Bitcoin (BTC) is again the new topic in the news as it has broken above a very serious technical resistance and has, once again, rekindled bullish hopes across the world of crypto markets. After trading sideways for some weeks, BTC is now riding above $87,000, with several dominant analysts and investors calling for 2025 to be the year for a massive bull run.

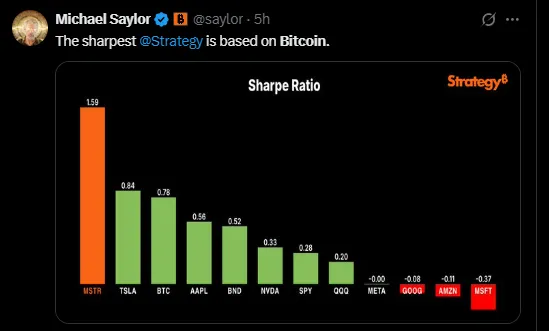

With Robert Kiyosaki predicting Bitcoin will hit $180,000 to $200,000 and Michael Saylor touting BTC's better Sharpe Ratio compared to traditional tech stocks, all looks set for the king of cryptos; however, is this just hype, or are we about to witness the real deal where Bitcoin's next mega rally has started?

Robert Kiyosaki, the famous author of the book Rich Dad Poor Dad, has expressed his outlook on BTC in a post on X (formerly Twitter), stating:

"Bitcoin is at $84,000. I believe it will hit between $180,000 to $200,000 in 2025. What do you think?"

Kiyosaki’s prediction comes at a time when U.S. dollar strength is in question, global economic uncertainties loom large, and institutional demand seems to build for alternative assets. The post came at a time when gold hit its 55th all-time high in a mere 12 months, indicating a macroeconomic shift toward hard assets like gold and the world's largest cryptocurrency.

From a technical perspective, BTC has just recently busted out of a falling wedge pattern, one of the favorite indicators of bullish reversals. Almost all of the indicators listed below support this breakout:

Prominent close of the daily candle above 20, 50, 100, and 200 EMAs

Volume showing signs of rising

The RSI showed at 57.91, which allows for bullish strength with no signs of an overbought condition

Price Targets Based on Chart Analysis:

Short Target: 92,000-95,000

Mid-Target: 100,000-104,00

Long Target- Q3 2025: 110,000+

This breakout ends months of price consolidation and potentially opens the door to a new bullish cycle heading into 2025.

BTC investment performance was said to have been highlighted with a Sharpe Ratio chart by Michael Saylor, Executive Chairman of MicroStrategy (MSTR). This data illustrates:

MicroStrategy Sharpe Ratio: 1.59

Bitcoin: 0.78

Tesla: 0.84

Apple: 0.56

Microsoft: -0.37

This indicates that assets in alignment with Bitcoin (such as MSTR) are risk-adjusted return outperformers compared to traditional tech giants, solidifying Saylor's stance that BTC should be a core part of every investor's portfolio.

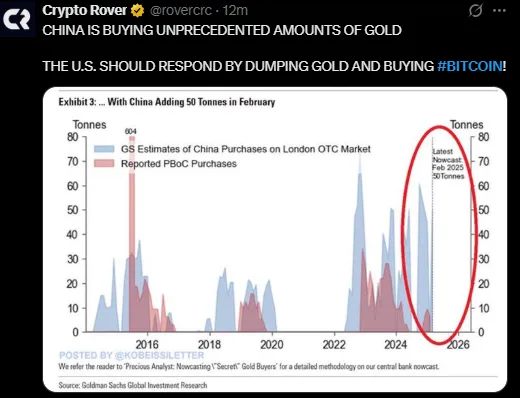

In line with this bullish macro development, China has gone on the offensive with its gold strategy. As Crypto Rover stated, China added 50 tonnes of gold to its reserves just in February alone, an "unprecedented" number. As the official PBoC acquisitions rise, so do those in the OTC market. Some analysts now recommend that the U.S. change its reserve strategy from gold to BTC.

The narrative is clear: as geopolitical and economic uncertainty grows, nations are moving toward non-sovereign assets like gold and the world's top digital currency for protection and diversification.

The asset's recent breakout above $87,000 signals a pivotal moment for the cryptocurrency market. As voices like Kiyosaki, Saylor, and leading technical analysts align on a bullish trajectory, the world's largest currency may be gearing up for a historic run toward $100K — and potentially even $200K in 2025.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.