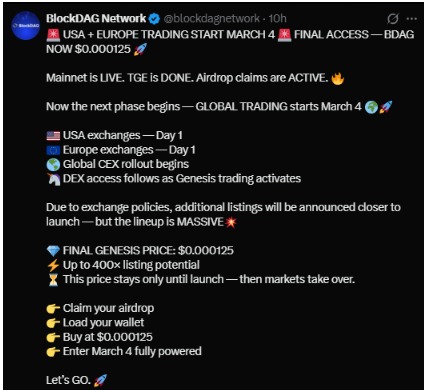

BlockDAG Network has finally launched its mainnet and completed its Token Generation Event (TGE). Airdrop claims are now active and global trading is scheduled to begin on March 4.

But the big question investors are asking is simple: can BDAG really deliver massive gains after listing, or will early sellers limit the rally?

The project has already created strong excitement. Over 35,000 users have claimed airdrops, and the team has hinted at a major Tier-1 U.S. exchange listing.

Many traders speculate this could be Binance, with a possible European exchange such as Bybit. If true, the liquidity and user base could bring heavy trading volume immediately after launch.

And this is where the hype starts — the official listing price is set at $0.05, while the final presale price is only $0.000125. That is roughly a 400x gap, which explains why early investors are closely watching the first trading hours.

BlockDAG is expected to launch with a relatively low circulating supply, a factor that often drives fast price movement in newly listed cryptocurrencies.

When demand from traders is high but available tokens are limited, prices can rise quickly during the first trading sessions. If major exchanges support the listing, the first 24–72 hours may bring strong volatility and aggressive buying activity.

In the early days, short-term targets could range between $0.15 and $0.30, while a strong momentum phase may push the price toward $0.30–$0.45. Much of this movement would come from hype, exchange traffic, and new investors entering the market, while airdrop holders and presale buyers secure early profits.

Exchange listings strongly affect launch performance. Large platforms offer liquidity, visibility, and credibility. More users can access the token, trading volume increases, and trust improves because established exchanges generally review projects before listing.

If BlockDAG gains major listings, trading activity could spike and push prices upward as buyers compete for limited supply. However, exchange hype alone cannot sustain long-term value without real network usage.

After an initial rally, markets usually see profit-taking. Early investors and airdrop recipients may sell, causing a temporary pullback. This is a normal market cycle and often helps stabilize the price.

A likely stabilization range may form around $0.25–$0.35. Holding this level would indicate genuine demand rather than short-term speculation.

Higher prices will depend on adoption rather than marketing. Stable mainnet performance, developer activity, partnerships, and user growth could support stronger momentum.

In favorable conditions, BDAG could move above $0.50 during bullish market periods.

By mid-2026, investors will focus on network usage, transaction activity, and real applications. If development continues steadily, BDAG may trade near $0.40–$0.45.

In the long run, utility determines value. Strong adoption could keep prices above listing levels, while weak activity may lead to consolidation or decline. Investors should also consider risks such as airdrop selling pressure, overvaluation, development delays, and market downturns.

Simply put, early hype may drive the first week, but real adoption will decide BlockDAG’s future.

Disclaimer: This content is educational only and not financial advice. Always do your own research before investing in cryptocurrency.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.