XRP traded at $3.01 on August 19, rising 1.31% in the past 24 hours but falling 3.93% over the week.

According to analyst EGRAG, a monthly close above $3.30 would serve as a crucial launching pad and activate the next measured moves.

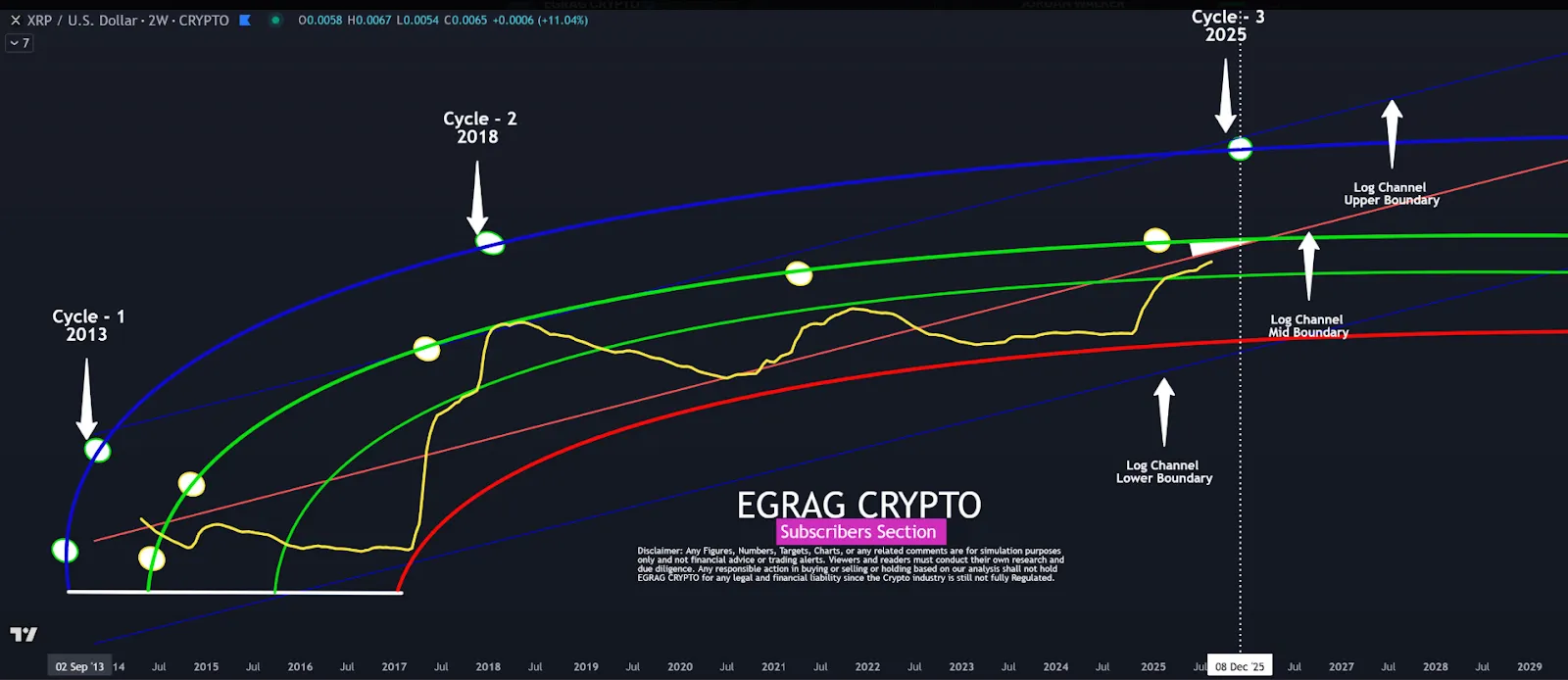

EGRAG applied the linear regression analysis to a log scale on a two-week chart to point out potential outcomes by December 2025.

XRP 2-week chart : Source : X

The model positioned the direction of XRP within a bent fork pattern, and price was shifting towards the mid and upper limits of a long-term log channel.

One more monthly chart of EGRAG revealed that the altcoin tends to have two major rallies per cycle.

During the 2017 cycle, Ripple initially broke out to a high of $0.39 in May and followed with a consolidation period before rallying to a high of $3.30 within eight monthly bars.

In the 2020-2021 cycle, the Ripple token initially hit a high of $0.79 in November, consolidated, and then hit a high of $1.96 five months bars later.

XRP cycle : Source : X

EGRAG notes that the same structure is evident once more, with the token peaking at $3.4 in January 2025. This cycle, that started after April 2024, may resemble these previous cycles and may precondition a second and larger peak later in 2025.

