WalletConnect is very much in all respects an uprising that connects a user to the Web3 universe. Being in the very center of this central connective network, WCT allows smooth connections to decentralized applications (dApps), wallets, and blockchains. Its famous blue background logo has become synonymous with 'trust' in crypto, like Visa has in traditional payments.

With more than 275 million connections and 45 million active users, WCT has grown to become the infrastructure of the Web3 experience. The launch of the upcoming WalletConnect Token is another phase in the history of this network toward decentralization and community ownership.

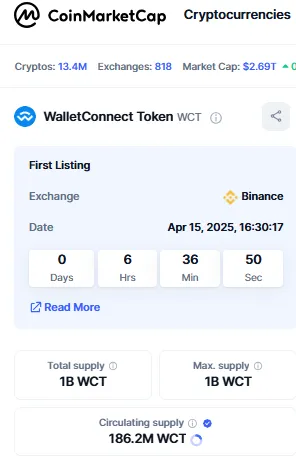

The exciting listing of WalletConnect Token on Binance, Bybit, OKX, Gate.io, KuCoin, and Crypto.com on April 15, 2025, beginning at 11:00 UTC, will be a milestone for both the project and the larger crypto community. Here is our WCT price prediction for the near and medium term.

1 Billion is the total supply for the WCT tokens, whereas tokens in circulation are 186.2 million. The purpose of the token distribution is to nurture the growth and sustainability of the WalletConnect network:

Core Development (7%): For enhancements of the protocol.

Rewards (17.5%): For staking and performance incentives.

Airdrops (18.5%): These tokens are distributed during seasonal airdrop distributions to users, apps, and nodes.

Team (18.5%): Allocations for the core WalletConnect and Reown teams.

Previous Backers (11.5%): These are the early-stage supporters of the network.

WalletConnect Foundation (27%): For partnerships and ecosystem development.

The total distribution of WCT tokens has set a four-year unlock period for the core development, team, and backers' allocations, along with a one-year cliff initiation at TGE. Gradual distribution will apply in the case of the airdrop allocation.

Opening Price Prediction (Listing Day)

Expected Range for Price: $0.48 – 0.55

Rationale: With strong demand, the price surged pre-market by 60%, then went down to $0.42. Listing on a top exchange might lure all retail and institutional investors. The buzz surrounding the airdrop parameter might additionally spike demand and eventually price on Day 1.

Bullish Scenario: $0.60 – $0.75

Base Scenario: $0.45 - $0.55

Bearish Scenario: $0.35 - $0.42

Factors to Watch:

Bullish Momentum: If the ecosystem keeps generating bullish momentum from airdrops and staking rewards to draw users into the WalletConnect ecosystem, the price could still be up.

Price Corrections: Price corrections are short-term results anytime liquidation happens by early investors or participants in an airdrop.

Supply Factor: Despite having a maximum limited token supply of 1 billion, there is only a measurement of WCT tokens at 186.2 million. Thus, short-term effects on token inflation will not be taken seriously, and price stability would mainly be affected.

Bullish Target: $0.80 - $1.10

Neutral Target: $0.50 - $0.65

Bearish Risk: $0.30 - $0.40

Important Elements:

Unlocking: They have a 1-year cliff on token unlocking, meaning that there will be no serious sell pressure in the initial year, and thus it is bullish for long-term investors.

Growth of Networks: The success of an ecosystem depends on a growing number of partners and new user onboarding that will bring future benefits.

Overall Macro Trends: An emotion and price movement in the crypto market will be defined by a larger part of trends in the market, as Bitcoin and Ethereum trends are most relevant.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.