The killer whale cryptocurrency ORCA has been enjoying a high-water mark 200% surge over the past 24 hours. The coin burst past the $5 range on March 21, the first time this year its price has hit that mark; the cryptocurrency is currently hovering near $4.45, marking its highest price since December 2024.

The altcoin had been hovering below the $2 mark for much of the past month, with slightly above-average volatility. However, the announcement of Upbit listing on March 21 at 17:00 KST sparked immediate investor interest, and within hours trading volume was skyrocketing, creating a new yearly high for the token.

Upbit Listing: Increased liquidity and accessibility for Korean investors.

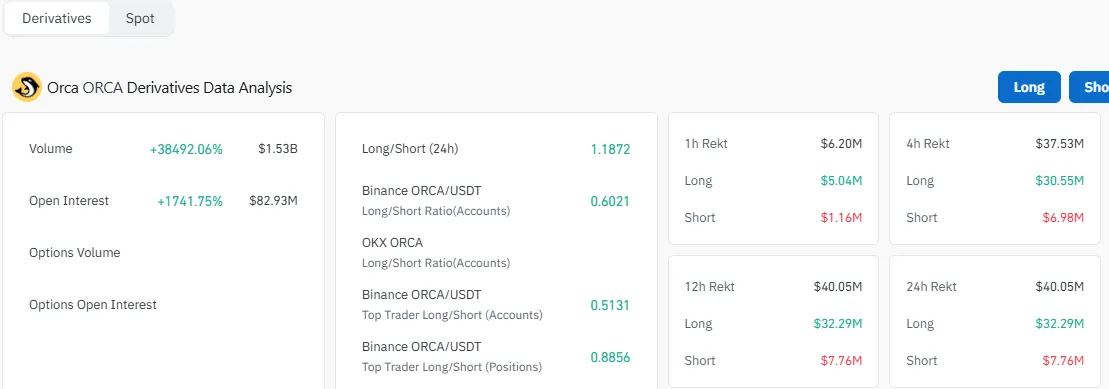

High Volume Trading: The derivatives volume of crypto rose 38,492.06% to $1.53 billion, according to Coinglass.

Institutional Interest: Open interest (+1.747%) surged to $82.93 million on strong speculative pressure.

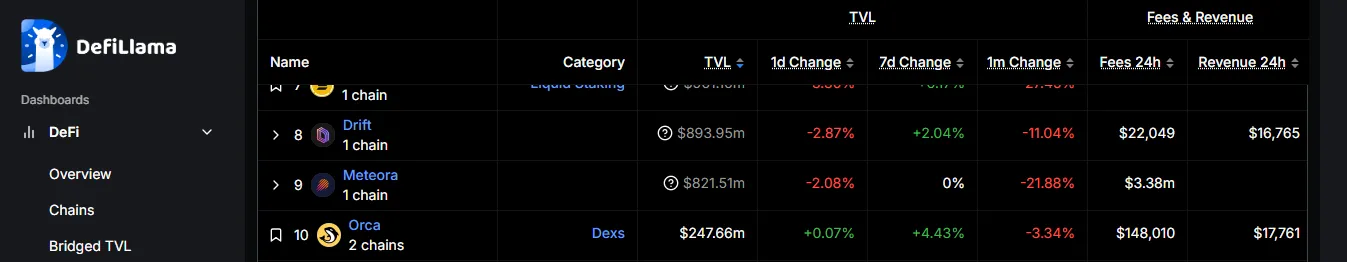

Solana ecosystem growth: ORCA is the 10th largest Solana-based decentralized exchange (DEX), according to DefiLlama, with a total value locked (TVL) of around $247.66 million.

Daily chart ORCA/USDT shows a swift move up, the token reached $4.336 before taking a slight retracement. The relative strength index (RSI) lines up at 84.03, which suggests overbought conditions, and perhaps a pullback or consolidation could occur (the MACD line is still positive) with an upward trend still expected.

Resistance Levels:

If the token stays above $4.00 we could see the next resistance zone in between $5. 50 and $6.00.

With a breakout above $6.00 the token may push higher to new highs over $7.00.

Support Levels:

If profits happen on coin maybe it can get some initial support near $3.20.

A deeper retracement could test the $2.50 zone, where buyers may re-enter.

Source: TradingView

Since the altcoin has been trading for very volatile periods, short-term a correction is likely; however, if bullish momentum continues the coin may reach $6 before any serious pullback occurs. The fundamental factors to consider are trading volume, derivatives activity, and sentiment in general in the Solana ecosystem.

Short-Term Forecast:

Bullish scenario - if the coin keeps above $4.00 to $5.50–$6.00 over the next few days.

Bearish Scenario: If the token drops below $3. 20 it could go lower to $2.50.

Long-Term Outlook:

If the token can maintain its momentum as a major Solana-based DEX, that could help push prices higher in the long term, and bring some of its historic $20.00 highs back in. However, investors should remain cautious of market corrections and macroeconomic influences.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.