XRP crypto is trading at $3.05 with a 2.51% increase in the last 24 hours. Nevertheless, price stability is accompanied by a worrying tendency of large holders, as on-chain data indicates.

Last month, whales sold 1.91 billion Altcoin, which has triggered the fear that a wider correction may be on the cards.

According to CryptoQuant data, whales have decreased their Altcoin crypto holdings by 640 million tokens since July 9.

The aggregate of these outflows in current prices is more than $1.91 billion. The majority of the selling took place when Altcoin was in the price range of between $2.26 and $3.52.

XRPL - Whale Flow 30DMA : Source : CryptoQuant

It is the second time in a year that big wallets dumped holdings in the price rallies. During one such case in November through January, Altcoin rallied 103% to $3.27 as whales scaled back.

The price correction that followed that period implies that there may be similarities to the present situation.

According to a CryptoQuant analyst, Altcoin crypto would continue to be structurally weak unless whale addresses were to experience daily sustained inflows of more than 5 million Altcoins.

There have been no regular indicators of mass accumulation at this point.

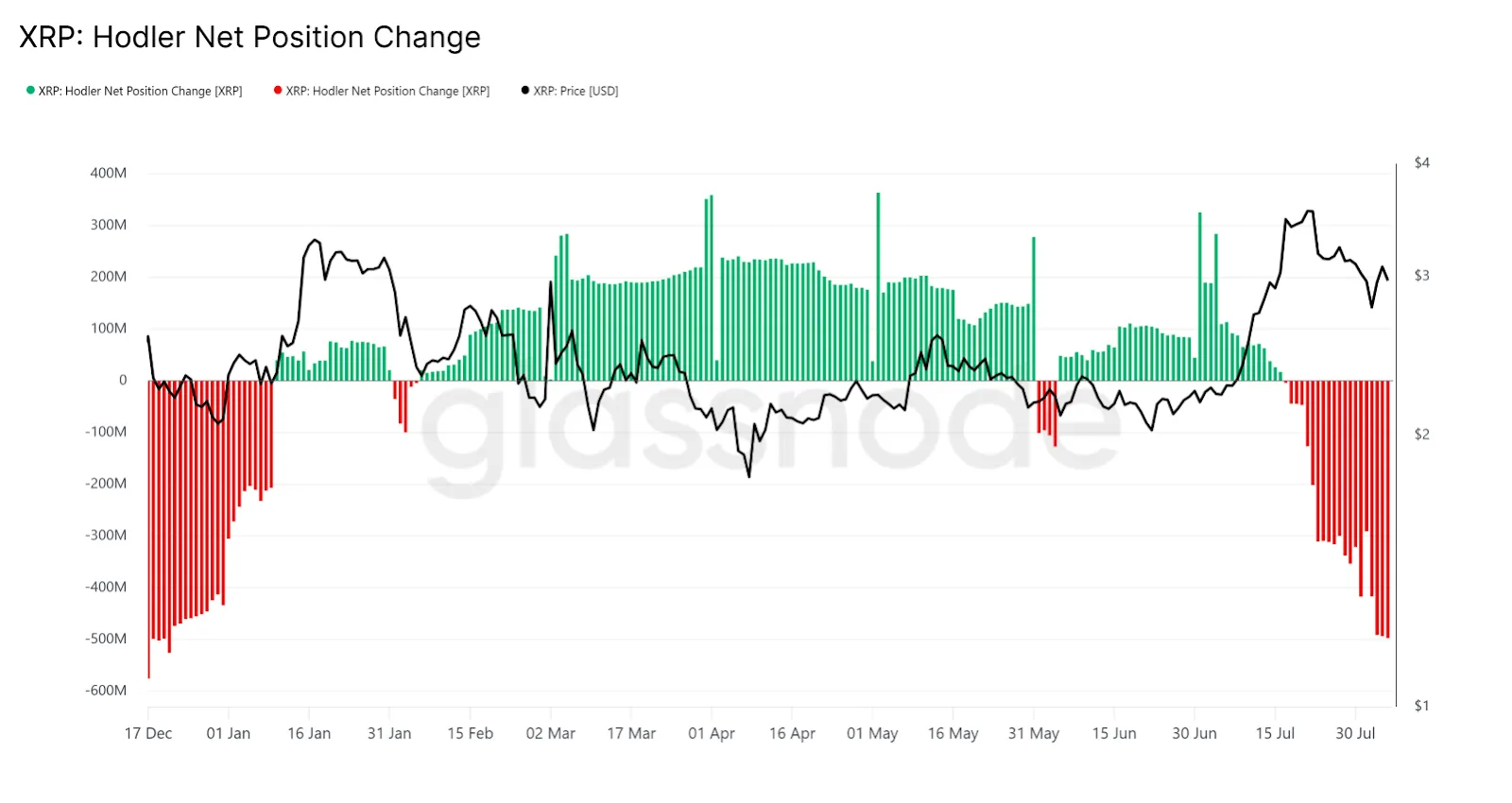

Additionally, Glassnode statistics show that XRP crypto hodlers are quickly liquidating their positions. Net position change has turned sharply negative, reaching levels last seen seven months ago.

The decline started in the middle of July and has picked up pace in the beginning part of August.

XRP Holder Net Position Change : Source ; Glassnode

The net position change was primarily positive and recorded a steady accumulation in January-June.

The green bars denoted inflows of more than 200 million Altcoins at peak times. These inflows were accompanied by a price range of 2.4 to 3.20.

Red bars prevail in the chart at present, with daily net outflows over 500 million Altcoins.

This movement indicates less long-term holder confidence and increased sell pressure. The trend is similar to the previous instances of decline after large distribution.

