Michael Saylor’s latest tweet, “Bitcoin is money. Everything else is credit,” has reignited the global crypto conversation. While simple at first glance, this bold statement sums up the billionaire’s long-standing belief that Bitcoin is not just an investment, it is the future of money. As more countries and companies take steps toward adopting Bitcoin as a financial reserve, Saylor’s vision is starting to look more like reality than theory.

Source: Michael Saylor X Handle

To understand why Saylor places Bitcoin above all other assets, we need to look at what he really means by “money.” In his view, real money must hold its value over time, not be controlled by any central authority, and be impossible to debase. Bitcoin fits that description. It has a fixed supply of 21 million coins and operates independently of banks or governments.

Everything else, according to Saylor, fiat currencies, debt instruments, or even altcoins, relies on trust, policy, or inflation. That's why he calls them “credit.”

During his recent keynote at Bitcoin Prague 2025, Saylor stunned the crypto world by claiming that one Bitcoin could be worth $21 million by 2046.

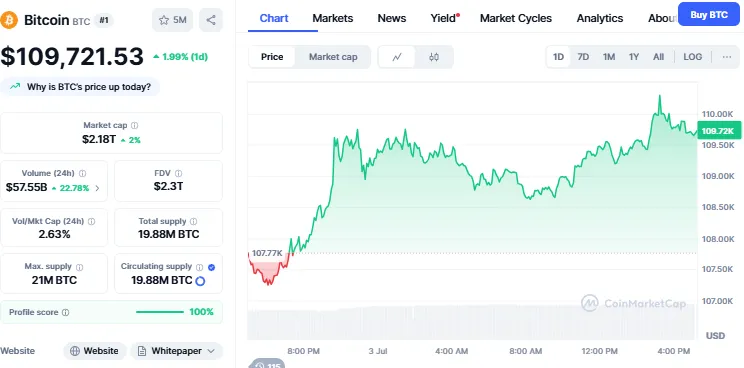

At a time when BTC was trading around $108,000, the number seemed wild, but it was backed by strong logic. Saylor said, “We are going to be at $21 million in 21 years... maybe the only time in Bitcoin’s history where such long-term clarity is visible.”

This statement wasn’t just a guess. It reflected his confidence that Bitcoin will become the ultimate store of value in a world filled with economic uncertainty and growing national debt. The currency is now trading at $109,721.53 with an increase of almost 2%, while the trading volume has increased by 22%.

Source: CoinMarketCap

Michael Saylor’s belief in Bitcoin is not new. Back in 2020, he invested $250 million of MicroStrategy’s funds into Bitcoin, buying it at around $11,000 per coin. This was during a time when many investors still saw Bitcoin as risky. When BTC crossed $60,000, MicroStrategy’s holdings turned into billions in profit. But the road wasn’t smooth. In 2022, when Bitcoin fell to $20,000, critics questioned Saylor’s judgment. Yet, he stood firm and refused to sell.

In 2024, his company bought 1,070 more BTC, and by 2025, MicroStrategy owned 592,100 coins valued at $60.11 billion. Saylor summed up his strategy perfectly: “Buy, Hold, Never Sell.”

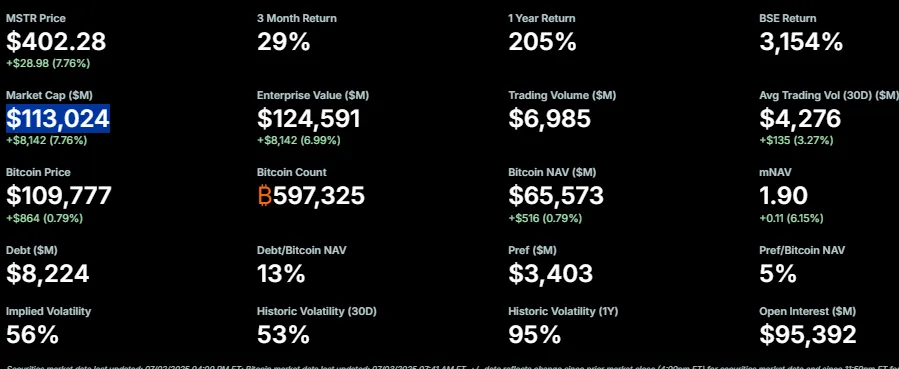

Michael Saylor’s Approach Boosted MSTR Stock

The Bitcoin buying strategy has worked in favour of the organisation as within a year the MSTR stock has seen an increase by 272%. The company has done exceptionally well in the previous months, this makes them potential to join the S&P 500 soon. The company has become the 95th largest company by market cap of $113,024. The current price of the stock is $402.28.

