When the broader crypto market starts cooling off, a sudden breakout in a coin like MORPHO quickly grabs attention.

Today the token jumped nearly 9%, pushing price toward the $1.44 level before facing mild resistance.

Even though the move slowed near the top, it has sparked fresh discussion around the Morpho Price Prediction 2026 outlook.

The reaction does not look purely speculative.

Moves like this often appear when positioning begins quietly rather than when hype peaks.

The question now is whether this was just a short-term burst of demand or early signs of larger capital choosing a new place to sit.

Let’s look at what may be happening behind today’s move.

Recent market attention increased after a report from crypto.news on X revealed that Apollo plans to acquire up to 90 million tokens as part of a strategic deal aimed at expanding on-chain credit markets and DeFi lending adoption.

Such developments usually matter more than short-term price action because they reflect positioning rather than speculation.

Large capital entering a protocol this often changes how traders interpret the move, treating it as a structural shift instead of a routine rally.

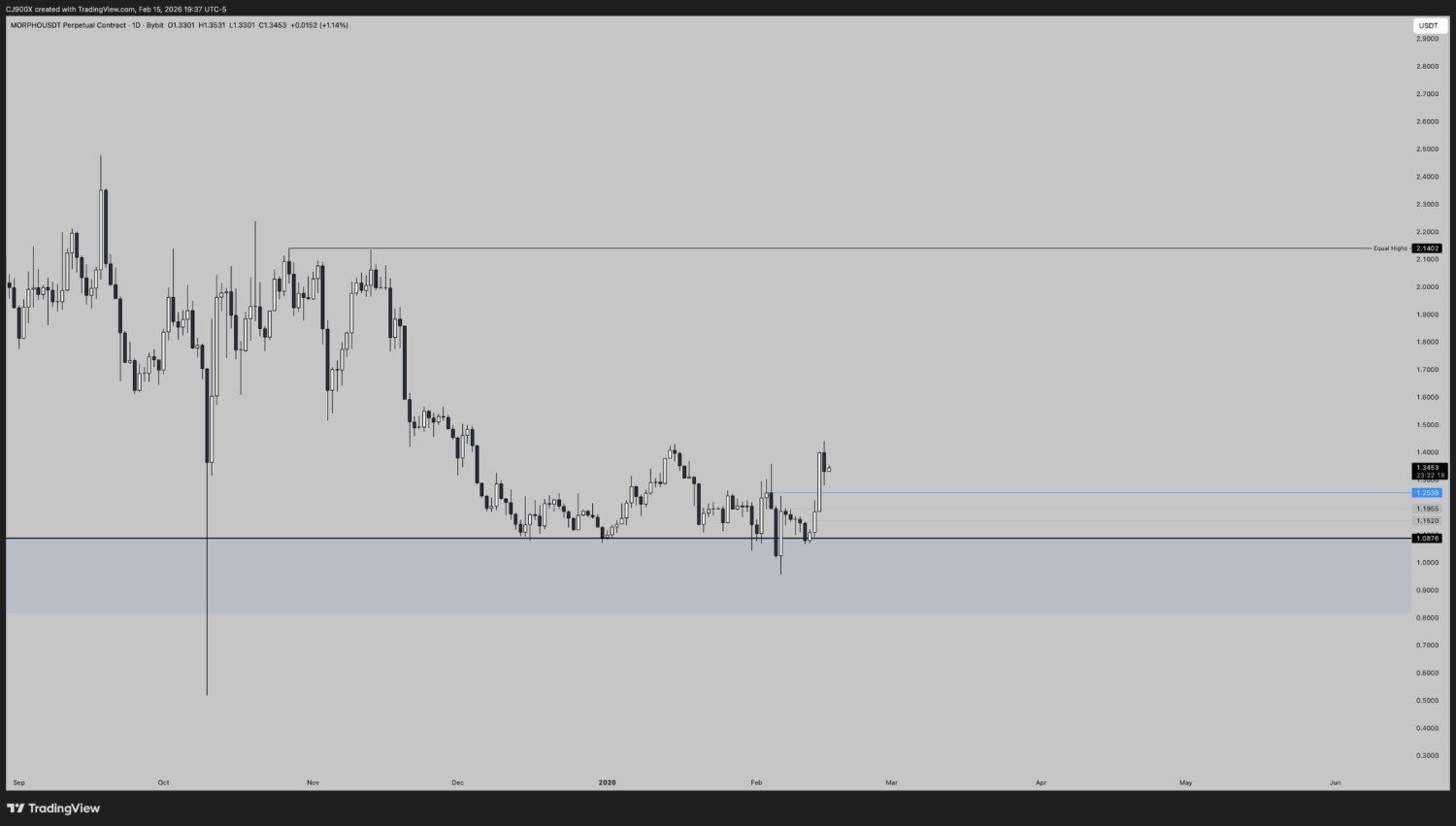

On the 4-hour chart, price previously moved inside a falling channel and has now broken above the upper boundary, signaling a shift in short-term structure.

After the breakout, price faced rejection at a long-term resistance and pulled back toward the 21 EMA, where buyers responded again.

The token is currently trading around the $1.42–$1.44 resistance zone.

EMA Structure

Price is holding above the 21 EMA, showing active dip buying and short-term bullish control. As long as the price remains above this level, the trend structure stays intact.

RSI Condition

RSI previously moved into the overbought region near 80. The recent pullback appears to be a natural cooldown rather than a reversal.

Resistance Levels

$1.42–$1.44 — Immediate resistance zone

$1.57 — Next resistance if breakout sustains

Support Levels

$1.31 — First support

$1.18 — Major support zone

Holding above the 21 EMA keeps continuation possible, while rejection from resistance may lead to short consolidation before the next directional move.

A market analyst on X pointed out a possible setup where price could first stabilize above the $1.25 level.

If price manages to sustain above this area, the next projected target comes near the equal highs zone around $2.1405.

This type of setup reflects how traders often wait for confirmation at nearby levels before expecting a larger expansion move.

MORPHO’s future now largely depends on institutional participation and whether recent technical breakouts can hold. Based on current structure and market sentiment, the roadmap appears to form in phases.

Short-Term

If price successfully flips the $1.44 resistance into support, the next upside area could open toward $1.80 to $2.14 (equal highs zone). Such a move would likely bring sidelined traders back into the market.

Medium-Term

According to the Morpho price forecast, the impact of the Apollo deal may gradually reflect in liquidity conditions, potentially pushing price toward the $3.50–$4.50 range, especially if Morpho V2 adoption expands at institutional level.

Long-Term

If on-chain lending activity continues strengthening, token could challenge and possibly move beyond its previous all-time high near $4.17.

Invalidation

A sustained breakdown below the $1.10 support zone would weaken the bullish structure and increase the probability of a deeper reset before any continuation.

From a structural standpoint, the Morpho Price Prediction 2026 outlook remains cautiously constructive as long as price holds above the $1.18–$1.25 demand zone.

The recent move appears driven more by positioning and improving sentiment than by short-term speculation, which usually leads to slower but steadier trends.

However, continuation depends on acceptance above the $1.44 resistance area.

A sustained hold above this level would strengthen the probability of expansion toward higher targets discussed in the broader Morpho price outlook scenario.

YMYL Disclaimer: Cryptocurrency investments involve high risk and extreme volatility. This Morpho Price Prediction 2026 analysis is for informational purposes only and does not guarantee future returns. Investors should conduct independent research and consult a qualified financial advisor before making financial decisions.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.