Solana price faced renewed pressure on Wednesday following whale activity that saw $1.53 millions worth of SOL moved into a meme token. According to Lookonchain, Whale BH84Uo transferred 9,295 Solana to Bybit and purchased 1.6 millions Fartcoin.

The timing of the whale transaction closely aligned with weakness during the London and New York trading sessions. Solana declined by 1.51%, to a low of $163.07, after trading at $167.8 earlier in the day.

Asian session trading had stabilised, but the downward pressure was renewed when the U.S. markets opened.

At the time of writing, SOL price is trading at $165, losing 1.06% on the day and 7.17% over the past week, according to CoinMarketCap. Market cap has dipped to $88.9 billion, and 24-hour volume has dropped by more than 20% to 4.17 billion.

The overall market sentiment of the top 10 cryptocurrencies is mixed, with Bitcoin and Ethereum gaining a little, but SOL and XRP losing over the week.

Furthermore, CoinGlass derivatives data indicates that 24-hour rekt was $12.56 millions, of which $10.14 millions was on longs. The open interest declined by 2.32% to $9.28 billion, and options volume fell by 54.18% to 1.17 million. Such signs indicate that SOL price is facing a low risk appetite as traders liquidate positions.

SOL spot flows went negative this week, following Monday positive net inflows. CoinGlass showed net outflows of more than $60 million on Tuesday, with further withdrawals on Wednesday pulling the mood down.

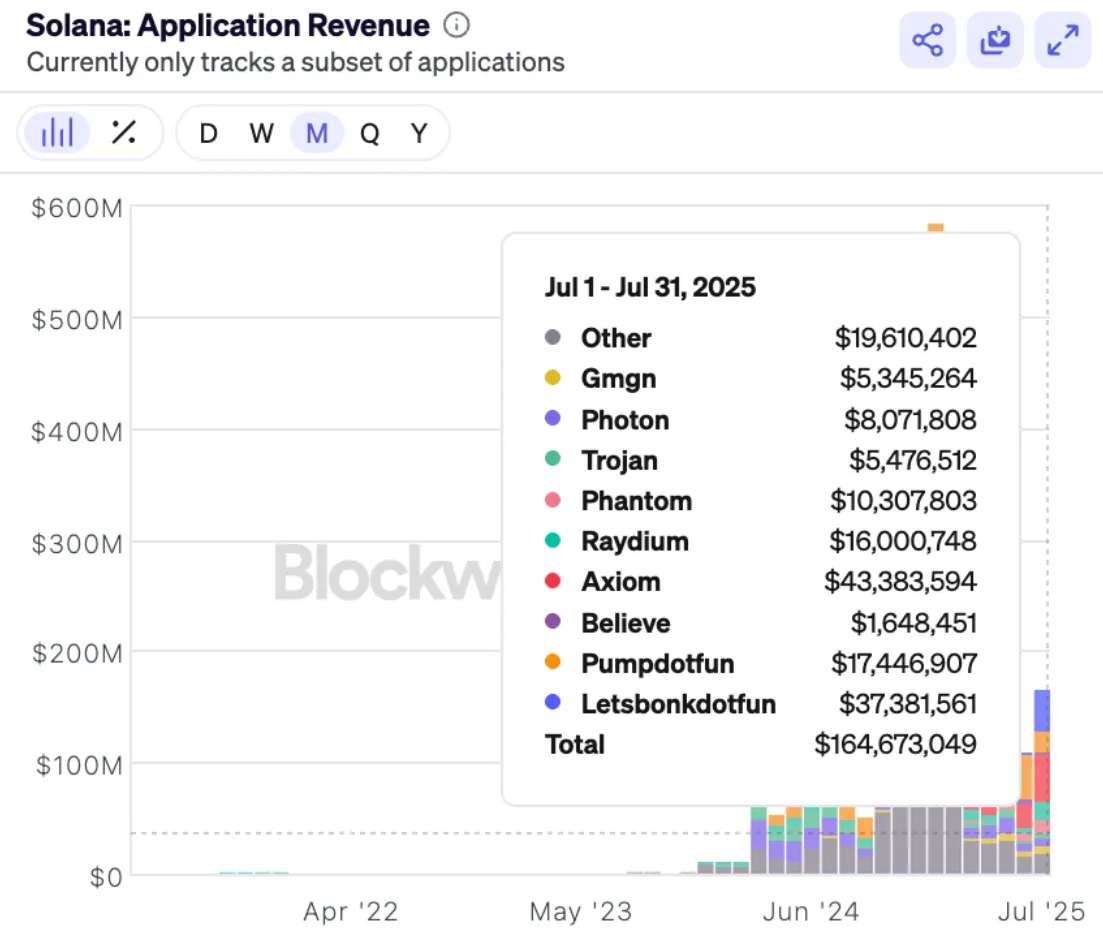

However, application revenue remains a bright spot. According to Blockworks data, SOL-based applications generated $164.67 million in July 2025, an increase of 50% compared to the previous month.

Solana Application Revenue : Source : Blockworks

Axiom was first with $43.38 million, Letsbonkdotfun second with $37.38 million and Pumpdotfun third with $17.44 million. The increase in utilisation shows that it continues to develop in spite of the fluctuating prices.

In chart terms, Solana price has been in a range since March 2024 between the $120 and $180 areas. A chart by Trader XO shows that the price is coiling around the lower part of that range, very close to the $160 support.

Source : X

The 12 and 25 EMAs on the daily chart once again crossed, which is an indication of a possible change in trend, but confirmation is yet to be made as the volumes are reducing.

Institutional and Governance Actions May Shape Atcoin Price Outlook

The recent recovery of SOL price above the $160 area indicates the initial stages of a 16.8% possible rebound towards the resistance level of $180. The 4-hour chart highlights the move from $160 to $167.7, yet the rejection at $169.32 remains notable.

Source : X

Moreover, institutional and governance developments also played a role. The block times have also been questioned as malicious validators take advantage of MEV, and Marinade Finance has declared to blacklist more than 30 validator nodes.

These validators will be kicked out, and the damage will be compensated by the guilty validators.

Additionally, adoption is ongoing, and the Minna Bank of Japan collaborated with Altcoin and Fireblocks on a pilot program with stablecoins.

It is a major real-world application of the first digital bank in the country, implying institutional trust in Altcoin technology stack in spite of the recent stagnation in SOL price.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.