Solana is no longer just spoken about as an Ethereum alternative.

That phase has already passed.

Right now, it is behaving like a network larger players are starting to take seriously.

Price has been stuck between $130 and $145 for weeks, neither crashing nor breaking out, which has left traders split between patience and quiet concern.

This is why Solana price prediction is back in focus, especially as network activity stays high while Bitcoin and Ethereum slow down.

Solana Liquidity Surge Puts Traders on Breakout Watch

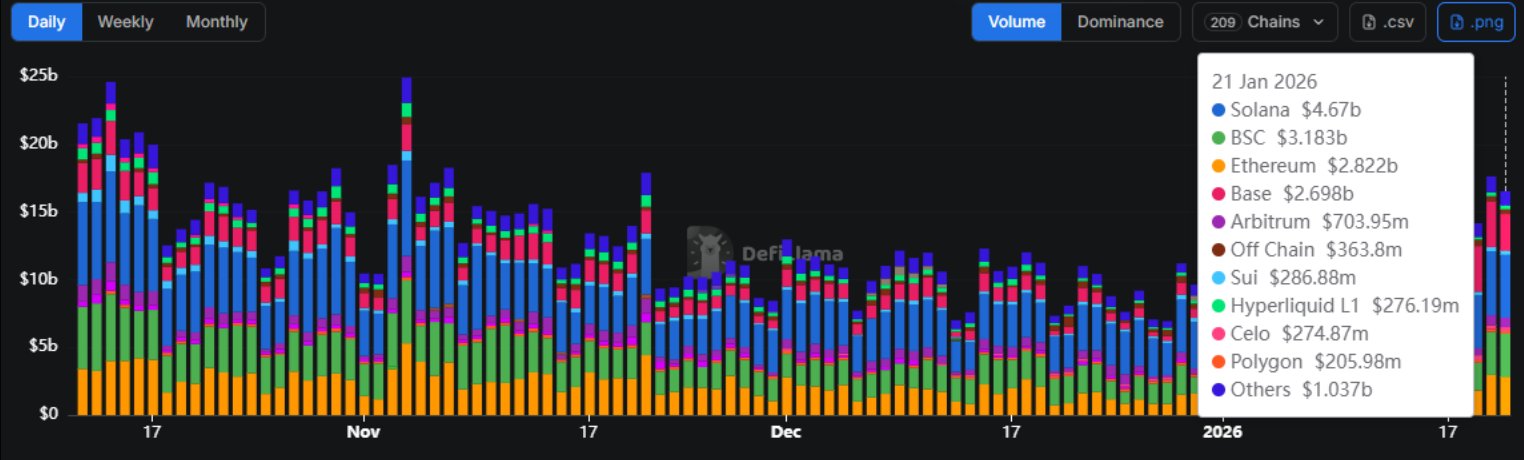

Based on DeFiLlama volume charts, Coin recorded over $4.4 billion in single-day DEX volume, outperforming every major chain during that session.

What stands out is consistency, not just the spike. SOL has been appearing near the top of daily volume charts while other ecosystems rotate in and out. That kind of activity usually reflects real usage, not short-term speculation.

Renowned market watcher NekozTek pointed this out on X, noting that liquidity often shifts before price does. When volume shows up first, traders tend to pay attention.

On the 4-hour chart, the SOL price has come down from the $145 area and is now sitting near a rising trendline that has held the price earlier as well. The drop was fast, but the structure has not collapsed.

Near this rising trendline, selling started to slow, and volume did not expand further. RSI dipped into oversold and then tried to lift. This does not look like fresh fear; it feels more like sellers running out for now.

The market is cautious here, not confident, and not panicked either. Buyers are watching rather than chasing.

Source: TradingView

Immediate Support and Resistance

Support Area: $123 to $125

Resistance Area: $134 to $136

This zone matters because it lines up with the trendline and earlier buying interest.

Short-Term Solana Price Outlook

As long as the Solana price stays above $123–$125, a slow move back toward $134 is possible. Anything higher will likely be uneven. No straight lines after a drop like this.

Invalidation: A clean move below $121–$122 would break the trendline and weaken this setup.

On the daily chart, price has started to behave differently after weeks of pressure. Price formed a base and slowly moved back toward the neckline area. The move did not feel rushed. Buyers showed up on dips instead of chasing.

The structure looks close to an inverse head and shoulders, with the right shoulder starting to form. Market analyst CryptoCurb pointed this out on X while tracking the setup.

Pullbacks have stayed shallow so far. Selling has not picked up. It feels more like stabilizing than breaking down.

Key Levels

Support: $123 to $125

Resistance: $145 to $150

Mid-term Solana Price Prediction

If SOL price holds above $123–$125, a move toward $220–$250 stays open over the mid-term. The path higher is likely to remain uneven.

Invalidation: A daily close below $121–$122 weakens this setup.

On the weekly chart, price is moving inside a large symmetrical triangle, showing compression after the earlier expansion. Price has respected the lower boundary so far, which keeps the broader structure intact.

As the range tightens, volatility has stayed muted, a phase that often appears before a larger move. Well-known technical analyst Moonbag highlighted this setup on X, noting that price is trading in a zone where long-term positions are usually built.

Long-Term Price Outlook

If price resolves higher from this structure, the chart leaves room for a broader move toward the $320–$400 range over the long term. The move is unlikely to be straight and may come in phases.

Invalidation: A daily close below the lower boundary of the symmetrical triangle weakens this outlook.

Technical observers see Solana Price Prediction reacting more to structure and liquidity than headlines. Buying interest has been showing up near the $123–$125 zone, while short-term upside remains capped near $145–$150 for now.

Moves are still uneven, but the broader setup points toward patience rather than aggressive positioning. Long-term expectations continue to depend on how price behaves around these levels as overall market activity develops.

Expert View on Solana Price Prediction

Technical observers suggest Solana's price prediction right now feels more driven by how the price is behaving than by headlines. Buying interest continues to appear around the $123–$125 zone, while upside moves keep slowing near $145–$150.

The market pace is calm, not fearful, which reflects patience rather than weakness. The $134 level could act as a near-term decision point. A sustained move above $150 would likely signal that the re-accumulation phase is starting to fade.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.