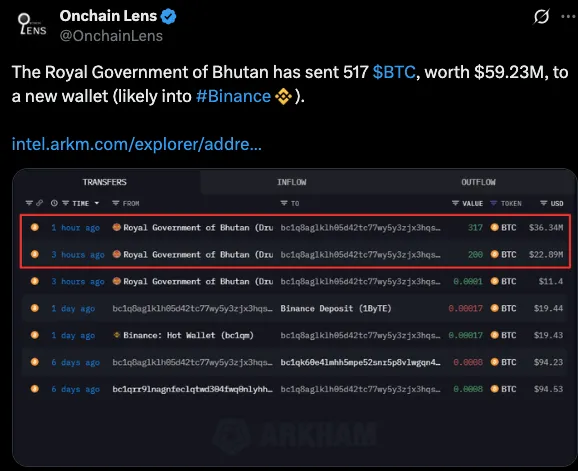

The Royal Government of Bhutan has transferred a total of 517 BTC, valued at approximately $59.23 million, to a new wallet. Blockchain analytics show the movement occurred within the last few hours, with 337 BTC and 180 BTC sent in two separate transactions. These funds are now linked to a wallet address believed to be associated with the Binance platform.

According to data from Arkham Intelligence, the recipient wallet bc1qa8glkhlh965d42tc77vy5y3zj3xh9sq...is likely linked to a Binance deposit address. This implies that the sovereign digital assets of Bhutan could be going into active trading or custody storage on the exchange. These transfers have resulted in renewed debates in the crypto community, as to the timing and amount.

In the last week alone, this wallet was in minor transactions with other wallets, including deposits in the hot wallet of Binance. Transfers of Bhutan have recently been in large numbers of considerable value and are also associated with a government entity, which is rather rare in crypto transfers to this extent.

The strategic move to transfer such a huge block of Bitcoins has been an eye-opener in the blockchain community since it was done by the Bhutanese government. Speculation rises as to whether it is an investment, liquidation, and reallocation how others move out will be of great interest to the analysts in the future.

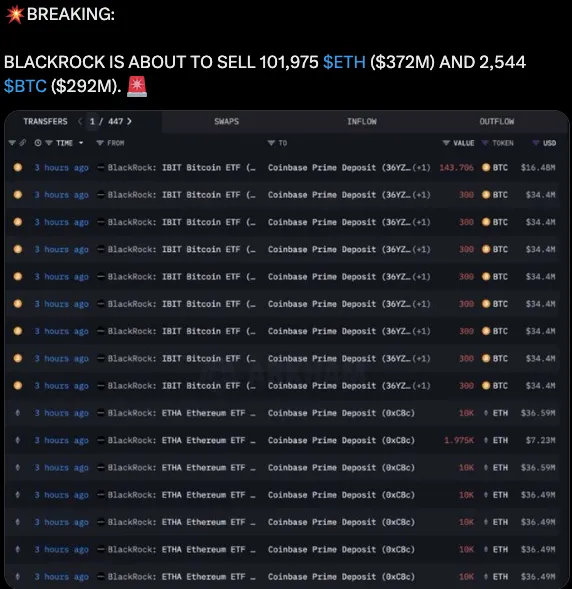

In a significant move, BlackRock has deposited a massive amount of cryptocurrency into Coinbase Prime earlier today.

Approximately three hours ago, BlackRock's Ethereum and Bitcoin ETFs initiated major transactions into Coinbase’s institutional platform. The firm transferred 101,975 ETH, valued at around $372 million, into its Coinbase Prime account. Alongside this, 2,544 BTC—worth roughly $292 million was also moved.

On-chain data shows a series of closely timed transactions. Bitcoin transfers included 300 BTC per transaction, while Ethereum transfers were mostly batches of 10K ETH. These patterns indicate a structured institutional deposit strategy rather than sporadic asset movement.

BTC price is trading at $112,860, facing downward pressure below the key $115,000 resistance level.

Bitcoin slides further after an unsuccessful attempt to exceed the level of $115,000. Sellers took back control and pushed price towards the next level of support near $110,000.

Relative Strength Index (RSI) is now at 36.80 indicates that the stock is close to going into an overbought zone. This is indicative of the increasing bearish power, and buyers are wary at the present levels.

At the same time, the MACD histogram is negative as well. The MACD line is below the signal line, which confirms the downward momentum confirmed. In the near-term, bullish crossover is difficult to expect unless the demand level is restored.

Source: Tradingview

Bitcoin price can't hold price above $115,00, and now it raises a red flag for price action in near term. Selling pressure may increase faster should the price go below $110,000.

On the positive side, the first important resistance is at the level of 115,000. A near break above it may set the stage towards a rally to levels above $120,000.

Annah Mugoiri is an emerging voice in the crypto content space With More than 5 years of experience, with a growing passion for blockchain technology and digital finance. She possesses a sharp grasp of market dynamics and the broader cryptocurrency landscape, skillfully simplifying complex topics like Bitcoin, altcoins, DeFi, and NFTs into reader-friendly, engaging articles. Annah combines in-depth research with a clear and concise writing style that appeals to both beginners and seasoned crypto investors. Dedicated to monitoring price trends, project launches, and regulatory changes, she keeps her audience updated on the rapidly evolving crypto scene. Annah is a firm believer in blockchain’s transformative power to foster innovation and expand financial access worldwide.