Will Hyperliquid mark a major breakout? The crypto market is abuzz with speculation regarding a potential Binance US listing as the token price soared by almost 7.30% over the last one week. The trading volume rose sharply by 21.40%. Currently, all attention is on whether the altcoin can retain momentum through bullishness beyond $50.

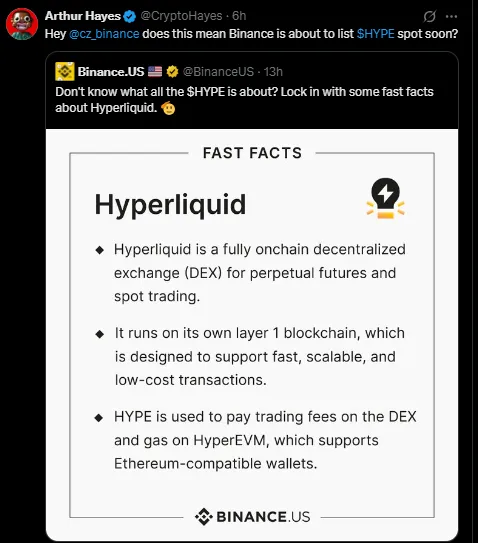

A social media storm was set in motion by Arthur Hayes, co-founder of BitME, when he tagged Binance founder CZ on X, asking: "When will HYPE be available for spot trading?" This was immediately preceded by Binance's own cryptic hints that HYPE support could be coming, strongly indicating that something massive could be in the works.

While in the limelight, Kraken and Coinbase are also rumoured to be looking into a HYPE listing. Binance launched HYPE futures barely after Coinbase, so the fight for the spot listing could erupt fast. Whoever lands the HYPE spot market listing will be the domino to fall for all the U.S. exchanges.

Listing rumors are more than just speculative; they indicate mounting confidence in the underlying strength of Hyperliquid as a decentralized exchange (DEX). Hyperliquid has grabbed market share and caused disruption with frictionless perpetual futures and spot trading, executing high-leverage trades very efficiently.

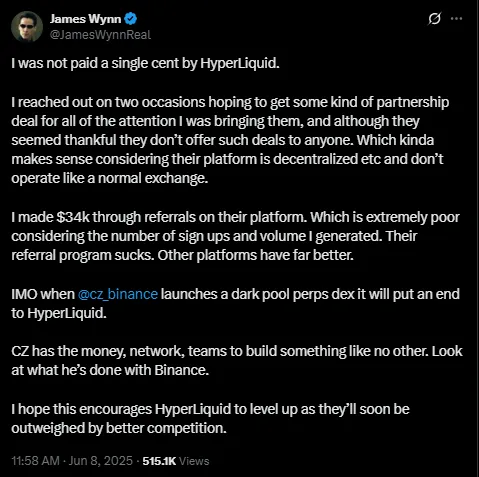

A recent round of attention came from Hayes, following the earlier buzz that had been created by crypto trader James Wynn, whose round of massive leveraged positions on Hyperliquid served as a sort of ultimate validation for the platform liquidity depth. But even Wynn did not hold back with criticism, however, noting the poor referral system and partnership proposals that fell on deaf ears.

In fact, Wynn went even further, suggesting that CZ establish a "dark pool" DEX to challenge Hyperliquid, implying that transparency on current DEXs sometimes works against whales by making the trades too visible. Regardless of the critiques, Wynn's activities on Hyperliquid cemented a great deal of visibility for the growing ecosystem.

Looking at the daily chart, the asset recently gave rise to a V-shaped bottom, a classic reversal pattern signifying a sudden shift from bearish to bullish mentality. The price is consolidating inside a small symmetrical triangle after a strong upward pole, forming a bullish pennant, which is a bullish continuation pattern now approaching the breakout zone.

The altcoin currently trades at $35.39, firmly above the exponential moving averages, 20,50,100,200. The 20 EMA, at $33.17, is now acting as dynamic support, lending strength to the bull case. A confirmed breakout above this pattern would send prices flying to the next resistance near $42–$45.

If buying momentum accelerates on volume, the altcoin could even target the psychological level of $50 in the short term.

Source: TradingView

On the downside, though, a break below $33 could prove the pattern false, with a downside target to the $28–$30 range.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.