The NFT-focused Zora Network is set to launch its native ZORA token on April 23, 2025, marking a pivotal moment for the Ethereum-based Layer-2 platform. Despite this milestone, the token pre-market price has dipped to around $0.0188, prompting concern among early holders and traders. Trading will begin tomorrow at 13:00 UTC.

As the crypto community speculates on what’s driving this drop, investors are left wondering: Is this a temporary dip, or the start of a bigger decline? Here’s a detailed ZORA price prediction, leveraging technical analysis, on-chain metrics, and market sentiment.

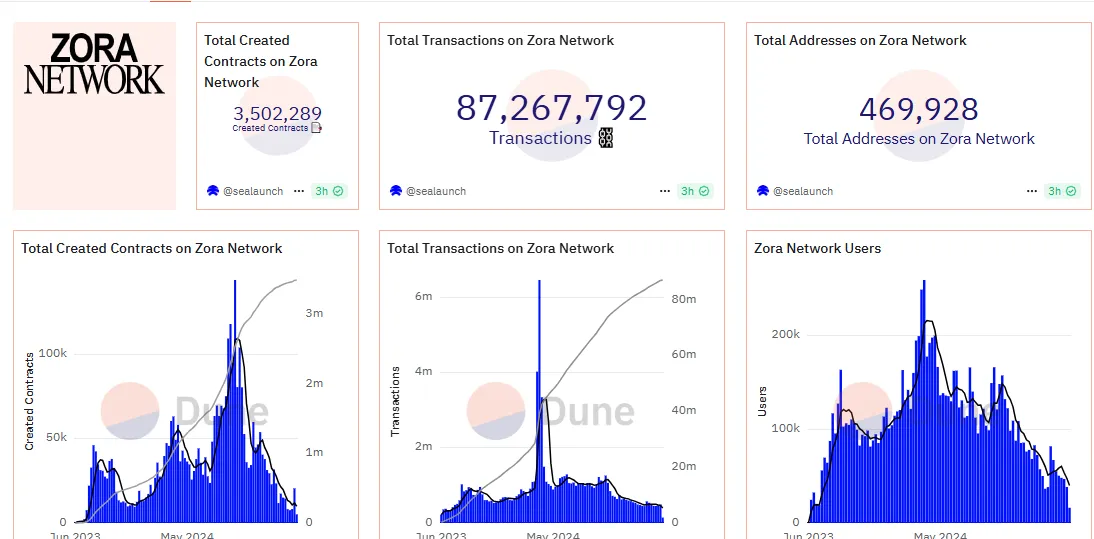

The Network has built a solid foundation, boasting:

Over 87 million transactions

Nearly 470,000 unique wallet addresses

More than 3.5 million smart contracts deployed

With 10 billion total tokens, the distribution includes:

10% Airdrop (1B tokens)

20% Community Incentives

20% Treasury

18.9% Team Allocation

26.1% Strategic Contributors

5% for Liquidity Provision

This structure reflects a typical long-term alignment strategy, but also hints at potential short-term volatility as large holders unlock tokens.

Despite strong fundamentals, the coin has dropped nearly 40% from earlier highs around $0.03. Let’s break down the likely causes:

1. Profit-Taking Before Listing

Early access holders—especially airdrop recipients—are likely cashing out while prices remain speculative.

2. Lack of Immediate Exchange Listings

Without a confirmed CEX or DEX launch partner, traders fear a lack of post-airdrop liquidity, leading to risk-off behavior.

3. Bearish Technicals

The chart shows a clear breakdown below $0.02, turning former support into resistance. This bearish pattern deters new buyers.

4. NFT Sector Fatigue

While the token focuses on NFTs, broader NFT market interest has cooled, adding to the lack of buying pressure.

5. Plunging User Activity

The token user base has cratered, with active participation dropping over 80% year-on-year — a major red flag for long-term adoption.

Let’s explore three potential price scenarios post-listing:

Bullish Case: $0.035–$0.05

If the community announces a Binance or Coinbase listing, or if NFT activity surges, the token could recover quickly. Airdrop farming, attention, and community support could push prices to the $0.04–$0.05 range.

Neutral Case: $0.018–$0.025

If no major listing news arrives but on-chain activity remains steady, the coin may range between $0.018 and $0.025. This aligns with pre-launch valuations and basic market support levels.

Bearish Case: $0.012–$0.015

If early sellers flood the market and there’s no roadmap update or NFT narrative revival, the token may slide toward $0.012, where some long-term buyers might find value.

The token's pre-market slump is not unusual in crypto, especially for airdrop-driven assets. While short-term volatility may persist, the Network’s massive on-chain footprint and focus on scalable NFT infrastructure suggest potential for long-term recovery.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.