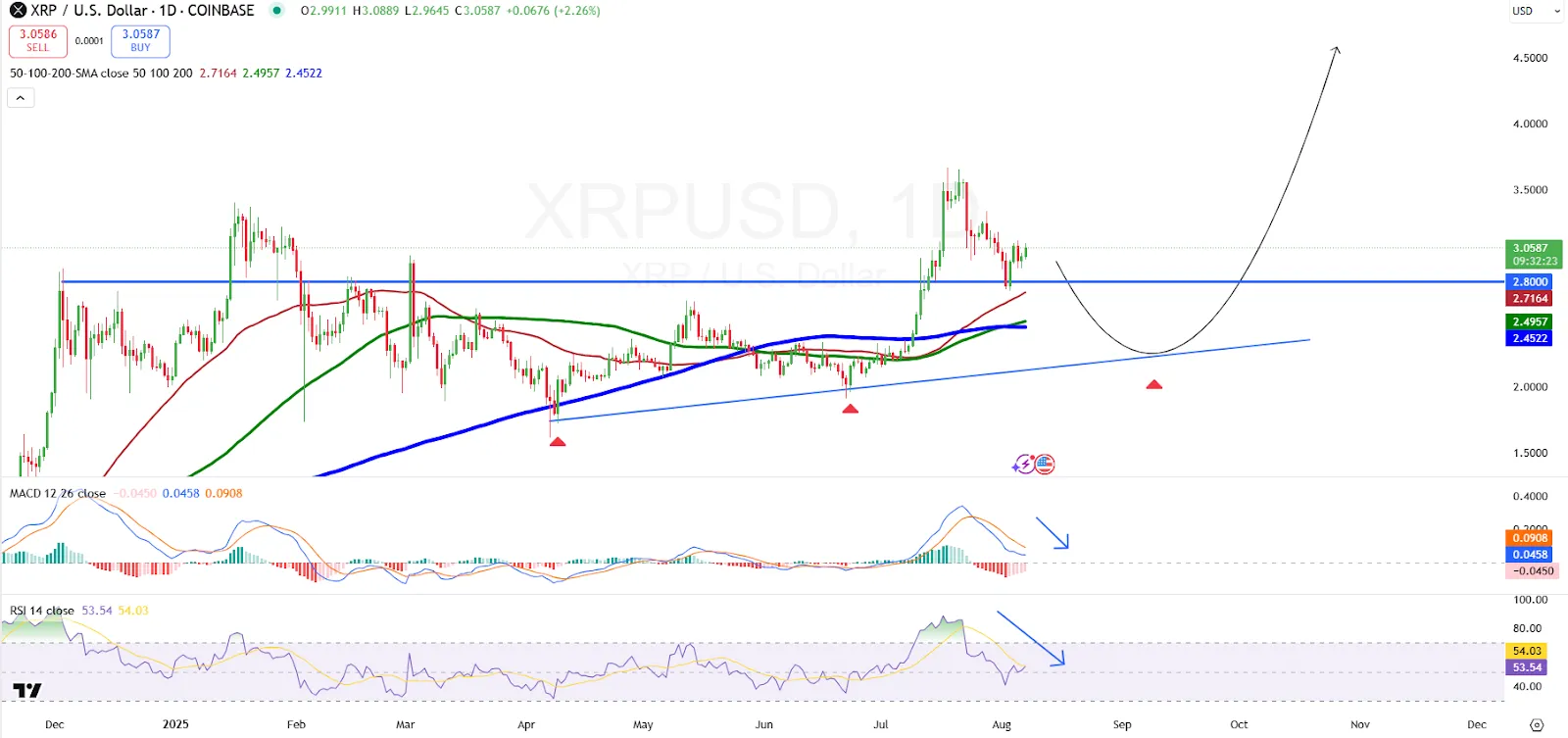

XRP is trading above $2.90, flipping the $3.00 range into support for the first time on the daily chart. Price action suggests that if $2.90 fails, the next major support lies at an ascending trendline around $2.20.

This trendline has supported price recoveries multiple times over the past six months.

Each touch resulted in a bounce, showing its technical relevance. However, a breakdown may expose Altcoins to deeper losses toward $2.00 or below.

XRP Price Analysis : Source : X

Momentum indicators reflect weakening bullish strength. The MACD line has declined to 0.0458, with the signal line at 0.0908, signaling a bearish crossover. RSI has also dropped to 54.03, down from previous levels above 70.

