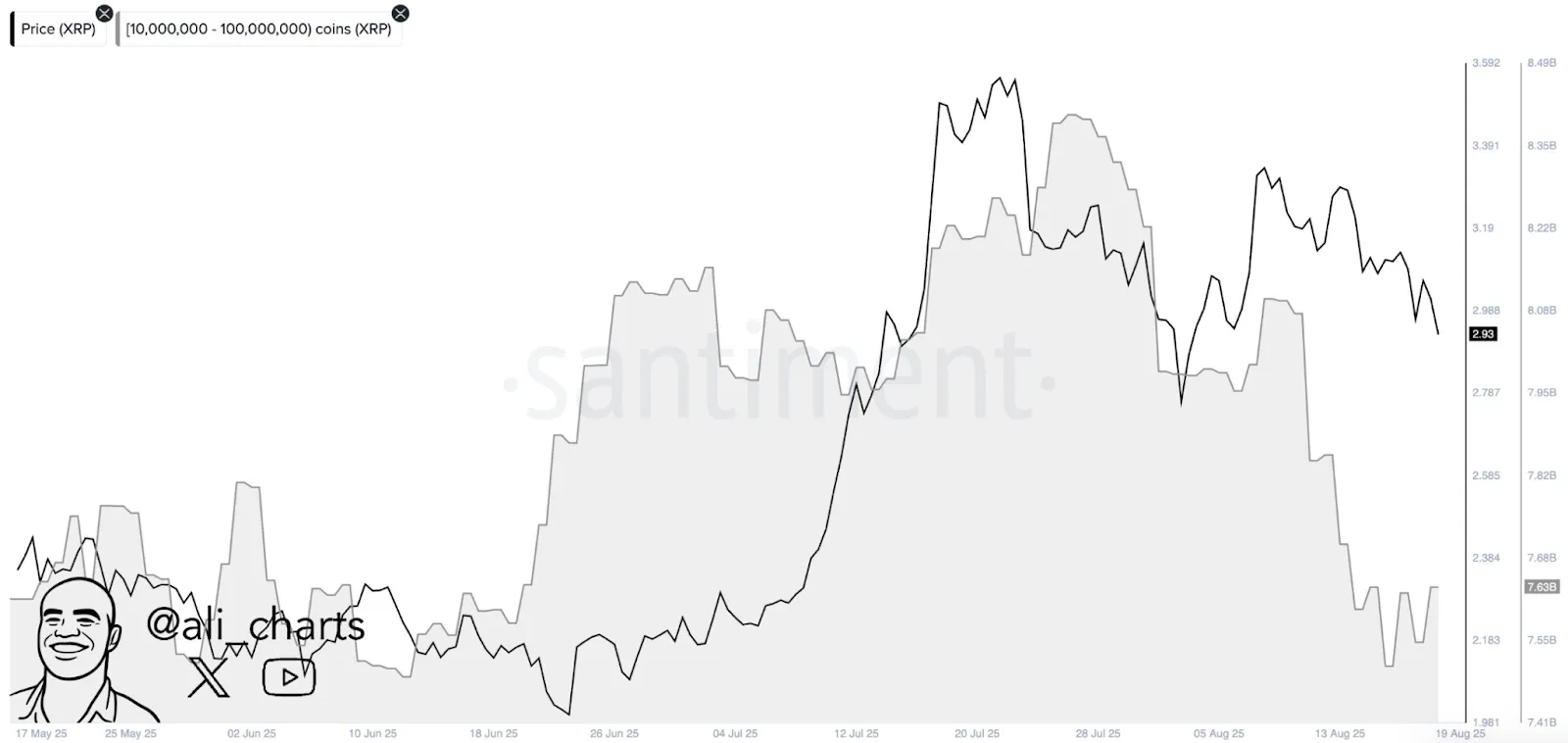

The XRP price has come under notable pressure as large holders trimmed their balances aggressively.

Over the course of the last ten days, whales possessing 10–100 million tokens sold roughly 470 million XRP. The large-scale selloff took place amid a price slide that pushed the token beneath $3.00.

Source : X

At the same time, whales with balances ranging from 1 million to 10 million tokens added roughly 130 million Ripple to their portfolios.

The contrast between the actions of large- and small-scale investors underscores the market’s mixed sentiment.

Looking back, the market’s price movements have frequently echoed the actions of the largest whales, underscoring how pivotal their moves are to near-term direction.

