With a big token unlock coming up, will Pi Coin's 20% surge maintain its momentum, or could it just as easily turn back down?

As hype for the Pi2Day 2025 builds, there has been a spectacular 20% rally for Pi Network's native token in the past 24 hours. Market participants are now once again turned toward the network on the possibility of a sustained breakout; however, amidst the bullish buzz, a token unlock looms and price volatility history asks a very crucial question-Is this the beginning of a bullish run, or will the hype be followed by another correction?

Pi Network has been consistent in the price behavior around major ecosystem events. The altcoin gain of 30% in the $1.33-1.80 range before March 14 (PiDay) to losing all those gains afterward, falling back to $0.40, all upon a letdown of the community's expectations.

Likewise, there was a 180% pump from $0.58 to $1.67 in the lead-up to Consensus 2025, only to subsequently descend back near to $0.40 with the alleged lack of any announcements to follow.

Now, as Pi2Day 2025 approaches, the token has already rallied 20%. This repetition of surge-and-pullback behavior is forcing many traders and analysts to tread carefully, questioning whether the current rally has more fuel or if it’s another setup for a post-event correction.

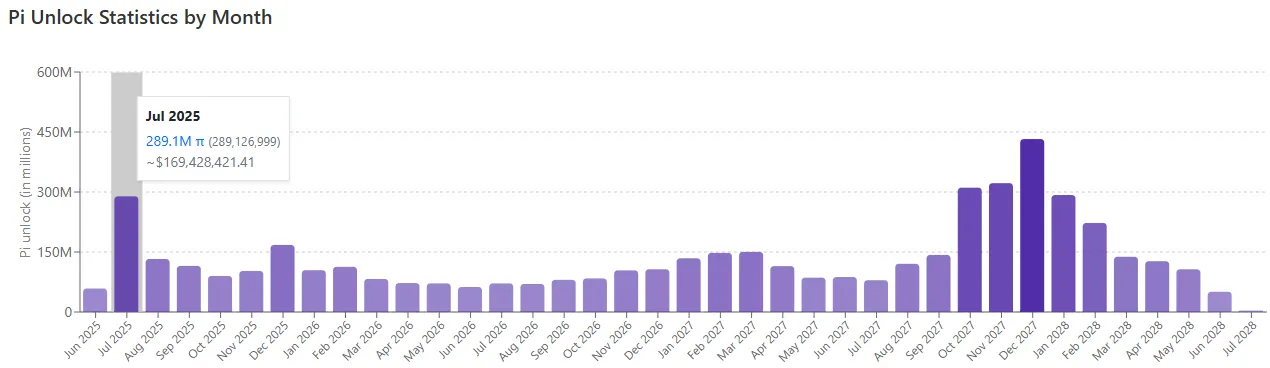

A further warning to investors is a scheduled unlocking of 289.10 million tokens in July: the biggest single release until the latter part of 2027. Historically, token unlocks of such magnitude tend to exert massive selling pressure-if they are not met by new demand or huge platform advancements.

Source: Piscan

If the larger ecosystem lacks strong updates-mainnet upgrades, GenAI integration, or a major exchange listing-the newly unlocked tokens will descend on the market and take prices back down into heavy support levels.

From a technical analysis perspective, the altcoin recently broke out of a falling wedge pattern, which is generally considered bullish. But while this breakout has brought about the current upside move, the momentum indicators are starting to give warning signals.

The price tested the 50-Day EMA, but resistance was encountered, and the move was pushed down again; the RSI also fell back below the 50 line, indicating another weakening instance of momentum. If the token fails to break above the $0.65 resistance, the bulls may struggle to push the price any higher.

If the Coin sustains its momentum and manages to break above the resistance level of $0.65, a further rally could be seen toward the zone of $0.80 to $1.00. This has acted as a psychological barrier during past rallies attracting both the interest of speculators and some profit booking.

Source: TradingView

In contrast, If Pi2Day becomes a reality with underperforming updates or unlock massive selling of tokens, the price may pull back towards $0.50. A somewhat deeper correction can surely test long-term support just about $0.40, where price noticed a strong bottom.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

7 months ago

It's a wonderful sharing.