Will Pepeto (PEPETO) explode after launch, or will early investors take profits and slow the rally? That is the main question traders are asking as this meme-style project prepares for exchange activity in 2026.

Pepeto built its identity around an “ancient frog god” character and a story tied to six symbolic powers — Power, Energy, Precision, Efficiency, Technology, and Optimization. While the theme adds community excitement, investors care about something else: price performance after listing.

The project combines heavy marketing, staking rewards, and planned exchange listings. That mix often creates early hype cycles in crypto markets. When visibility meets new liquidity, trading activity rises fast — and that is usually when the first price discovery happens.

PEPETO has a total supply of 420 trillion tokens, which is extremely large. Tokens with very high supply rarely start at high prices. Instead, they begin at very small decimal values and rely on demand growth.

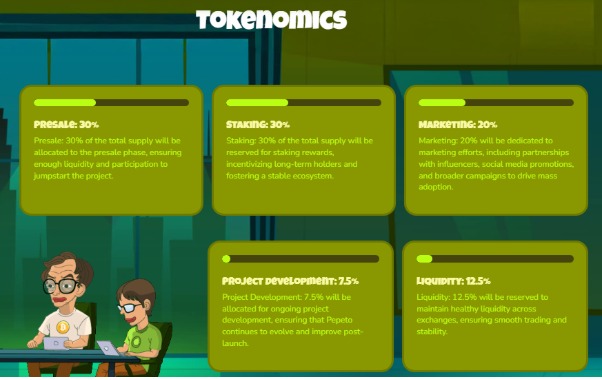

Key allocations:

30% Presale (early funding & community entry)

30% Staking rewards (long-term holding incentive)

20% Marketing & partnerships

12.5% Liquidity for exchanges

7.5% Development and upgrades

The staking allocation reduces circulating supply, while the liquidity and marketing allocation increases visibility and trading volume. Together, these factors usually support early volatility — both upward and downward.

Because of the massive supply, scarcity will not drive the price at launch. Instead, the first trading price will depend mainly on hype, exchange liquidity, and community participation.

Estimated listing range:

$0.00000005 – $0.00000012

In the first few days, a short spike above this range is possible. New traders often rush in during listings, especially meme-based projects. However, such rallies are usually followed by quick corrections once early buyers secure profits.

During the early trading phase, staking can play a major role. When users lock tokens, fewer coins circulate in the market. Reduced supply plus strong marketing often leads to momentum trading.

If exchange activity and social media attention remain high:

Possible short-term price range:

$0.00000015 – $0.00000040 (2x–4x from listing)

Still, investors should expect sharp pullbacks. Presale holders own a large portion of the supply, and many typically sell part of their holdings after listing to secure gains.

Long-term value will depend less on hype and more on utility and adoption. The project reserved 7.5% of tokens for development, suggesting planned upgrades and platform features.

If the team launches real utility, maintains community growth, and lists on multiple exchanges:

Possible long-term range:

$0.0000007 – $0.0000015 in a strong crypto market cycle

If adoption slows or interest fades, the price may stay near early trading levels. Meme coins historically rely heavily on community engagement, not just technology.

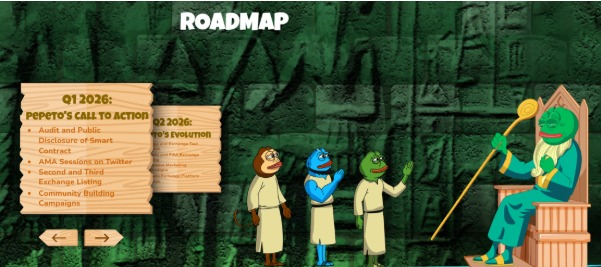

Q1 2026 – Transparency & Community Expansion

Smart contract audit and disclosure

Twitter AMA sessions

Multiple exchange listings

Community campaigns

Q2 2026 – Expansion Phase

Exchange test launch

More listings

Large marketing push

Beta exchange platform

These events matter because listings and marketing are the biggest price drivers for new crypto tokens.

PEPETO is a high-risk crypto asset. Meme-style tokens can rise quickly, but they can also fall sharply. Prices depend on sentiment, not guaranteed fundamentals. Never invest money you cannot afford to lose and always do your own research (DYOR).

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.