Binance has listed the Towns Protocol token, but the result diverged from the investors’ expectations as the TOWNS token price crashed 50%. The TOWNS coin has officially gone live with an airdrop on Aug 05, 2025, at 14:30 UTC (8:00 PM IST).

Interestingly, many other crypto exchanges, like Bitget, MEXC, ByBit, and others, have also listed the token, which is usually bullish, but the price performance is bearish. Why? Let’s discuss.

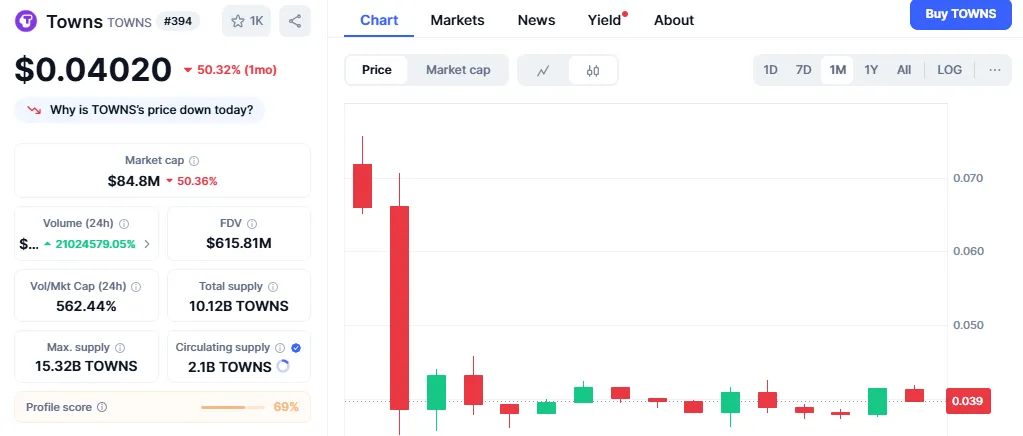

Binance, the popular crypto exchange, is among the first to launch the TOWNS token. The Genesis Supply is 10,128,333,333. However, After the listing, the coin has experienced a significant correction, shedding 50.32% of its value to trade near $0.04020 at the time of analysis.

A steep decline of this magnitude coincided with a simultaneous sharp reduction in market capitalization-from a value greater than $170M to a current value of about $84.8M-indicative of heavy distribution during that period. The highlights were infrequent purchases.

On the chart, the token has moved from its early peak near $0.08878 down to a support cluster placed somewhere between $0.038 and $0.040. After the sharp initial selloff, the market entered into a consolidation phase, with price action trading sideways in a tight horizontal channel between $0.038 and $0.046. This indicates a temporary equilibrium between sellers cashing out or closing positions and speculative buyers stepping in at perceived bargain prices.

The large red candles in the beginning of this period indicated capitulation selling, while the following low volatility candles indicate that the participants are waiting for new catalysts. This pattern is known as the post-selloff base formation and is usually followed by

1. Relief rally if buying emerges out of oversold demand.

2. Further depression if prevailing sentiment stays bearish or token unlocks add supply pressure.

While its 24h Volume/Market Cap ratio of 562% sounds like an overstatement due to low price levels, it still points to short-term speculation in force. Hence, no sustainable green volume spikes so far failed to put forward any strong rebound.

With just 2.1B Tokens out in the wild from the max supply of 15.32B, an FDV as high as $615.81M clearly depicts a potential long-term dilution risk that might weigh on the medium-term recovery of the price, barring that utility demand heavily compensates.

Source: CoinMarketCap

The immediate support zone is at $0.038, currently seeing some sideways consolidation near the recent lows. A clean break below on a daily close could then open the retesting of lower support zones in the $0.035–$0.033 range. A relief rally toward $0.052–$0.055 is projected, though, if strong volume is confirmed above resistance at $0.046.

Bias: Neutral-to-bearish in the near term; Cautiously bullish only if $0.046 resistance is broken with strong buying momentum.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.