What happens when a major Web3 football project delays its token launch—but promises something bigger? That’s exactly what OneFootball has done with its $OFC Airdrop and TGE update, and the crypto community is paying close attention.

Instead of rushing to market, the team confirmed that it delayed the launch to focus on product readiness and strategic partnerships, aligning the token release with the FIFA World Cup 2026 narrative. This decision has sparked strong speculation: could it launch stronger—and higher—than expected?

Let’s break down the OFC price prediction step by step, using simple language and realistic market logic.

As per the tweet, OneFootball has clearly stated that the TGE and Airdrop are now expected in Q2, with the token launch before June, most likely around April or May. This timing places OneFootballClub ahead of the broader World Cup hype, which could work as a powerful demand catalyst.

By delaying the listing, the team is aiming for a more stable rollout, better liquidity planning, and stronger ecosystem readiness—factors that often support healthier price action after listing.

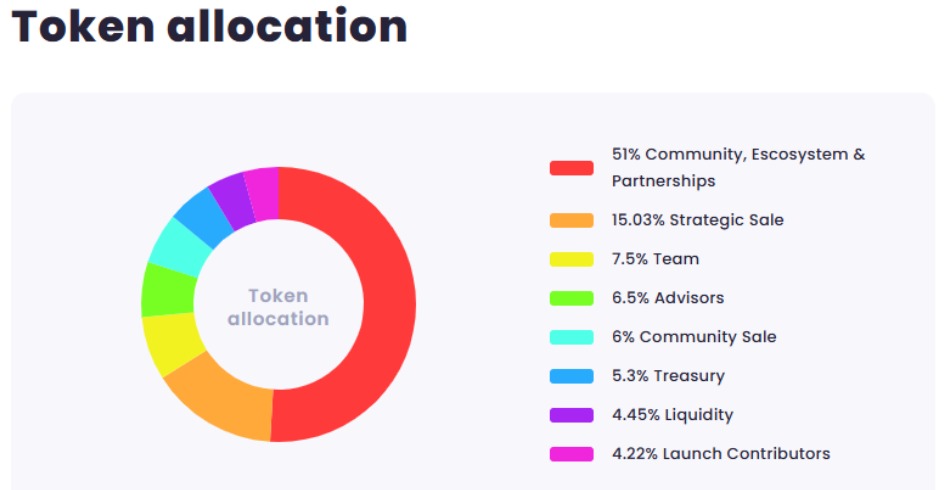

The OneFootballClub total supply is capped at 1 billion tokens, with over 51% allocated to community, ecosystem growth, and partnerships. This heavy community focus reduces extreme centralization and supports long-term adoption.

Lower allocations to liquidity and team tokens also help limit early sell pressure. When combined with controlled token releases, this structure creates a more balanced environment for price growth—especially in the early trading phase.

At launch, it is expected to list between $0.02 and $0.04. This range reflects limited initial liquidity, strong community allocation, and high anticipation following the airdrop.

Short-term volatility is likely, as early participants take profits and traders react to hype. However, if buying demand remains strong, price dips may be quickly absorbed.

In the weeks and months after listing, it could benefit from ecosystem updates, partnerships, and football-related marketing campaigns. If OneFootball delivers steady progress, the token may gradually move higher.

A realistic short-term price range sits between $0.10 and $0.50, depending on market sentiment and adoption growth. This phase will likely reward patient holders rather than short-term traders.

Over the long term, OFC’s performance will depend on real utility, user adoption, and ecosystem demand. If OneFootball successfully integrates OFC into its platform and expands partnerships, the token could see sustained growth.

In a strong adoption scenario, it could trade between $0.50 and $2.00 within 1–3 years. This outlook assumes broader crypto market stability and continued product development.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk. Always conduct your own research before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.