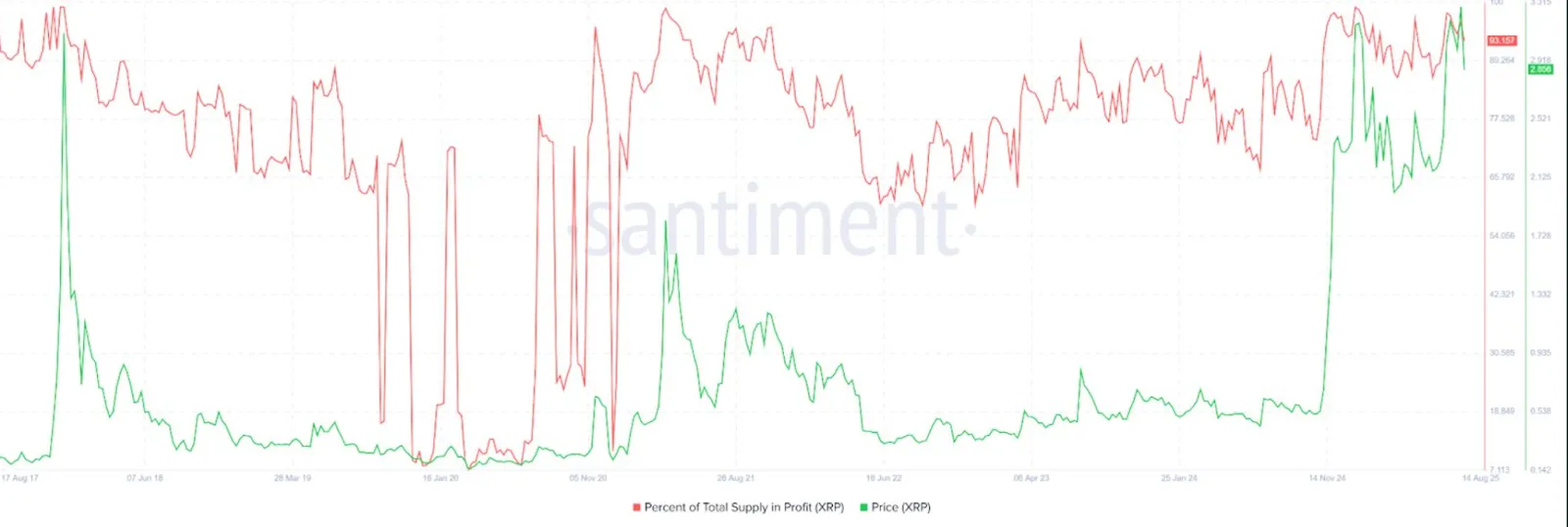

Even amid the recent slump, Altcoin continues to boast among the strongest profit margins of the major cryptocurrencies.

More than 93% of the circulating supply continues to stay in profit, and it has maintained an average margin above 90% since mid-July.

Source : X

The prolonged spell of profitability commenced once XRP surged on positive regulatory news and the conclusion of Ripple’s legal clash with the SEC.

However, extended profit margins at these elevated levels can frequently prompt broad selling as investors look to lock in gains.

Since November, the average profit margin has never dipped beneath 80%, thereby setting the stage for a bearish shock to accelerate profit-taking.

Institutional Moves and Regulatory Delays

The SEC pushed back several ETF applications—among them the Nasdaq CoinShares filing—to October.

The decision dampened institutional confidence, prompting several major investors to hold back until regulatory clarity is established.

Moreover, a separate audit placed the XRP Ledger at the bottom of 15 major blockchains when security measures were assessed.

The unfavorable findings re-ignited a wave of skepticism among institutions that had only recently contemplated taking exposure.

Collectively, the postponement of ETFs and the poor security audit results inflicted twin blows on Altcoin, driving the price to sharper declines.

On August 19, the token dropped 4% in a sharp two-hour selloff, falling from $3.04 to $2.93.

Market positioning data points to a split outlook. The total volume of Altcoin derivatives climbed 6.25% to $9.21 billion, underscoring continued speculative activity.

Yet open interest fell 3.72% to $7.57 billion, indicating that traders are adopting a cautious stance.

Simultaneously, options volume declined by roughly 7%, while open interest leaped more than 56%. Collectively, the data indicate that traders stay engaged, yet they are adopting a more selective approach to positioning.

Long-to-short ratios across the major exchanges remain distinctly bullish. At Binance, the account ratio is 3.45, while on OKX it sits at 2.61.

Data for top traders likewise points to a bullish bias, with Binance accounts maintaining ratios above 1.9.

Even so, the 24-hour aggregate long-to-short ratio across platforms still sits just below 1.0, implying that while optimism endures, it is delicate.

Short-term weakness is indicated by the technical signals. The four-hour chart of XRP indicates significant resistance at $3.00 and a key support area at $2.70.

Recent price action suggests that there may be more selling pressure in the event that support is tested. The momentum indicators such as MACD are still giving bearish crossings, further strengthening the downtrend.

XRP Price Analysis : Source : TradingView

Provided that the $2.70 support level is maintained, XRP can recover by more than 10% and drive the price up to the $3.00.

But when this support is breached, then declines may continue further, and this could wipe out some of the gains experienced earlier in July.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.