As 2026 gets closer, Hyperliquid price prediction is coming back into focus, not because the price is flying, but because it has slowed down. That usually gets attention; the coin is no longer making wild swings. It moves, pauses, then moves again. Right now, it feels like the market is in waiting mode, not in reacting mode.

At the time of writing, HYPE is trading around the mid-$25 area. Volume has picked up a bit, but price has not followed aggressively. Volatility is tightening; this type of behavior often shows up when traders are choosing levels carefully, not chasing candles. Below, we break down what is actually happening with Hyperliquid.

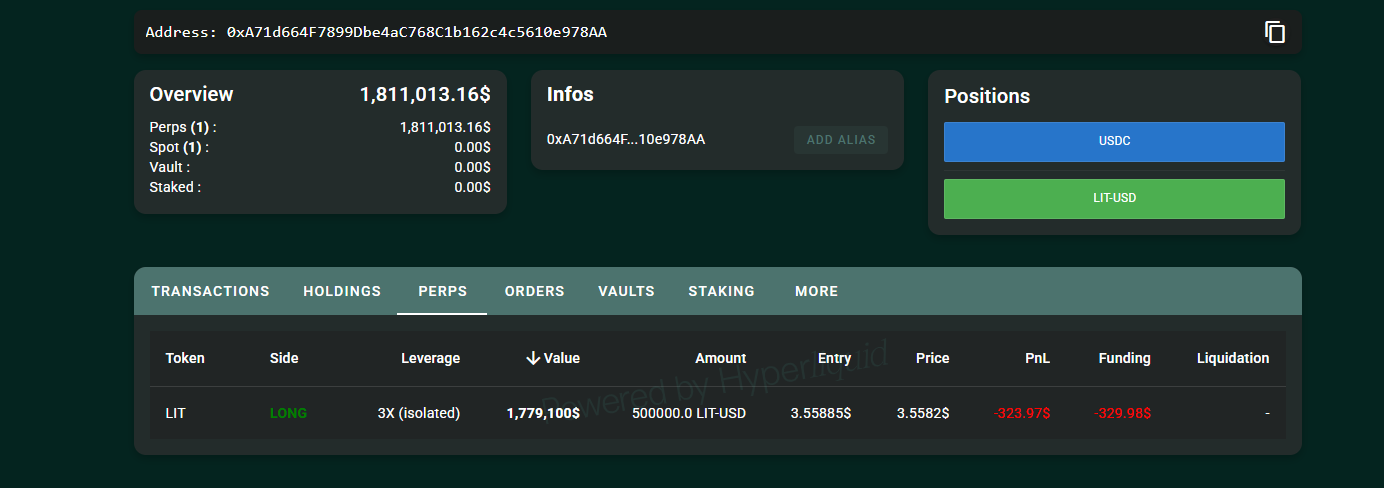

On-chain data added an interesting layer recently. A wallet tagged as 0xA71d deposited roughly 1.81 million USDC into HYPE about 8 hours ago and opened a 3x long position on 500,000 LIT, valued near 1.83 million dollars.

Data Source: Hypurrscan

One whale trade does not decide market direction, but trades like this are rarely random either. This type of large leveraged long usually appears when downside risk is seen as limited, at least in the short term. It suggests confidence, or at minimum, a calculated bet rather than impulse.

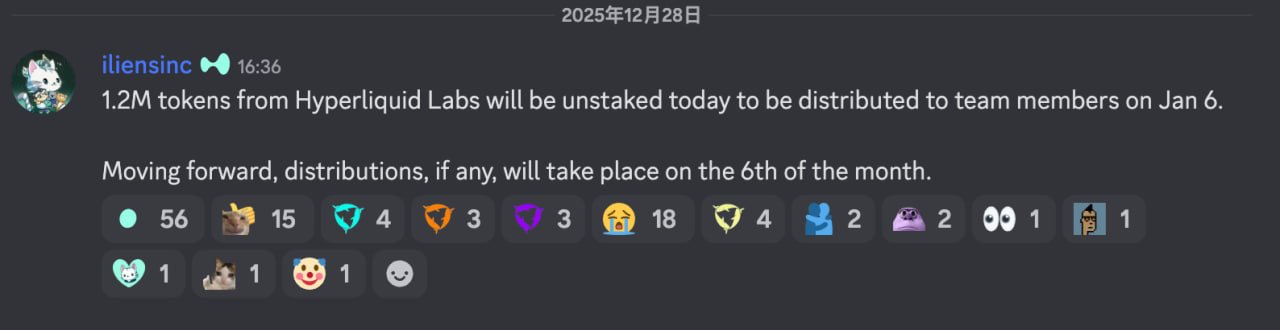

There is also supply-related information shared by Hyperliquid cofounder Iliensinc on Discord that 1.2 million tokens from Hyperliquid Labs will be unstaked and distributed to team members on January 6. Going forward, any future distributions are expected to follow the same date.

Source: X@WuBlockchain

This information does not automatically mean selling pressure will hit the market, but events like this do make traders cautious. Many prefer to wait and see what happens to those tokens. Do they stay idle, or do they move toward exchanges? Until that becomes clear, price often stays hesitant.

On lower time frames, the structure is still mixed. On the 4-hour chart, Hyperliquid price remains below a descending trendline that has acted as resistance before. Price has tested it, failed, and pulled back. Until that line is broken, upside moves may struggle.

