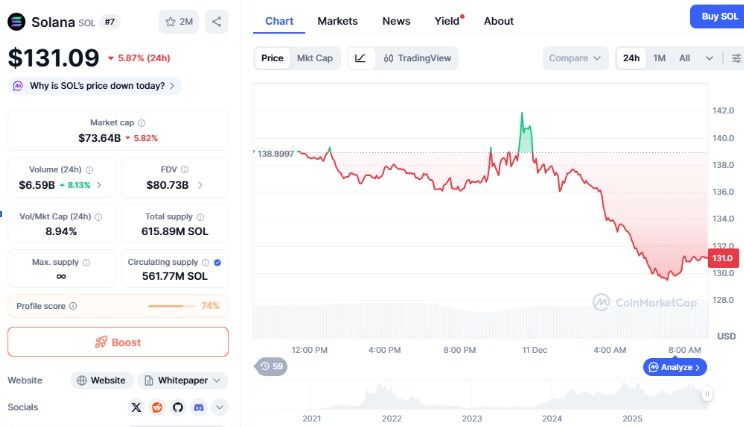

Solana traded lower in the latest session, slipping toward the $131 area after failing to hold an early intraday recovery. Market data showed increased activity and steady selling pressure as traders assessed whether the token could stabilise near its short-term floor.

Solana’s price moved from an early high near $142 before retreating to about $131, reflecting a broad downturn across intraday trading. The latest CoinMarketCap snapshot recorded a 24-hour decline of nearly six percent, with market capitalisation sitting around $73.64 billion. Trading volume rose more than eight percent, indicating active repositioning while the market absorbed the downturn. Many traders monitoring sol price prediction trends focused on whether the token could maintain its position above the key support area.

Source: CoinMarketCap

The chart indicated a down-shift following a short spike, forming a trend that indicated that sellers were still in control at higher levels. The $130 area was a visual support band, and this was supported by repetitive touches through the past few sessions. Market valuation was maintained close to price movements with circulation supply at about 561.77 million tokens, which was approximately 91 percent of the total supply. This level also remained a part of short-term sol predictions in the market.

Momentum indicators were indicating a slight improvement and the technical indicators reflected less downward momentum following late-November pressure. Although this was not a sign of reversal, the structure showed the possibility of a base in case buyers were able to support the existing range.

A detailed TradingView chart shared by analyst VΣGΣƬΛ.OKX (@VegetaCrypto1) outlined a potential shift in structure if Solana cleared key resistance. The chart displayed a descending trendline stretching back to October, with the market currently testing its lower boundary near $137. Traders tracking crypto price prediction themes noted that this area had been a recurring reaction point throughout the recent downtrend.

Source: X

According to the chart, a close above $145.85 could open a path toward a higher band between $180 and $190. The projection showed a break, retest, and continuation pattern often monitored during trend changes. From current prices, the upper target zone would represent gains of roughly 30 to 38 percent. These targets featured prominently in updated sol predictions shared across community discussions.

However, the chart also showed a rejection scenario. If Solana failed to move above the trendline, levels at $130, $125, and $120 remained visible on the downside. A deeper slide toward $110 was also noted in the grid markers, reflecting broader market pressure if selling resumed. The absence of strong volume on the breakout attempt left traders waiting for confirmation before adopting a directional stance.

MACD indicators on the daily chart recently reported a bullish crossover that demonstrated initial improvement after weeks of decline. The histogram shifted to neutral territory indicating smaller momentum loss. RSI was close to 41, indicating that Solana was still in a mild range, yet it was bouncing back out of oversold prices which it hit in late November. Such indicators remained useful in the short term sol price prediction debates among trading communities.

Source: TradingView

The prevailing trend was for a narrow range between $130 and $140 as traders awaited a decisive action. The first indication of renewed appetite would be a push above the mid-range at $138.9 and the case would be reinforced by a close above $142. Until then, the market continued to monitor volume changes and chart behaviour to guide the next Solana price prediction and broader crypto price prediction coverage.

This analysis is based on market trends and does not guarantee future results. It should not be treated as financial advice. Cryptocurrency investments involve risk, so always do your own research (DYOR) before investing.

Shristy Malviya is a skilled English Blog Writer and Content Writer associated with Coin Gabbar, specializing in producing well-researched and SEO-friendly content on cryptocurrency, blockchain innovation, and financial technology. She is passionate about making complex industry topics accessible and valuable to a wide audience. Shristy’s work reflects her commitment to delivering credible and high-quality information that aligns with current market trends. Outside her writing career, she enjoys reading books, an activity that deepens her understanding of global markets and continuously inspires her professional growth.