The broader cryptocurrency market is still under pressure. Bitcoin and most major altcoins are moving slowly, and many are struggling to keep any real momentum. In the middle of this dull stretch, Polymesh is beginning to stand out. POLYX is trading around $0.06220, up about 1.6%, while trading volume has jumped sharply to nearly $29.18M, an increase of more than 300%. That kind of volume move is hard to ignore, especially when the rest of the market is offering very little support.

Moves like this usually raise questions. Is this just short-term activity driven by traders, or is something quietly building beneath the surface? This Polymesh price prediction looks at what the recent price and volume action could be hinting at and whether this strength can hold while the rest of the altcoin market sentiment remains slow.

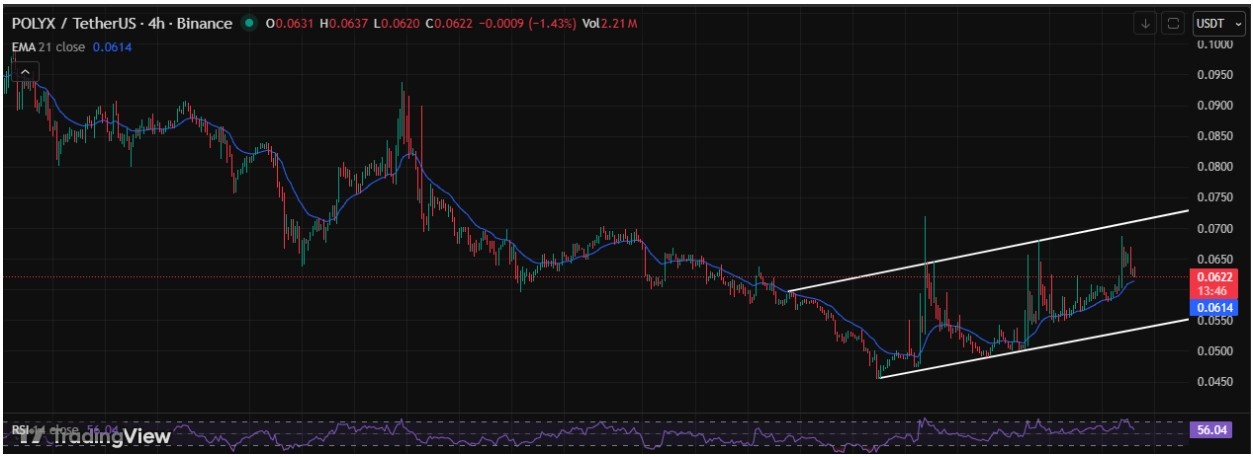

Looking at the 4-hour chart, POLYX is still holding its ground for now. The move up was decent, and the price is still trading inside a rising channel. Some selling happened, but it did not flip the structure. The $0.0575–$0.0594 area keeps showing up as support, and the 21 EMA is also supporting the price in that zone.

Source: TradingView

There was also an attempt to break the channel on the downside, but there was no strong momentum. Price dipped, but buyers defended the $0.0500 level quickly and pushed it back up. That tells me demand has not disappeared, even if momentum has slowed a bit.

On the upside, $0.0650–$0.0660 is where the price struggled last. If that area gets cleared and holds, then $0.0700–$0.0720 comes into view, and after that $0.0770–$0.0780. Volume has cooled compared to the spike earlier, which usually happens during pullbacks. RSI is hovering at 58.

If the price breaks $0.0575, the rising channel pattern also breaks, and the picture changes. Then $0.0500–$0.0450 becomes relevant again. For now, it feels cautious, not broken.

On the long-term daily chart, Polymesh looks like it is trying to come out of a rough phase, not flipping bullish overnight. Price stayed in a clear downtrend for a long time, sellers had control, and rallies kept failing. That started to change after the bounce from the $0.0450–$0.0500 zone. That move was not small, and it did not get sold off instantly, which matters on a daily chart. One important shift is that price has already closed above the 50 EMA, and instead of rejecting, it is now sitting around that same level and trying to use it as support. That usually shows behavior is changing, even if slowly.

Source: TradingView

Right now, the main hurdle sits around $0.0720–$0.0750. If the price manages to break and hold above this resistance with daily closes, the move can extend further. In that case, the next area that comes into focus is near $0.085, and if momentum stays strong, price can stretch toward $0.095–$0.100 over time. It will not be a straight line, but the room opens up.

On the downside, things change quickly if the price cannot hold above the 50 EMA on the daily chart. A daily close back below that level would be the first warning, and the price can slip toward the $0.0590–$0.0565 area, which lines up with recent reactions. If that zone also fails to hold, then the market may start drifting back toward the $0.0500–$0.0480 range.

That area acted as a strong base earlier, so buyers will likely react there again. If the price starts living below that zone, then the whole recovery idea gets delayed, not invalidated, but pushed further out in time.

Right now, the Polymesh price prediction looks better than before, but it is still not certain, especially compared to other altcoin price prediction setups in the market. Analysts are watching the daily close above the 50 EMA, which is important after such a long drop. It indicates that sellers are backing off a bit, but nothing has been confirmed yet. The $0.0720-$0.0750 area remains heavy until the price passes through that level and remains there; this is viewed as a recovery rather than a true trend change. The key is to hold the support. If the coin loses that, the entire movement will slow down again.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.