MilkyWay's native token, $MILK, is stepping into the limelight with its much-awaited TGE and major exchange listings on April 29, 2025. $MILK is meant to power security, gas fees, and liquidity across the MilkyWay ecosystem, being the fuel for a modular liquid staking protocol. With significant community excitement, heavy tokenomics, and included participation by Binance Wallet, the query that all potential investors want to ascertain is: Whether the altcoin can give exponential returns post-launch?

Now, let's delve into the fundamentals, token metrics, and anticipated price trajectory for $MILK in 2025.

MILK is the utility and governance token for the MilkyWay Chain, a platform designed specifically for modular liquid staking solutions. Having a finite supply of 1 billion coins, it will secure the chain, serve as the native gas token, and lock in on-chain liquidity operations as the backbone itself.

Following the launch on April 29, Milkway will be listed on MEXC, Bitget, Bybit, and KuCoin at 10:00 UTC, and also celebrate an exclusive TGE via Binance Wallet in collaboration with PancakeSwap, as the 13th such event within the Binance ecosystem of Web3 Wallet.

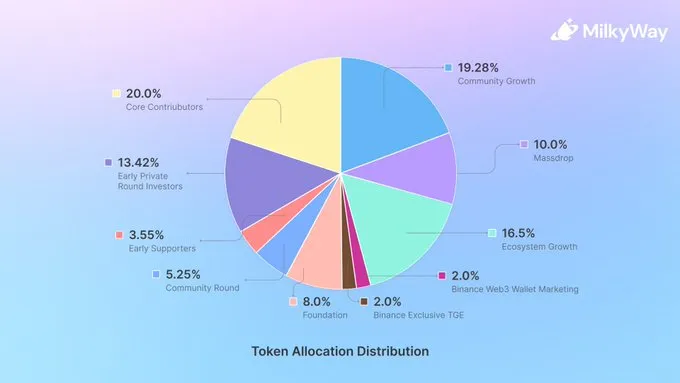

Token allocation is thus intended for ecosystem sustainability and community orientation:

Core Contributors: 20% (locked 12 months, 3-year vesting)

Private Investors: 13.42% (locked 12 months, 2-year vesting)

Community Growth: 19.28% (nearly 10% unlocked at launch)

Ecosystem Growth: 16.5% (6.25% unlocked)

Massdrop & Binance TGE: 12% combined, with gradual unlocks

The structured release plan above helps minimize immediate selling pressure on Milkyway, allowing for gradual momentum building.

Several catalysts are driving strong performance, including several top-tier exchange listings, exclusive TGE access, and broad community engagement. Here's a forecast price based on continuous momentum and similar projects:

| Timeframe | Estimated Price Range | Rationale |

|---|---|---|

| Launch (April 29) | $0.08 – $0.15 | Based on initial exchange demand and listing hype |

| Q2 2025 | $0.12 – $0.25 | Post-launch accumulation phase with low float |

| Q3 2025 | $0.20 – $0.35 | Ecosystem development, staking rewards, and new AVS onboarding |

| Q4 2025 | $0.30 – $0.55 | Momentum builds as utility deepens and liquidity grows |

However, if MilkyWay increases its AVS (Actively Validated Services) integration and staking adoption successfully, the price could easily mean a 5X-7X value by the end of the year from the TGE price level.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.