His cyclical model was also consistent with his linear regression channel, estimating that XRP is still on course to retest upper channel limits sometime in late 2025.

The similarity between the historical cycles and regression analysis supported the argument that more rallies were to come.

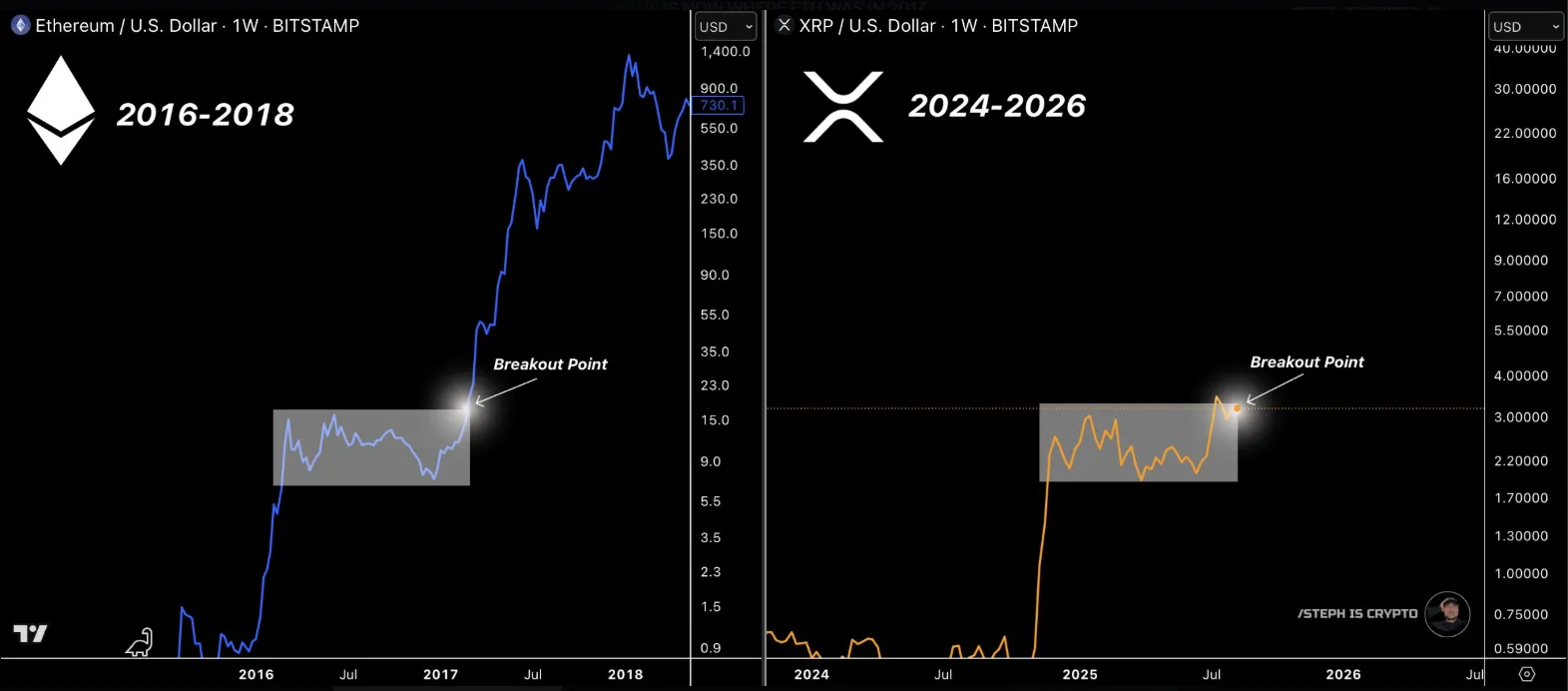

Analyst Steph_iscrypto compared the structure of the altcoin to the price action of Ethereum in 2016–2018. The research implied that the altcoin is currently in the same position that Ethereum was prior to its 20-fold increase.

XRPvsETH : Source : X

The chart indicated that XRP was consolidating around the price of $3, just like ETH around the price of $15 before it broke out.

In addition, CryptoWZRD emphasised near-term technical indicators, which showed a dragonfly doji on the daily Ripple chart, which is commonly associated with bullish continuation.

Source : X

Source : X

He indicated that the next intraday resistance will be at $3.23 and a break above this level will be the opening to the level of $3.65.

Nonetheless, the analyst observed that short-term pullback is still possible before continuation is achieved.

