A very exciting time is anticipated currently in the Pi Network community, with the expectation of some major announcements on May 14, at Consensus 2025. Having strong rumours of perhaps a token burn, an ecosystem fund launch, or an exchange listing, PiCoin began exhibiting some bullish momentum. The technical analysis performed lately, in conjunction with this highly anticipated news, essentially gestures toward an ongoing breakout.

Let's delve into the more likely scenarios, their impact on price action, and to which extremes could scale within the days to come.

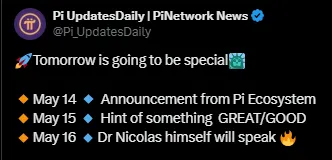

According to a series of posts by Pi Updates Daily, May 14–16 is a very significant time for the network. The following is expected by the community:

May 14: Big announcement about the ecosystem

May 15: "Something good" teased to be revealed

May 16: A speech by the founder, Dr. Nicolas Kokkalis

It was hinted by the PiCore Team that today's news revolves around the PiEcosystem. So this has led to the building of speculation around whether the PiNetwork Ecosystem Fund could be announced to incentivize developers to build decentralized applications (dApps) on the platform.

Solana: $300M ecosystem fund

Polygon: $415M ecosystem fund

Aptos, Arbitrum, Avalanche: Multi-million-dollar grant programs

With Pi currently struggling to retain developer traction, this well-calibrated move will provide the foundation for long-term growth, particularly in the areas of DeFi and GameFi.

The rumour of an exchange listing has been generating tremendous hype. While Picoin is already listed on MEXC, BitMart, and OKX, it is still not listed on top-level exchanges like Binance, Kraken, Coinbase, and Upbit.

Furthermore, exchange listings are usually announced by exchanges but not by projects. This is why an announcement from PiNetwork itself is a less likely event, though still a wildcard.

Therefore, any listing of PiCoin on any major exchanges would almost have to result in a price explosion. Remember Orca; it went up more than 200% in 1 day upon its listing on Upbit.

Another situation in the pipeline is a PiCoin token burn, where a large quantity of tokens would be transferred to an unusable wallet. This move reduces the amount available for circulation, which usually has the tendency to induce a sudden price surge.

With more than 1.3 billion tokens due to be released in 2025, an on-time token burn would balance the ecosystem and assuage investor worries of inflation.

Taking such an action would send a powerful message to the community and could be a leading short-term bullish catalyst.

From a chartist's point of view, the altcoin seems to be forming a typical Elliott Wave pattern, now moving through Wave (3) after the dramatic breakout from long-term consolidation at the $0.40 level.

Important levels to track:

Wave 1 high: $1.0968 (23.6% Fibonacci level)

Wave 3 target: $2.05 (61.8% Fibonacci level)

Wave 5 target: $3.00 (100% Fibonacci extension)

Source: TradingView

The RSI is way above 76, confirming bullish momentum, and the MACD is exhibiting a bullish crossover, further in favour of the uptrend. Sentiment must be good if this continues; particularly following today's news, the altcoin may test the $2.5 to $3.0 region in the near term.

With three significant announcements set for this week and strong bullish technical indications, the coin is in store for a massive move. While its exchange listing or token burn could cause a day-of-the-week drama, even an ecosystem fund can help create long-term value for the project.

Investors will need to pay their very close attention to the Consensus event and follow-up Pi Core Team release. Short of a derail, as expected, the coin may be one of the leaders of the week, potentially bursting up through to $2.50 to $3.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.