Solana price prediction shifts as market finds short-term balance

Solana is currently trading close to $132 as traders evaluate a significant intraday drop in market cap, which has since stabilized. The recent price outlook indicates a period of consolidation following liquidation pressure, supported by ongoing institutional interest and increasing access through exchanges.

The Solana price prediction is shaped by a 24-hour market cap chart showing a swift decline and subsequent base formation. Market capitalization slipped from near $78 billion toward the $74 billion region during the session.

Source: Coingecko

Early trading showed a narrow consolidation band, followed by an accelerated breakdown with minimal pauses. The steep slope suggests forced selling rather than gradual distribution during the decline.

stabilized after reaching the $73.5 billion to $74 billion zone and recovered in a modest manner. This zone has since served as short term support and the price action has been contracting towards a narrower range.

The recent consolidation of about $74 billion to 75 billion means low volatility and equal involvement. The Solana price prediction is reserved as this base maintains without a definite directional catalyst.

On the four-hour SOL/USD chart, price structure remains defined by lower highs and lower lows. The visible range spans from a peak near $229 to a cycle low around $121.

Source: TradingView

Recent candles show price oscillating between $125 and $135 after the steep decline. Moving averages continue sloping downward, with price trading below slower trend indicators.

This structure places emphasis on range behavior rather than immediate reversal expectations. The Sol price prediction stays neutral while price struggles to reclaim the $145 to $150 resistance band.

Volume activity has moderated following earlier sell pressure, suggesting reduced urgency from both buyers and sellers. Consolidation continues to dominate the near-term technical outlook.

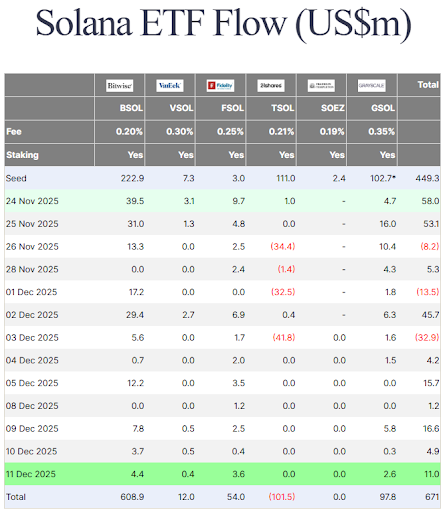

In addition to chart structure, the interest has shifted to institutional action around the Tokens-linked investment products. Statistics quoted by players in the market demonstrate that on December 11, more than one million dollars flowed into the US Spot Sol ETF.

Source: Farside Investors

That inflow extended a six-day streak, with cumulative ETF inflows reaching $671 million since launch. These figures have circulated widely across social platforms during the consolidation phase.

In parallel, Token’s official account stated that the tokens will be instantly tradable by 100 million users on Coinbase. The post emphasized broader access rather than near-term price expectations.

According to another post on CryptoCurb, the same ETF inflow numbers were mentioned as institutional accumulation continues. The Sol price prediction now balances between technical stabilization and stable signs of capital participation.

Shristy Malviya is a skilled English Blog Writer and Content Writer associated with Coin Gabbar, specializing in producing well-researched and SEO-friendly content on cryptocurrency, blockchain innovation, and financial technology. She is passionate about making complex industry topics accessible and valuable to a wide audience. Shristy’s work reflects her commitment to delivering credible and high-quality information that aligns with current market trends. Outside her writing career, she enjoys reading books, an activity that deepens her understanding of global markets and continuously inspires her professional growth.