As the week begins, focus has shifted to London, where the much-anticipated highest-level trade talks between the US and China are going to get underway. Investors of traditional markets as well as digital ones look on with bated breath. But an ugly question needs an answer: Will the prices for Bitcoin and Ethereum fluctuate or stabilize depending on the outcome of these big trade negotiations?

That could very well be the trigger of a major movement of the crypto market with inflation data, rising retail interest, and geopolitical tensions converging. So how do you think that weighs on BTC, ETH, and altcoins in the next few days to come?

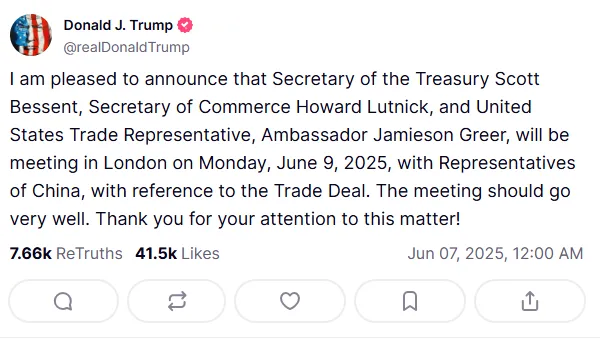

Thus Monday, June 9, 2025, President Donald Trump announced via his social media that top U.S. officials like Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick will honor the trade representatives of China with their presence in London. The goal: finalize a new chapter in the ongoing trade deal after months of tit-for-tat tariffs that shook global markets.

Earlier this year, Trump slapped a 125% tariff on Chinese imports, with China retaliating with countermeasures, pushing the duties up to 145%. Although a temporary truce in May did provide some relief and reduced the tariff rates to 30% and 10%, respectively, the investors still remain cautious about a final resolution being reached.

In such circumstances, there has always been a warranted consideration of crypto as a hedge. The market waits for signals now about the possibility of this trend repeating itself.

Cryptocurrencies are enjoying record participation in a world filled with tension globally. According to data from Santiment, Ethereum ($ETH) remains at the top with over 148.38 million holders, followed by Bitcoin ($BTC) with 55.39 million. There's an accelerated adoption trend for altcoins like Dogecoin (7.97M), Tether (7.79M), and XRP (6.53M).

The huge spike amounts to a change in investor mentality-as fiat systems are being scrutinized heavily, digital assets are becoming the go-to store-of-value and an alternate investment vehicle.

If positive agreements come out of trade talks between the US and China on Monday, then a cooling effect could develop upon the crypto markets. Reduced economic uncertainty often produces stable asset performance. Here, Bitcoin may consolidate around $100,000-$105,000, while Ethereum wavers between $2,400-$2,500.

On the other hand, if the talks do not go anywhere or new tariffs are installed, fear and volatility will take center stage. Historically, such cases tend to bring an investor frenzy onto decentralized assets. The implication would be a sharp rally by Bitcoin toward the $110,000 resistance level or making a new all-time high, while Ethereum would likely be pushed back higher to $2,750 or $3,000 as the flight-to-safety play.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.