At the time of writing, XRP price was trading at $3.23, with strength after breaking the significant resistance at $3.27; analysts are now forecasting a significant upside.

Several chart patterns, technical indicators, and market statistics are all indicating a possible rise to 3.60 and above.

But the forecasts are mixed, with some predicting a retest of higher prices such as $5.21 and others forecasting potential longer-term tops in the double digits.

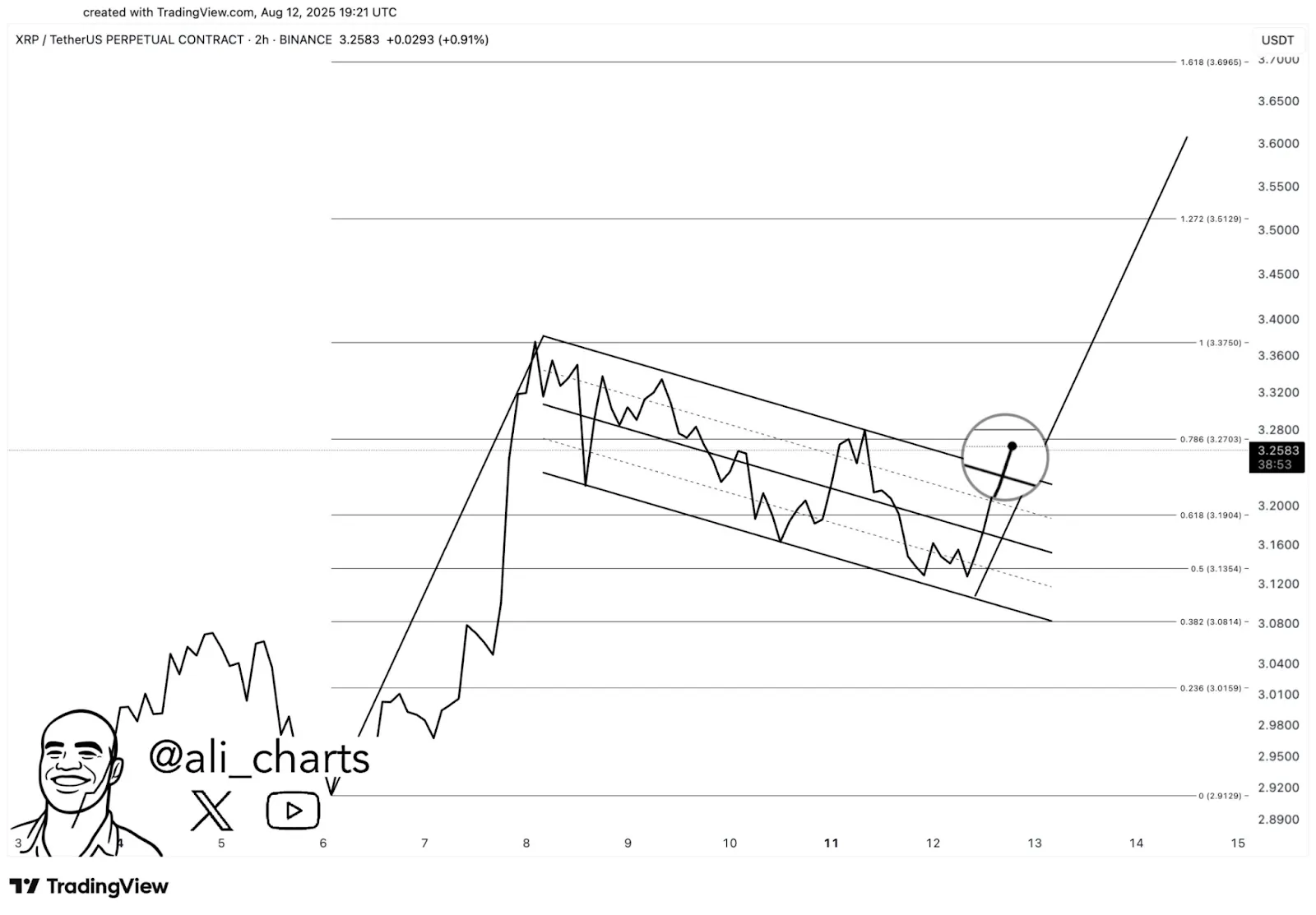

Analyst Ali Charts pointed out that Ripple price has a vital resistance at $3.27 and a breakthrough would lead to the potential of $3.60. The asset has breached the descending channel resistance and has been facing the 0.786 Fibonacci retracement at 3.27.

Source : X

Ali observes that staying above the breakout level would affirm bullish continuation patterns on the lower time frames.

Egrag Crypto has described a double-bottom pattern, which complies with a long-term bullish Ripple price thesis. His chart forecasts a long-term movement based on the breakout point, which may have double-digit targets in the long run.

Source : X

Nevertheless, he warns of possible cyclical retracement, citing analysts who have predicted a cycle high at around 4.13 and a substantial bear-market correction. The described sweet spot target implies the progressive offloading approaches in rallies.

Xaif Crypto identified a massive cup and handle pattern on the daily chart with the next bullish target at the price of 5.21. Depending on the depth of the pattern, the breakout may drive Ripple market cap above 306 billion.

Source : X

According to the analyst, projections further indicate that XRP might breach the $10 mark in case a prolonged bullish run is sustained due to increased market participation and adoption.

Moreover, derivatives market indicates that the Ripple open interest increased by 4.83% to reach $8.33 billion, whereas options open interest increased by 19.26% to $1.24 million. Spot trading volume dropped by 14.19% to $10.94 billion.

Options volume decreased drastically by more than 70%, an indication that traders are moving towards holding as opposed to speculative positioning. Increasing price stability with an increase in the open interest is usually indicative of continued buying pressure.

In other news, Versan Aljarrah, co-founder of Black Swan Capitalist, talked about possible long-term XRP plans with crypto tax attorney Andrew Gordon, and the advantages of using XRP as collateral, rather than selling.

https://x.com/VersanAljarrah/status/1955430537277170097

This is one way of releasing liquidity that does not attract capital gains tax since there is no taxable sale. As Gordon emphasised, it is essential to consider the repayment capability, but the loans of this kind are tax-efficient.

The use of this strategy has already been proven in the real markets, as wealth manager Digital Wealth Partner recently borrowed a seven-figure sum using XRP as a collateral.

Aljarrah also cited the Ripple RLUSD stablecoin as a future facilitator of wider collateral-based lending services.

Market commentator Cypress Demanincor and other advisors have recommended investors borrow against Ripple or lend XRP to keep the long-term upside potential. This allows them to meet short-term liquidity interests.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.