Bitcoin (BTC) continues to live up to expectations in the green amid mounting economic concerns about President Donald Trump's proposed reciprocal tariff measures. Bitcoin's chief currency is up 1.60% in 24 hours to $84,508, according to CoinMarketCap data. However, in the past week, BTC shed 2.59%, pointing to an uncertain market.

Since its inception, the currency has generally responded to macroeconomic events with short-term volatility, usually returning to the trend after markets have settled. Since President Trump became the president, the asset has gone through a roller coaster ride: a peak of $109,312 on January 20—the day he took office—and a steep 23% drop since then, with much of the drop being driven by geopolitical tension and economic uncertainty.

The current trade war and reciprocal tariffs may accelerate inflation, forcing the Federal Reserve to reconsider interest rate policies. If rates are slashed to stabilize the economy, Bitcoin adoption could surge as investors seek hedges against fiat devaluation.

The top currency is still battling very strong resistance levels at the 200-day Moving Average (MA) of $86,200 and the 50-day MA of $88,300, according to crypto analyst Ali Martinez.

A breakout above the latter area could help regain bullish momentum, boosting the BTC to its next support levels of $94,280 and $112,380, according to CryptoQuant.

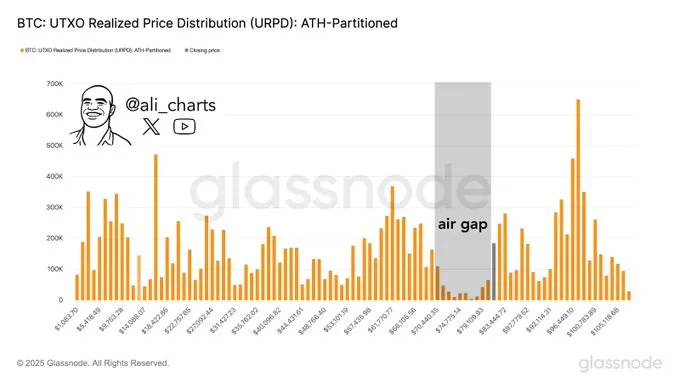

With the help of Glassnode price data, one can see that the main levels of support are found at $76,180, $58,080, $43,740, and $39,980. If the asset faces downward pressure they could serve as key levels where buyers may want to take action to stop further downward movement.

Above $80, 000 the token enters an air gap zone (it has a small amount of support on the way to $70, 000 so there could be an immediate drop) if bearish pressure becomes more intense.

Based on the daily BTC/USD chart, the asset is currently trading around $84,508, facing resistance from a long-standing descending trendline since February.

If the token can break and hold above $88,000, we may see a rally towards $93,000–$95,000. If it can't break and hold above $88,000, we may see further consolidation or a retest of the $80,000 support level.

The world's largest currency is, in fact, still in a long-term bull market after escaping a 4-year-old inverse head-and-shoulders (iH&S) neckline, according to crypto analyst Gert van Lagen. He projected the price of Bitcoin at a staggering $300,000 but pointed out that once the weekly close was below $74,400, the bullish trend would fail.

Bitcoin's price is still strongly dependent on macroeconomic developments and technical resistance levels. If BTC clears the descending trendline and key MAs, we could see a bullish rally toward the $93,000+ zone. But if some more uncertainty remains, we could see further consolidation or a drop to the $80,000 level.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.