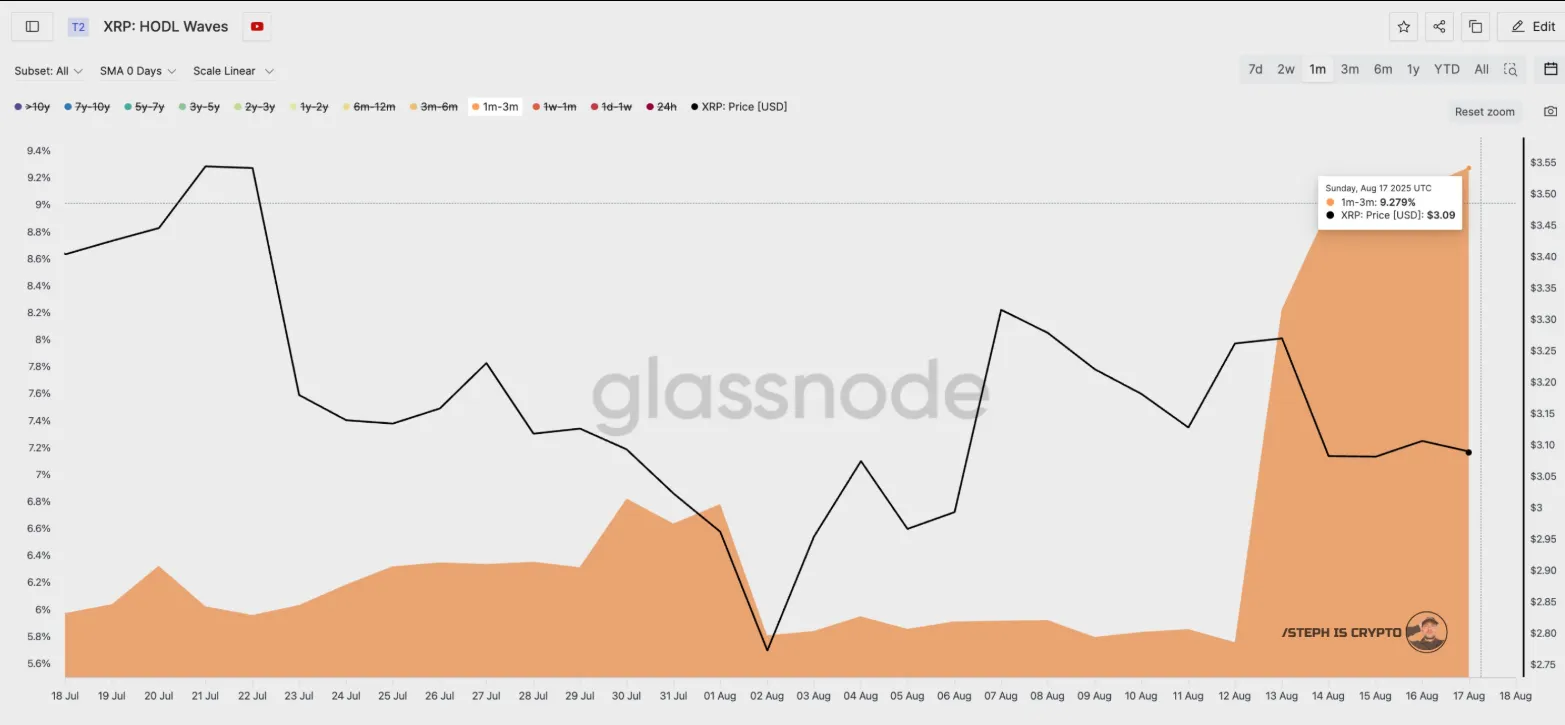

In other news, Glassnode data indicated that the number of short-term XRP wallets surged in the last two weeks.

The proportion of wallets that contain Ripple token in a one- to three-month range increased to 9.3% as compared to the 5.8% previously, which is an indication that retail investors have been stocking up during market corrections.

HODL Waves : Source : glassnode

This shift in distribution meant that smaller holders were increasing their positions and this helped in the buying activity despite the wider volatility.

The increase in short-term wallets showed a new confidence in the retail side towards the near-term prospects of the altcoin.

Ronny Mugendi is an experienced crypto journalist with four years of professional expertise, having made substantial contributions to multiple media platforms covering cryptocurrency trends and innovations. With more than 4,000 published articles to his name, he is dedicated to informing, educating, and bringing more people into the world of Blockchain and DeFi. Beyond his journalism work, Ronny finds excitement in bike riding, enjoying the adventure of exploring fresh trails and landscapes.