Altcoin price prediction looks cautious today as the broader crypto market turns weak. The overall market is down around 2.84%, and total crypto market capitalization has slipped back below $3.10T. When the market moves like this, altcoins usually feel the pressure first, and that is clearly visible today.

Bitcoin is also trading lower, down close to 2.10%, and that is not helping

sentiment at all. When BTC starts slipping, altcoins usually do not get much room to breathe. Today looks similar. Ethereum, BNB, and Solana are all moving down together, not because of any single issue, but because the market mood itself is weak. When selling spreads like this, it usually means traders are stepping back rather than taking fresh risk.

This drop is coming at a time when many traders had started talking about an altcoin season. That makes the situation more interesting. Everyone is asking: Is this just a normal pullback after a rally, or is the market starting a deeper downside phase?

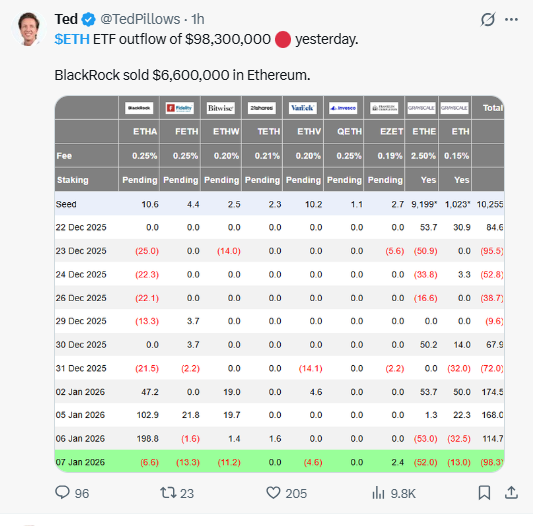

Ethereum is seeing added pressure from the ETF side, which is visible in recent flow data. Spot ETH ETFs recorded a net outflow of around $98.3M in a single day, showing clear selling activity. Even large issuers reduced exposure, with BlackRock selling roughly $6.6M worth of Ethereum.

Source: @TedPillows

These outflows showed up while the market was already weak, which makes their effect feel heavier. It does not mean Ethereum’s long-term trend has flipped, but it does help explain why short-term momentum looks dull and lacks follow-through right now.

At the time of writing, Ethereum is trading near $3,110; after a strong rally, the recent move looks like a retracement. On analyzing the 4-hour chart, the price faced rejection near the $3,300 zone, after which selling pressure increased due to profit booking and resistance. This kind of pullback is common after fast rallies and does not automatically signal trend weakness.

Source: TradingView

On the 4-hour chart, ETH is now reacting around the 50 EMA, which is acting as the first support level; as long as the price stays above this EMA, the structure remains intact, and the reversal is possible. If buyers step in from this area, ETH can attempt a recovery toward $3,180–$3,200.

However, if the 50 EMA fails to hold, the next support comes in near $3,050, which is also a strong demand area, and a rising trendline is also available to act as a support. In case the selling momentum is strong, a move below the trendline may increase the risk of a deeper pullback towards $2900, which makes the short-term market outlook more cautious.

