The price of Solana (SOL) has demonstrated a positive 24-hour price action, rising from $178 to $189 before slightly pulling back to $184. This upward movement signifies strong momentum and optimism surrounding the crypto, which is currently priced at $185.88.

Market forces revealed dynamic activity within the 24-hour window. Solana surfaced with further intense buying interest, notwithstanding its price oscillations.

Amid this perfomance, the altcoin's price action drawn by analyst Ali Martinez against Tether (USDT) on the 12-hour chart highlights an ascending triangle. Such a pattern generally signals a potential breakout to the upside thanks to a rising support and a flat resistance.

Source: X

In this particular case, the resistance level is just shy of $205.78 and the support line is slanting upward, which is an indication of sustained buying pressure.

To target key price zones, Fibonacci retracement levels have been drawn. With Fibonacci levels running from $118.77 to $205.78 and the current price above the 0.786 retracement level of $176.42, Solana is seen to be maintaining a bullish trend. The price earlier rebounded off 0.5 ($143.81) and 0.618 ($156.33) levels earlier this year, forcing these zones to become very important support.

Fibonacci extension targets lie ahead should the altcoin break above resistance at $205.78. These targets include $250.26 at the 1.272 extension, $277.18 at the 1.414 level, $320.99 at the 1.618 extension, and $362.23 at the 1.786 extension.

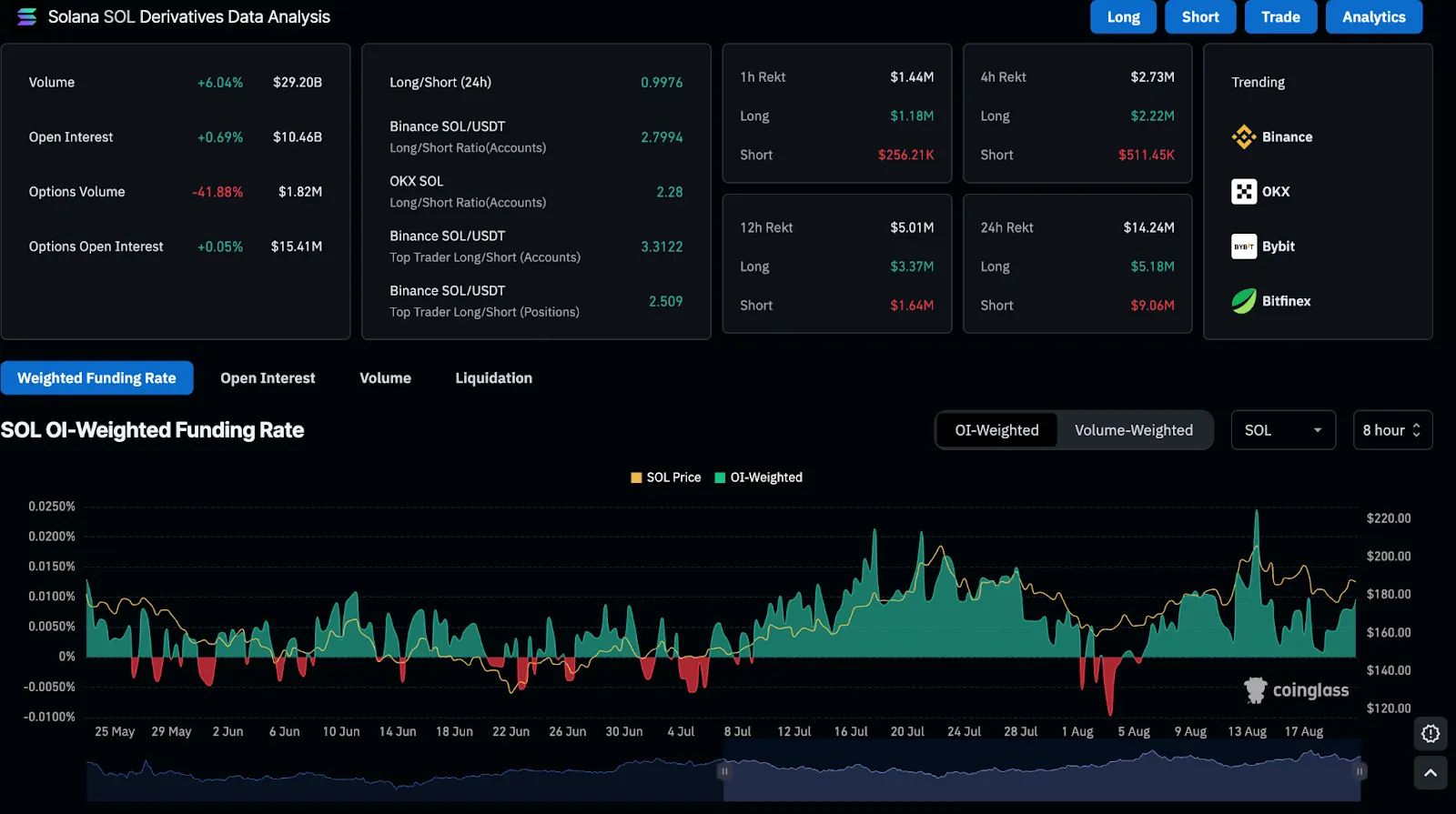

According to CoinGlass data, trading activity in derivatives of Solana has risen considerably with volume shooting up by 6.04% to $29.20B. A volume surge represents increased market participation and hence greater interest in Solana contracts.

Source: CoinGlass

In contrast, open interest has grown at a meager rate of 0.69%, now at $10.46B. While the outstanding contracts have increased a little, the volume accompanying the increase has not grown proportionally.

Options volume thus saw a decline of 4.88%, implying a slight retreat from options trading. However, the open interest in options is virtually unchanged, up 0.05% to $15.41M, implying that traders may be choosing to stay on the sidelines and hold positions until the marketplace presents more clarity to allow further decisive moves.

Long/Short ratios speak of bullish sentiment in the Solana market. Binance shows the SOL/USDT long positions nearly 3 times more than short positions. Likewise, OKX's figure of 3.312 pivots towards the preference for long positions by traders. Liquidation data favors the bullish perspective even more.

Strong liquidation in short positions is the sign of a probable short squeeze, which often suggests price appreciation. Alternatively, the liquidation data for the 12-hour period denote predominantly short liquidations on different timeframes.

Meanwhile, funding rates have oscillated between positive and negative, reflecting the ongoing volatility. These shifts correspond to changes in market sentiment, with the positive funding periods being indicative of general bullishness.

Kelvin Munene is an experienced crypto and finance journalist with over five years in the industry, known for delivering detailed market insights and expert analysis. Holding a Bachelor’s degree in Journalism and Actuarial Science from Mount Kenya University, he is recognized for his thorough research and strong writing abilities, especially in cryptocurrency, blockchain, and financial markets. Kelvin consistently offers timely, accurate updates and data-driven perspectives, helping readers navigate the complex world of digital assets. His work focuses on identifying emerging trends, analyzing market cycles, exploring technological advancements, and monitoring regulatory changes that influence the crypto sector. Outside of journalism, Kelvin enjoys chess, traveling, and embracing new adventures.