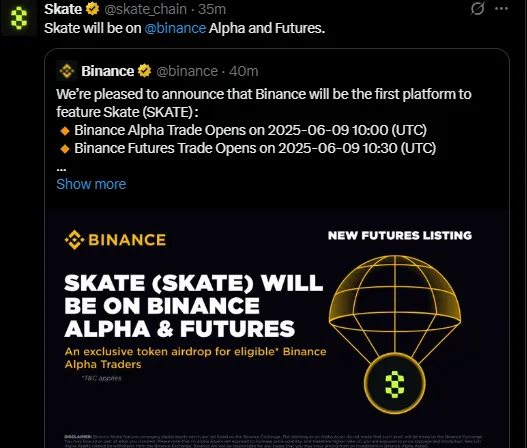

Skate (SKATE), known as the state-of-the art multi-VM infrastructure protocol, is officially making its way into the world's biggest crypto exchange, Binance Alpha trading is set to start on June 9, 2025, at 10:00 UTC, whereas Futures trading shall commence at 10:30 UTC, showing that the token has a great market presence and strong backbone of technology.

This article dives deep into SKATE’s tokenomics, analyzing its listing dynamics, and considering price projections could give us some insight into whether this project can make it up the $1 mark by 2026.

The core of a multi-VM infrastructure lies at the heart of SKATE. With this enchantment, dApps can run on many blockchains at once. Be it EVM chains such as Ethereum or non-EVM ones like Solana's SVM or Move-based chains-SKATE gives the developers native cross-chain capability. This really matters as the Web3 space has been vehemently moving towards modular, scalable ecosystems.

Binance Listing: The Fuel Behind the Initial Surge

The listing of SKATE on Binance Alpha and Futures instantly opens up visibility and liquidity to this asset. The token will be available for trading with the SKATE/USDT pair, and the perpetual contract could be leveraged with up to 50x. So aggressive is this positioning on Binance, especially as a first-time listing venue, that it only sets up short-term speculation and trading activities.

Add to this the typical pattern in which Binance has been at the forefront of highlighting quality infrastructure projects, giving them added credibility and market confidence, which often carry such projects into an uptrend in its opening days.

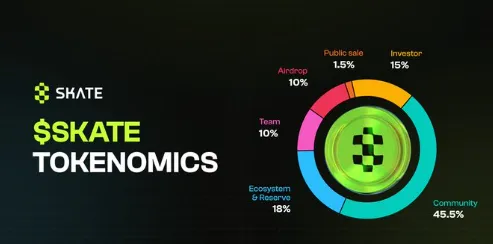

SKATE's tokenomics mechanism, along with being community-centric, is designed for long-term growth. With a total fixed supply of 1 billion tokens, and a circulating supply said to be about 180 million tokens, scarcity becomes a useful driver of this first set of demand.

Here’s the breakdown of SKATE's token allocation:

45.5% to Community

18% to Ecosystem and Reserve

15% to Investors

10% to Team

10% to Airdrops

1.5% to Public Sale

Such a structure is oriented towards decentralization, rewarding early actors, and supporting ecosystem development- all these are crucial metrics upon which one will start to gauge a token's sustainable trajectory and growth in price.

Short-Term Price Prediction (June–Q3 2025):

Upon listing, projected price range from $0.05 to $0.10 on pre- and early listing market liquidity, airdrop claims, and speculative trading. Given the scarce early circulating supply and generous community allocation, the token should potentially bounce to about $0.15 to $0.18 within the first two weeks, provided there is a buildup in momentum on stake rewards or even DeFi integrations.

Long-Term Price Outlook (2025–2026):

After additional product launches, ecosystem integration, and listings at other Tier-1 exchanges during the year, the price should slowly rise to $0.40 to $0.60 by late 2026. Fast-track in a general bull crypto market in acceptance among developers would quickly push for a breakout to $1, placing a fully diluted valuation at $1 billion-a little way from a pure top-layer infrastructure protocol.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.