Solana (SOL) appears to enter some fresh bearish pressure as the market sentiment embraces risk-off trades. The coin staged a staggering 10.4% weekly decline, and over $46 million worth of unstaked SOL was sold to exchanges by whales. Is this a buyable dip and a correction with deeper implications or the initiation of such?

Let us unwind the forces behind the current price action of Solana with the important technical and on-chain signals and determine if it will soon reverse into bullishness.

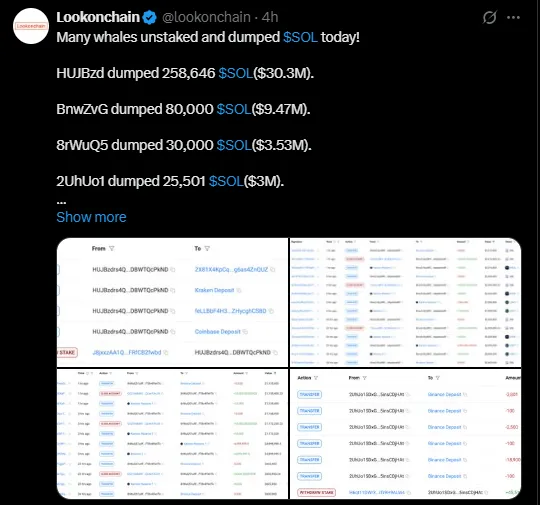

Based on information from Lookonchain, giant crypto whales have begun offloading large quantities of SOL, consistent with the token's recent price fall. In the past 24 hours alone, four wallets collectively unstaked and sold about $46 million worth of SOL, fueling bearishness in the market.

Below are the wallet addresses and the respective amounts dumped:

- 'HUJBzd' – about $30.3 million

- 'BnwZvG' – about $9.47 million

- '8rWuQ5' – approximately $3.53 million

- '2UhUo1' – approximately $3 million

Large sell-offs like these normally reflect heightened selling pressure , which is generally responsible for a bearish sentiment among investors. Solana's poor price performance has further heightened vigilance in the market.

The huge unlocking comes with a backdrop of increased macro volatility, following the tariff escalation by Donald Trump, which has terrified many investors of cryptocurrency, moving capital into stablecoins and, well, gold. The timing is extremely adverse for bulls.

At the time of this report's writing, SOL began trading at $118.57, marking a marginal communication low of only 0.30% over the past day, which is a huge decline when compared to earlier week highs. The altcoin is undergoing critical testing of the Fibonacci 0.382 support zone at around $100 to $115, a point that has historically triggered profound bounces, most notably sometime before the coin's 2,100% bull run in 2020.

Key Support Levels:

$115-$100 (Fibonacci 0.382) → slight accumulation

$72-$50 (Fibonacci 0.618 golden pocket) → buying pressure

Failure to hold above this $110 is likely to accelerate the fall into the golden pocket for what should be a highly lucrative long-term entry.

Bullish Fractal Points Towards 10x Rally to $1,000+

Technical analysis has highlighted that Solana remains in immediate weaker hands, owing to recent accumulation efforts, drawing parallels from its fractal present since almost 2020 to 2021, wherein the last such buildup led the way into a spectacular rally. If the fractal pattern holds, then mathematically, we foresee price fountains aiming close to the $1,000 level-plus, supported by further Fibonacci targets.

$186: Breakout confirmation level

$296: Previous all-time high

$1,011: Fibonacci-based bull cycle target

Smart money may be accumulating quietly in the $100 to $115 price zone, looking to capitalize on the next parabolic phase if this equilibrium holds.

The RSI (Relative Strength Index) currently sits at 43.64, suggesting neutral to slightly oversold conditions. Yesterday’s Doji candle reflects market indecision — a classic setup for a potential reversal or continuation.

All key moving averages (20, 50, 100, and 200) are positioned above the current price, highlighting the importance of reclaiming the $130 zone to shift short-term momentum back in favor of bulls.

Based on the current market dynamics, here are the two most probable scenarios for Solana in the short to mid-term:

Bullish Scenario:

SOL holds the $110–$115 support and bounces

Breaks above $130 resistance

Next target zones: $142 → $186 → $296 → $1,011

Bearish Scenario:

$110 breaks down under pressure

SOL revisits $100 or golden pocket support at $72–$50

Long-term accumulation opportunity before next bull cycle

Source: TradingView

While Solana is under short-term pressure, long-term fundamentals remain strong. The blockchain continues to lead in TPS (transactions per second), developer activity, and NFT ecosystem strength. For U.S.-based investors with a long-term horizon, the current pullback could offer a strategic entry — especially if key support levels hold.

However, cautious traders may wait for a confirmed breakout above $130 to re-enter with momentum. Keep an eye on whale behavior and macro events — particularly regulatory updates and U.S. fiscal policy, which are likely to steer the next major move.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.