Galaxy Digital, Jump Crypto, and Multicoin Capital are reportedly raising $1 billion to build the largest Solana-focused digital asset reserve. Bloomberg sources indicate that the three intend to purchase a publicly listed firm, which it will convert into a SOL-focused treasury vehicle.

Cantor Fitzgerald is reportedly lined up as the lead banker and the Solana Foundation is reported to be behind the effort. In case of such a move, the reserve would be larger than all the current corporate stash of the altcoin.

Upexi currently has the biggest Solana treasury with 2 million SOL, which translates to the equivalent of $400 million, and the second biggest is DeFi Development Corp with 1.29 million SOL. Bit Mining is also planning to raise up to $300 million in its own SOL holdings, indicating more corporate interest in the network.

The $1 billion treasury initiative would increase the size of the largest known SOL reserves by more than double, which will indicate institutional confidence in the potential recovery and subsequent value of Solana.

The top altcoin is currently trading at $198 and has increased more than 9.6% in the last week despite the short-term dip. Technical indicators point to a rise in momentum, but significant resistance is nearby.

Source : X

Analyst Ali said the key breakout to monitor is $211. A confirmed close above it may result in an upside move towards $222 and minor resistances are likely at $213, $216 and $218.

The price structure is indicative of healthy consolidation, and the bulls may push the price higher should these levels be cleared. This setup favours the wider bullish trend despite short-term selling pressure.

While the altcoin shows strong performance in USD terms, some analysts remain cautious when comparing it to Ethereum and Bitcoin. Pentoshi observes that SOL/USD can move to $250 level, but the asset lags behind on key crypto pairings.

https://x.com/Pentosh1/status/1959802749370953864

SOL/ETH is currently trading at 0.04424 ETH, which is way below the resistance level of 0.05446 ETH, meaning that it is underperforming in this cycle. Likewise, the SOL/BTC pair is close to 0.0018558 BTC, where several breakouts have been halted since 2021.

Even in the event of Solana gaining in dollar terms, Pentoshi predicts a limited upside against ETH and BTC. This underlines a disconnect between USD strength and retail and institutional favouritism of upper-tier assets.

Solana has seen significant growth in 2025, supporting a bullish outlook despite its technicals. Circle has minted 1 billion USDC on Solana in 2022, and the total amount of USDC released has reached 25 billion, which improves DeFi liquidity.

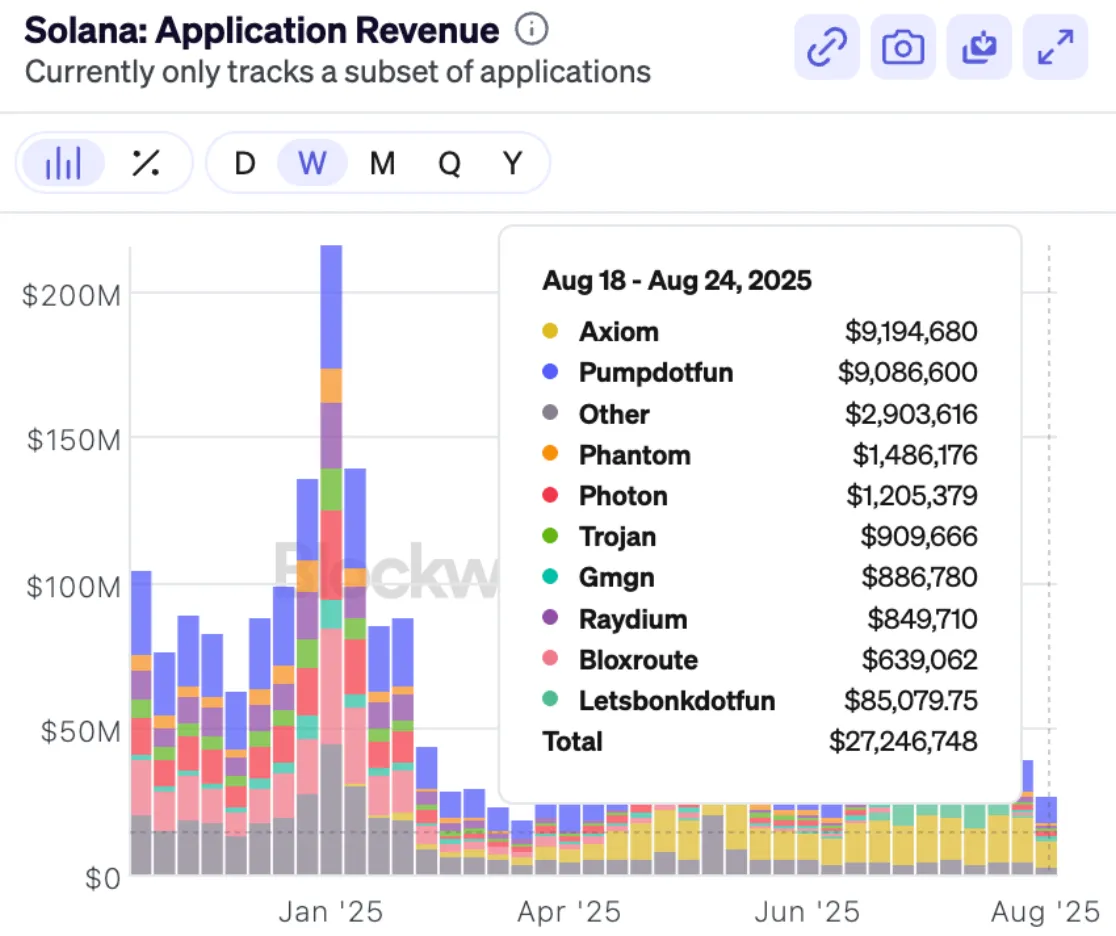

At the same time, almost 300,000 new tokens, mostly memecoins, were created on Solana, contributing to record-high fee activity. Pumpdotfun was the driver of this trend, with an estimated 90% of all launchpad revenue.

In the last seven days, Solana-based DApps have collected over $27 million in fees. Axiom Exchange and Pumpdotfun contributed the most, at $9.19 million and $9.08 million, respectively.

Application Revenue : Source : BlockWorks

These metrics point to an increasingly engaged user base, a healthy network, and revenue. With these fundamentals and with increasing corporate interest, there is a good argument to support further gains in the altcoin market performance.

Ronny Mugendi is an experienced crypto journalist with four years of professional expertise, having made substantial contributions to multiple media platforms covering cryptocurrency trends and innovations. With more than 4,000 published articles to his name, he is dedicated to informing, educating, and bringing more people into the world of Blockchain and DeFi. Beyond his journalism work, Ronny finds excitement in bike riding, enjoying the adventure of exploring fresh trails and landscapes.