PumpFun Price climbed over 7% on Tuesday as the token extended its short-term rebound for the fifth day. It is now trading around $0.0032 with a $1.13 billion market cap and 24-hour volume of $603.1 millions according to CoinMarketCap.

PumpFun Price maintains momentum after reclaiming $0.003260, supported by a breakout above descending resistance and a double bottom pattern. The 4H chart reveals a broadening triangle, formed by higher highs, with diagonal resistance and $0.003666 acting as critical breakout levels.

Pump.fun 4hr chart Price Analysis : Source : TradingView

The break above the zone might drive the price to the level of $0.0046 and even retest the all-time highs, whereas a close below the current price of $0.0022 could trigger a fall to the next psychological support at $0.0015.

This structure is supported by indicators: RSI is above 61 and MACD remains in uptrend, which confirms bullish divergence and presence of buying pressure.

According to the latest report by Cryptogics, PumpFun had a total revenue of 15.3 millions, which is the sixth-highest among the top 15 protocols.

It was only outdone by five projects, such as Tether $435M, Circle $176M, Ethena $39.3M, Sky $37M, and Pancake $32M. It had 1.9 millions monthly active addresses, surpassing protocols, such as Aerodrome 62.6K and Photon 40.9K.

Top 15 Projects by total revenue : Source : Cryptogics

PumpFun does not report a TVL, but it competes with those that have billions in TVL. This implies a lot of transactional activity even without the traditional DeFi metrics.

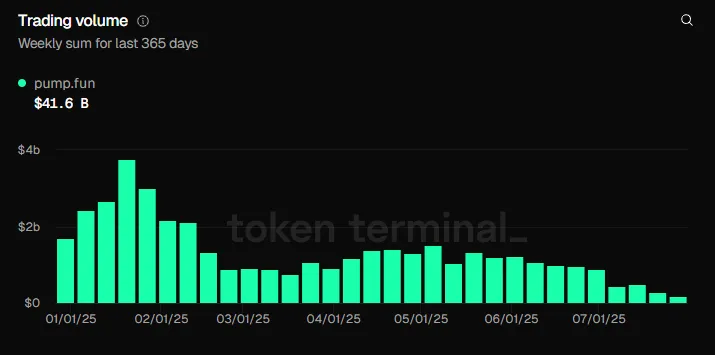

According to token terminal, the platform's trading volume reached 41.6 billion, and the revenue was 411.5 million in the past 365 days. But revenue has been falling steadily since the peak of more than $3.76 billion in late January.

Pump.fun weekly sum for last 365 days : Source : token terminal

On weekly data, trading volume recently hit $13.9 billion and fees totaled $411.5 million. PumpFun collected no supply-side fees, indicating all generated fees possibly went to the protocol. Although revenue has slowed, the project’s fee and usage activity keeps it in the top ten list.

PumpFun’s derivatives data, as per Coinglass, shows $1.65 billion in 24-hour volume, up 73.46%. Open interest rose 4.45% to $486.71 million. Binance users show a long/short ratio of 2.375 (accounts), with positions at 1.7556, suggesting more bullish bets are placed.

Across all exchanges, the long/short ratio is 1.0056, indicating neutral-to-bullish market sentiment. Over the past 24 hours, $3.08 million was liquidated $1.85 million from longs and $1.24 million from shorts.

Short-term liquidations were also recorded: $722K at 4 hours and $2.01 million at 12 hours, confirming high volatility.

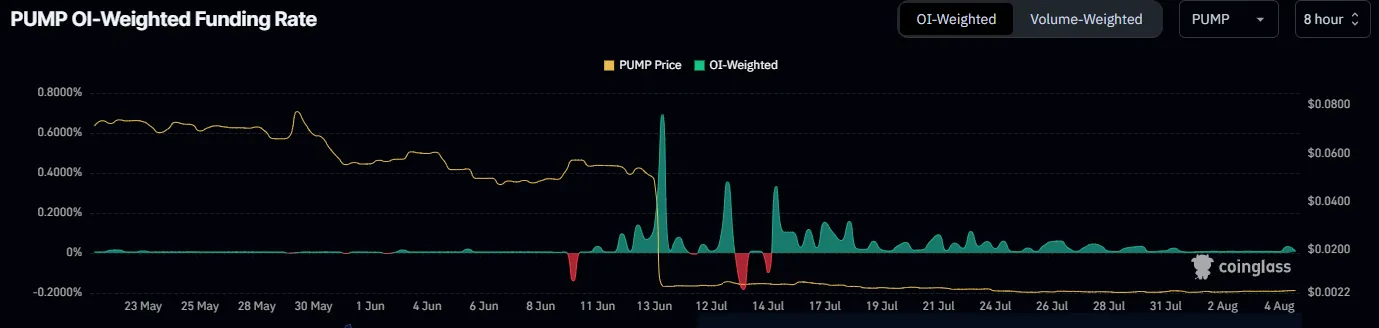

PUMP Weighted Funding Rate : Source : Coinglass

PumpFun is near-neutral to slightly positive on the funding rate side. The OI-weighted rate was at its highest of 0.69% in January but declined and leveled off in July, showing less bullish funding aggression. Up to August 4, there is no extreme spike or adverse swinging in funding.

