A shocking fall caused turmoil within the crypto market as the native token of MANTRA Chain, OM, collapsed over 90% in the last 24 hours- from above $6 to trade around $0.7350 in time for the press. The market cap saw a free fall from $5.9 billion to just $710 million, making immediate inquiries about how healthy the project is and whether it's going the Terra Luna or FTX way.

While some traders and community members have started to claim that this looks like a possible rug pull, the MANTRA team has instead stated that "forced liquidations" had caused the price drop and had nothing to do with internal team actions.

Blockchain analysis shows that at least 17 wallets have been seen depositing 43.6 million OM tokens (then worth $227 million) into exchanges since April 7. That is roughly 4.5% of the circulating supply of OM tokens. It is said that two of these wallets belong to Laser Digital, a strategic investor in the MANTRA ecosystem.

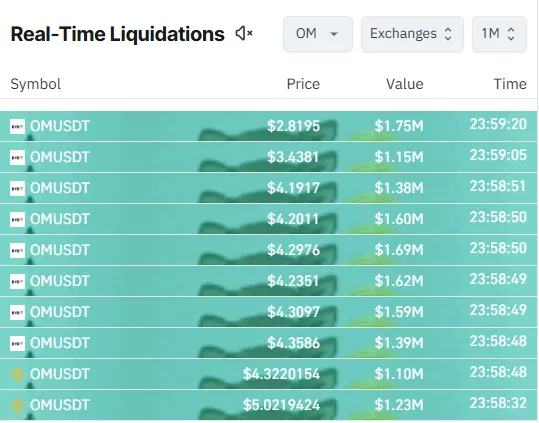

Liquidations of $70.02 million within 12 hours, including 10 positions greater than $1 million, indicate a cascading situation. Open interest has dropped almost 68%, down to $111.36 million, while trading volume skyrocketed by 6578% to $5.59 billion, an indication of mass panic, exit liquidity, and bot trades.

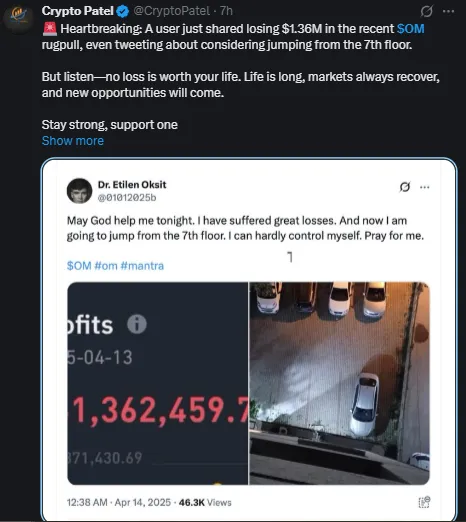

The price crash caused some emotional damage to investors. One user went so far as to publicly indemnify a loss of $1.36 million and suggested suicidal ideation. Such traumatic occurrences remind anyone that no monetary loss should ever supersede your existence or well-being. The markets go in cycles; there is always a possibility for recovery. Help is out there.

Please reach out to someone when you need support; you're never alone on this journey.

Breakdown of Key Indicators:

Current Price: ~$0.7350

Previous Support Levels: Completely breached

EMA Resistance Zones:

20 EMA: $5.77

50 EMA: $5.82

100 EMA: $6.42

RSI: 15.65 – deep oversold territory

The chart of the OM/USDT pairs concerning daily shows an adverse environment. After a long and difficult sideways consolidation, OM was unable to hold the exponential moving averages, resulting in a bearishly engulfing candle subsequently backed by very high volume. Further, the extremely low reading of the RSI at 15.65 points indicates the capitulation sign, and it could happen before the relief rally, but any subsequent bounce is very likely to die out unless it gets recoiled into some important zones.

Forecasting for the Next Short Term (Next 7 Days):

Bull Case: It makes its way toward the relative highs between $2.50 and $3.00 upon a reclaim of said volume riding on a repricing march back over $1 volume.

Bear Case: Ongoing sell pressure and sentiment may thus push the price to $0.50 or lower.

The MANTRA team took to X (formerly Twitter), assuring the community:

"Today's activity was brought on carelessly liquidations-not anything to do with the project. This was not our team."

While the promoters insisted that the fundamentals of the project are intact, the crypto community is demanding full-on transparency, especially concerning wallets linked to Laser Digital. Until then, it would seem that fear and uncertainty will continue to grip OM's short-term narrative.

OM's crash was almost like the collapse of Terra Luna, but there are striking differences- foremost is, however, MANTRA's public acknowledgment and continuing investigation. Long-term investors should be cautious about the goings-on, while short-term players should be ready to enjoy the risks and rewards that come from volatility.

With enough transparency, strategic communication, and education, the MANTRA ecosystem could even emerge from this cloud stronger. For now, though, it is too soon to predict any recovery in OM, and all positions should be managed with care.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.