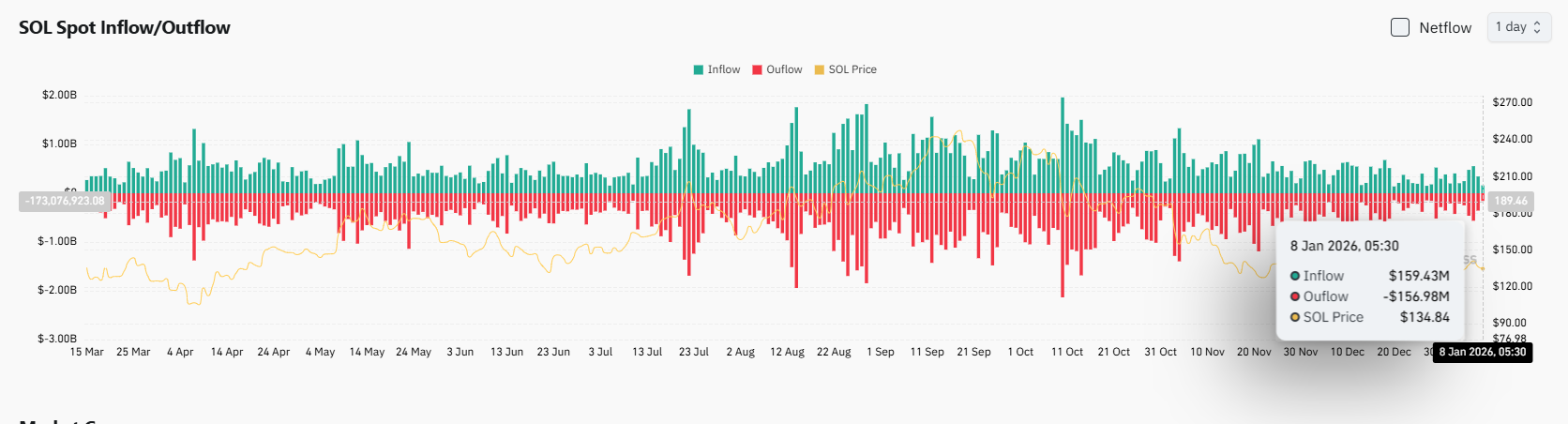

As per Coinglass data, Solana spot market flows are not showing a clear direction right now. Recent data shows inflows near $159M, while outflows are almost the same, around $158M. That tells a simple story. Money is moving in and out at the same time. This usually happens when traders are unsure and not ready to commit fresh capital.

Source: Coinglass

It also fits with the current price pullback, where some participants are taking profits instead of buying aggressively. There is no heavy dumping visible, but strong accumulation is missing as well. Because of this, Solana price action looks slow and choppy rather than ready for a strong move.

The Solana has been pushing higher inside a rising channel for the last few days on the 4-hour chart. The move was clean at first, but it started slowing down near the top. That usually happens when early buyers begin to book profits, with just momentum cooling off and the price taking a step back.

Source: TradingView

The Solana price is sitting in the $130–$135 zone, which is an important area because it lines up with the 0.5 and 0.618 Fibonacci retracement levels, and the 100 EMA is also running through the same area. When multiple levels sit together like this, price does not move through easily. Price action and reactions typically appear here. Till the zone holds, Solana can stay inside the rising channel and spend some time consolidating. But if selling pressure increases and price slips below this area, the channel structure would likely break.

In that case, downside levels near $125 and then $120 come into view. For now, the Solana market outlook stays cautious, with price trading at an important decision point.

BNB is currently trading around $884, down close to 3%, and volume has also started to dry up a bit. Moves are slower, follow-through is missing, and the price is not attracting aggressive buyers right now. When volume fades like this after a rally, it usually hints that momentum is cooling.

Source: TradingView

Over the last few days, the BNB price was moving higher inside a rising channel, pushing up step by step. But near the $915 resistance, changes happened. Buyers looked weak there, sellers stepped in heavier, and the price could not hold the structure. The rising channel eventually broke, which often happens during profit-booking phases, especially after a decent upside run.

Right now, BNB has reacted around the 100 EMA, which is acting as short-term support. If the price manages to hold above this level, a bounce toward $900–$915 can still happen.

But if the EMA fails, the next important support for the BNB price sits near $872. A break below that opens the downside toward the $850 zone, where stronger demand may try to slow things down.

Right now, altcoin price predictions are not doing anything exciting. The rally cooled off, selling picked up, and prices are just trying to find their base. This looks more like traders locking in profits than the market fully breaking down. Momentum is slow, volume is light, and no one is rushing in.

If support zones manage to hold, this phase can just stretch sideways for a bit before the next move. But if those levels slip, prices can sink a little more. For now, it is a wait-and-watch market, not a chase-the-price one.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.