Can ETH sustain its proposed breakout over $3,400, or will a correction occur before a much bigger move above $6,000? Ethereum seems ready to enter a mega bullish phase if recent on-chain activity and sentiment from market participants prove right. ETH is outperforming Bitcoin by forming the key technical pattern, leaving traders wondering if this is just the start of the long-awaited rally for Ethereum.

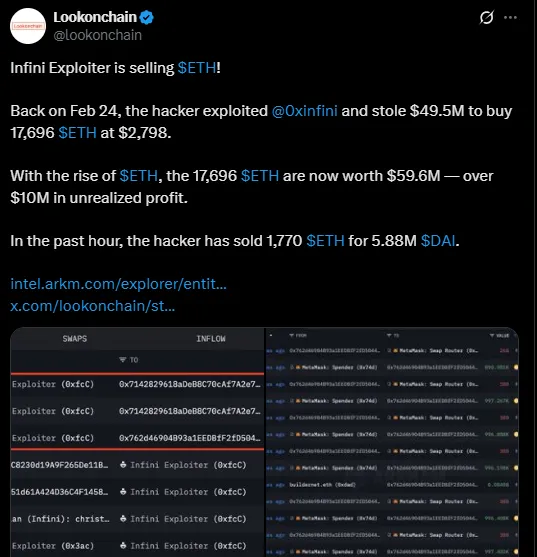

Much of this recent price action during the Ethereum rise has thus been accompanied by some high-profile on-chain movement. The Infini Exploiter, who committed a $49.5 million hack on @0xinfini on February 24, has recently begun the selling-off of stolen ETH. The hacker had acquired 17,696 tokens at an average price of $2,798 and was sitting on an unrealized profit of more than $10 million when the surge took Ethereum past $3,400.

Source: Lookonchain

Within one hour, though the exploiter managed to sell 1,770 ETH for 5.88 million DAI, it triggered fear for a wider sell-off. Nevertheless, the price of Ethereum remains bullish despite sell pressure-strong underlying demand, indeed.

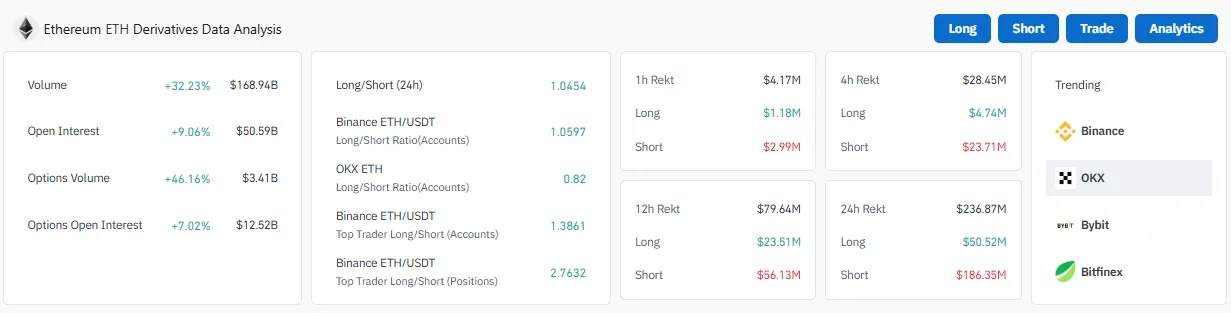

The new rally is being held aloft by unique institutional interest and a mighty technical breakout. Whale accumulation and more growing institutional exposure set up the solid demand. The sudden surges observed are corroborated by Coinglass on-chain metrics: In 24 hours, the futures volume jumped by 32.23% to $168.94 billion, and open interest up by 9.06% to $50.59 billion — confirming fresh long positions.

Long/short ratios are also bullish for bulls, with Binance showing a ratio of 1.0433, and the top traders are even more aggressively long, with a ratio of 1.061. The options market has seen an increase of 46.48% in volume, further suggesting that traders expect this rally to continue. This is only enhancing the speed of Ethereum's rise with the increase in derivatives activity and enthusiastic sentiment.

Source: CoinGlass

The altcoin has finally broken out of a huge inverse head-and-shoulders pattern, which is a bullish chart formation typically followed by explosive price moves. After several months of consolidation, altcoin surpassed the $3,400 level for the first time in five months, confirming the breakout and establishing a major trend reversal.

Analysts now think that the altcoin could potentially make a run toward $6,000, with long-term targets resting at $8,000 and $10,000.

However, a retracement to around $2,800 before the next climb cannot be ruled out. In this case, it would retest the support and strengthen the bullish pattern.

Ethereum, the whole rally, comes in line with larger altcoin market dynamics. The Altcoin Season Index hit the five months high recently, indicating interest outside Bitcoin picking up among investors. As capital rotates into altcoins, ETH is becoming the leading candidate to benefit from this trend.

While BTC dominance remains strong, aggressively gaining interval and strength is ETH with support from the smart contract ecosystem and institutional narrative. As altcoin season heats up, traders are increasingly bet positioning in ETH to short or potentially mid-term outperformance of BTC.

With the strong breakout technically and the increased demand from investors, and then we hear optimism in the market too; there appears to be room for some further upside in price. If the altcoin carries the momentum with it in the next few weeks, the $3,800–$4,200 levels are very likely to be seen, and a more distant target will be around $6,000 by the end of the third quarter of 2025.

Traders should, however, be wary for the short term. It is possible to see a quick correction to $2,800–$3,000, more so if the Infini Exploiter keeps on selling ETH; even this dip would most likely serve as a chance to buy into the bigger trend.

Will Ethereum cross $6,000 before Bitcoin reclaims dominance, or will a correction delay the rally? All eyes remain on the next moves from traders and from the Infini Exploiter as the bulls and bears continue to fight.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.