The much-awaited listing of the Mango Network (MGO) coin has finally come through. At 9:00 UTC (2:30 PM IST) on June 24, 2025, Mango Network would be listed on MEXC, KuCoin, and Bitget, thus inviting speculation from traders and investors. However, a very pressing question still demands an answer: Is it possible for the token to ever rise to $0.10 in the long run?

Now, let's take a deep dive into Mango Network's background, tokenomics, and future price outlook to get a hint.

This ambitious Layer-1 omnichain blockchain with Move, OPStack, and ZK Rollup as its triumvirate of developer software engineering can look toward seamless cross-chain interoperability with multi-VM support and high-performance infrastructure for Web3. Made for growth and effectiveness, the Mango Network holds a solid promise for being a formidable heavyweight in the Layer 1 blockchain environment.

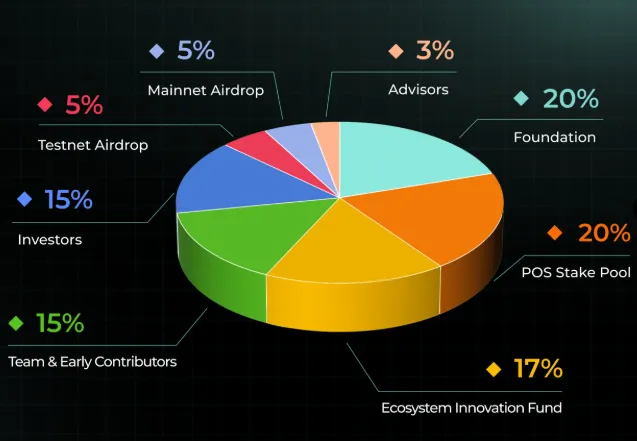

Run by a native token called MGO, Mango Network Ecosystem observes a total supply of 10 billion tokens. Token distribution remains structured such as to allow for sustainable ecosystem growth and user engagement:

20% to POS Stake Pool for the encouragement of long-term network security and staking rewards

20% to the Foundation for steady project development and operational support

17% to the Ecosystem Innovation Fund for funding new projects and partnerships

15% for Team & Early Contributors

15% for Investors

15% for Team & Early Contributors

3% for Advisor

With such a balanced allocation, a signal is set that between sustainability to the project and community-driven growth, are among the key elements that may affect the price of the token.

Due to the current and prevailing market sentiments and exchange demands on the one hand, and the wide exposure that would be accorded MGO by being listed on these major exchanges on the other hand, the initial listing price could thus be set between $0.005 and $0.01.

Short-Term Price Outlook (3–6 Months): $0.01 to $0.03

Several factors will likely determine the short-term action of MGO-related price in the first three-to-six month window:

Staking rewards from the 20% POS Stake Pool allocation

Community airdrops creating community engagement

Ecosystem activities from the Innovation Fund

With these mechanisms producing buy-side demand and users getting engaged, the price could just manage to stay between $0.01 and $0.03 during this time window.

Looking way ahead at the 1-to-2 year horizon, the price potential appears even more alluring for MGO. As the community fulfills the promises of its roadmap, releases new cross-chain dApps, and grows the ecosystem through projects backed by Ecosystem Fund, there will naturally be growing utility for and adoption of the token.

Given:

The market staying very favorable

Milestones being successfully achieved

Rapid growth in both developers and the community

The token could very well be aiming for a long-term valuation somewhere between $0.05 and $0.10

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

7 months ago

Good

7 months ago

I think is a good project