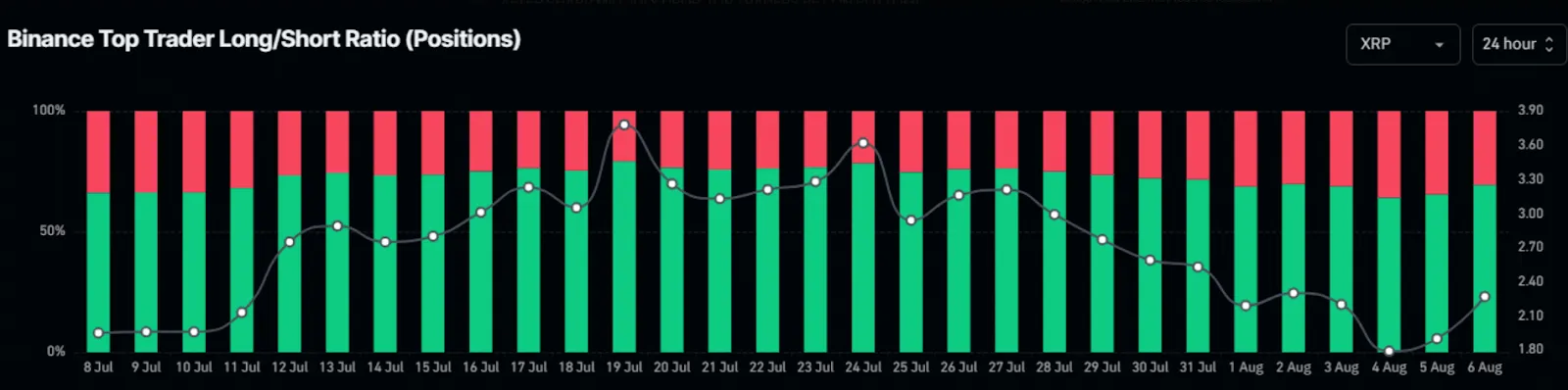

According to Coinglass data on the 4-hour chart, 69% of traders on Binance have long positions on Altcoin.

This follows a steep drop in the middle of July, which shows a newfound optimism in the top accounts. Longs have surpassed shorts by a great extent.

XRP Binance Top Trader Long/Short Ratio : Source : Coinglass

This change in the derivatives' positioning indicates that certain traders anticipate a change of direction in the XRP price despite the recent exits of the whales. The surge in long interest could be anchored on the perceived support at $2.90.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.