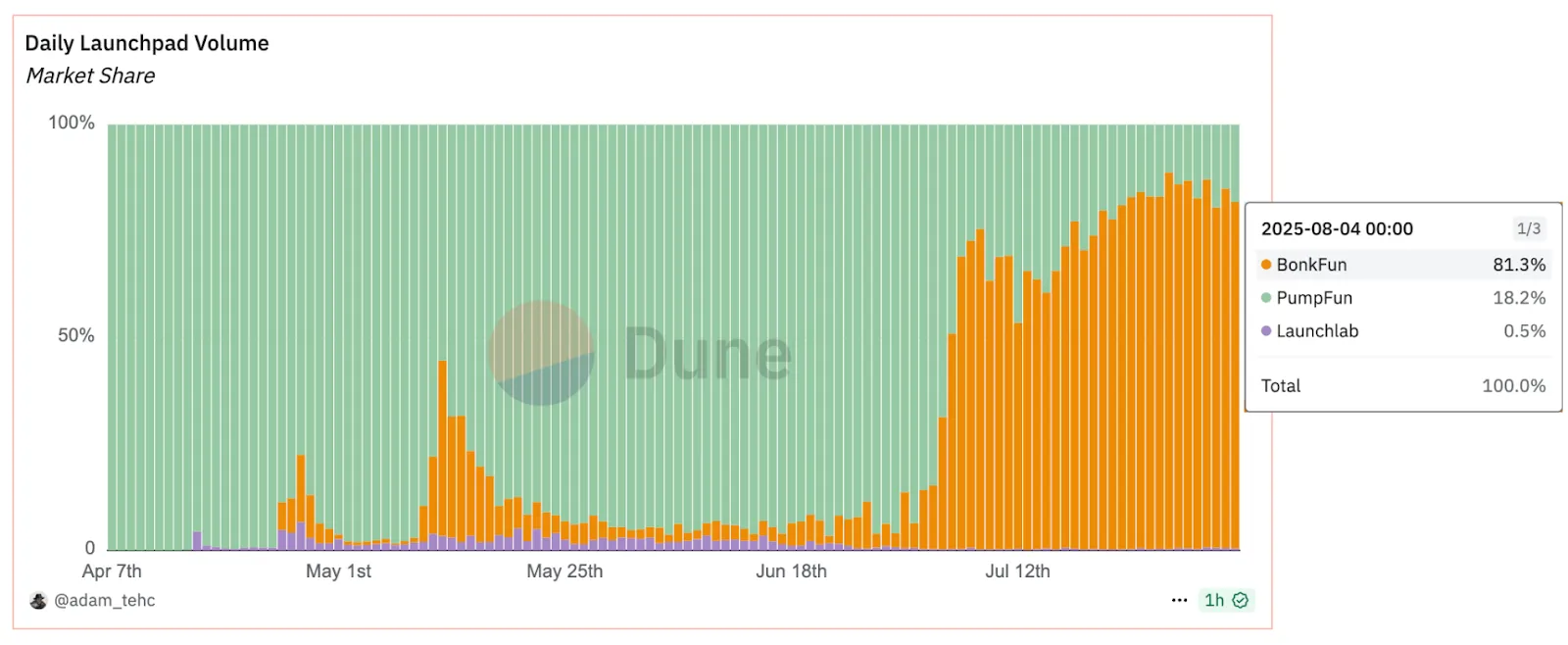

PumpFun’s launchpad activity saw a decline in dominance. According to the Dune Analytics data, BonkFun captured 81.3% of the daily launchpad volume, with PumpFun capturing 18.2%.

This is a huge decline in comparison to the previous months when PumpFun had control of the market. The decreasing numbers can be an indication of a lesser token enthusiasm or the emergence of newer competitors.

Daily Launchpad Volume : Source : Dune

On the spot exchange heatmap, Bybit is the leader with a 1-hour volume of $2.87 million, followed by Coinbase $1.71M and OKX $1.38M.

Nevertheless, the net inflows are negative in all exchanges. OKX reported a deposit outflow of 327K, Bybit 294K, and Kraken 187K, showing the current sell-side pressure in the near future.

Ronny Mugendi is an experienced crypto journalist with four years of professional expertise, having made substantial contributions to multiple media platforms covering cryptocurrency trends and innovations. With more than 4,000 published articles to his name, he is dedicated to informing, educating, and bringing more people into the world of Blockchain and DeFi. Beyond his journalism work, Ronny finds excitement in bike riding, enjoying the adventure of exploring fresh trails and landscapes.