Chart Source: TradingView

RSI sits around 56, behaving neutrally—not so bullish, not bearish. Bollinger Bands are starting to squeeze, and that usually means volatility is building quietly. Volume has also picked up sharply, suggesting traders are starting to take positions, even if price is not moving much yet.

There are some short-term levels to watch:

Immediate support: $24.80–$25.00

Strong support area: $22.50

Immediate resistance: $26.80 – $27.20

Short-term upside zone: $29.80–$30.50

If HYPE loses the $25 area and closes below, downside pressure could grow, and we might see the level of the next support zone of $22.50. This short-term bearish structure will be invalidated if the coin price breaks above the trendline and holds on a daily close.

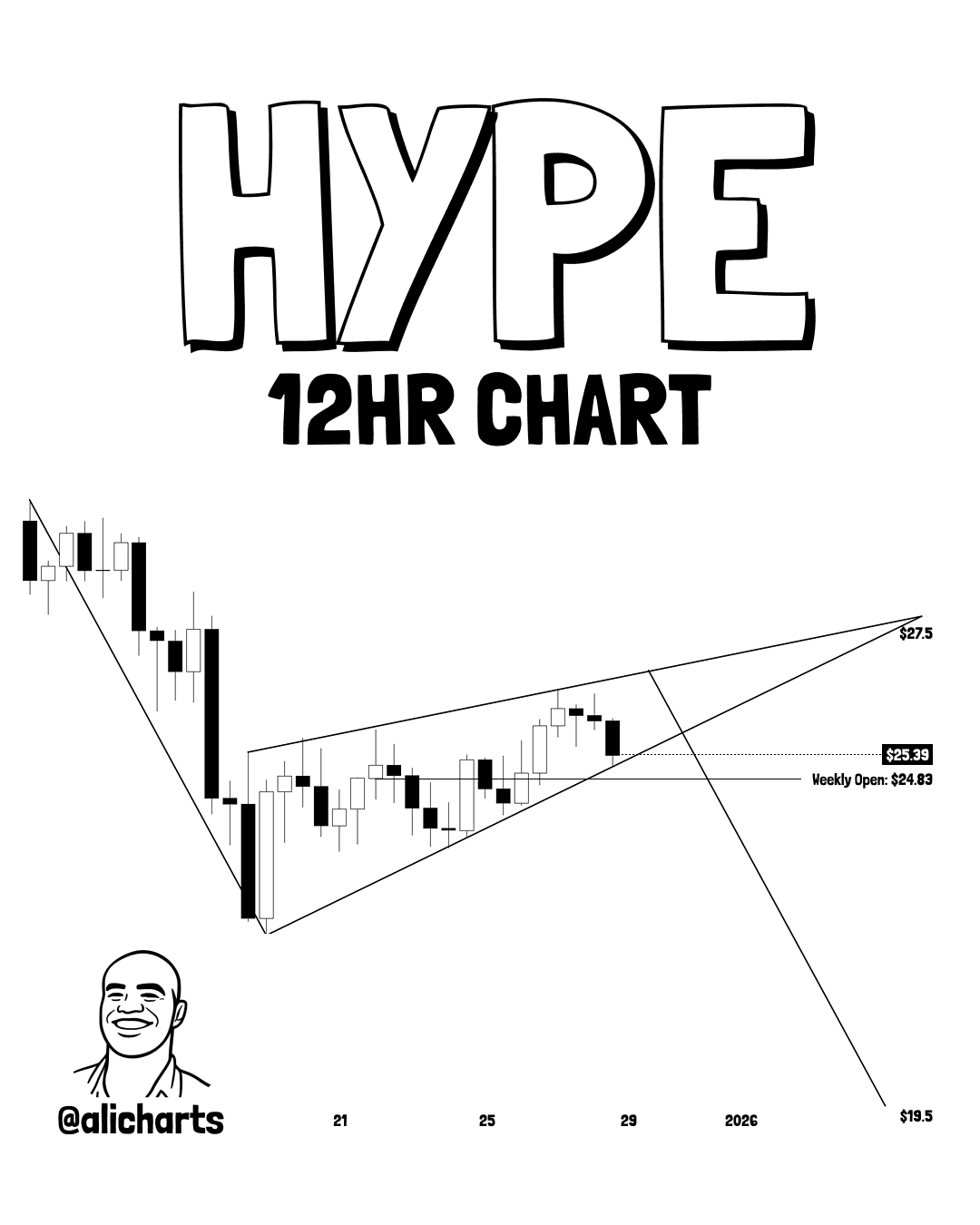

Looking at the bigger picture, an analyst named Ali Martinez says the 12-hour chart still looks more like consolidation than reversal. Price is hovering near an important pivot level. A sustained close below the weekly open could put HYPE under pressure, especially if volume expands on the downside. That would signal weakness rather than simple consolidation. For now, that breakdown has not happened.

Chart Source: X@alicharts

Long-term levels:

Key long-term support: $22.00 – $23.00

Major invalidation level: Below $19.50

Long-term resistance: $36.00–$37.00

Extended upside potential: $45+ if broader market conditions improve

As long as the price holds above the $22 zone, the broader structure remains intact. A break below will open the room for more downside levels.

Experts' opinion for HYPE price prediction is that Hyperliquid looks like it is waiting. Whale positioning, rising volume, and tightening volatility all point toward a market that is preparing rather than reacting; resistance from the downtrend line and upcoming token distribution events mean short-term caution is necessary. Direction will likely become clearer once price moves clearly out of this range, not before.

Disclaimer This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile; do your own research before making any investment decisions

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.