Source: Strategy (MSTR)

Though most were skeptical of Saylor's plan initially, the globe is starting to take his cue. Numerous states and nations are instituting strategic Bitcoin reserve, viewing BTC not only as an asset but also a national security. The United States is considering the BITCOIN Act, which would allow the Treasury to purchase up to 1 million BTC over a five-year period to assist in the reduction of national debt.

Texas is nearing the passage of Senate Bill 21, North Carolina just signed the Strategic Bitcoin Reserve Bill, which allows the state to invest in funds associated with BTC. Bhutan's state-owned company, DHI, transferred millions of BTC to Binance, with evidence of active reserve management. India is mulling over a national Bitcoin reserve, and a government spokesperson is calling for swift action to remain at the forefront of the digital trail.

These actions demonstrate that what was previously a niche concept is slowly becoming mainstream policy. Nations are now starting to use Bitcoin as a means to secure national wealth.

Why are these institutions and governments looking to Bitcoin now? The answer is easy: inflation. Central banks across the globe have printed trillions of dollars over the last few years, devaluing standard currencies. Bitcoin, with its capped supply, is a haven.

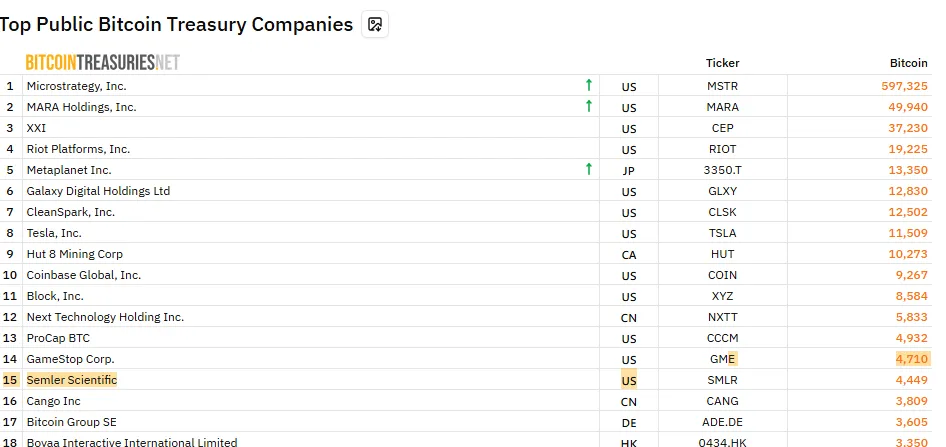

Corporations are also increasing their Bitcoin purchases, not just for profit, but to protect their reserves from inflation and financial instability. As Microstrategy is the top Bitcoin holder, other major names in the list are Japan's Metaplanet, Twenty One Capital, Riot Platforms, Coinbase, Semler Scientific, and Tesla.

Source: Bitcoin Treasuries Net

Source: Bitcoin Treasuries Net

Saylor saw this years ago. His famous tweet, “Borrow billions, buy Bitcoin,” was once mocked, but now looks prophetic.

Saylor’s latest statement, “Bitcoin is money,” goes beyond economics. It's a call to view Bitcoin not just as an investment, but as a strategic asset for national and personal freedom. He believes Bitcoin is hope, a term he used in another viral tweet during a time of market panic caused by war tensions.

It made the investors more hopeful and his message can be the reason why the market recovered slightly.

In a world where currencies may collapse, savings may be canceled out by inflation and so are accounts by governments, Bitcoins can provide a form of financial freedom. That is why Saylor named it, “hope” and why many are now listening to it.

The Buy, Hold and Never Sell is a basic strategy put up by Saylor that has not only improved MicroStrategy as one of the discussed institutions in crypto but also set a direction that other institutions and even nations can follow. He is beginning to be vindicated as he thought Bitcoin is the purest form of money not only through price charts but also according to global policymakers who are changing in a significant way.

Whether it indeed reaches the mark of 21 million or not, Saylor has already managed to alter the very concept of money people have. And with more governments, businesses and even citizens joining his bandwagon, it remains apparent that the world is gradually getting its way towards a Bitcoin standard.

Sourabh Agarwal is one of the co-founders of Coin Gabbar and a CA by profession. Besides being a crypto geek, Sourabh speaks the language called Finance. He contributes to #TeamGabbar by writing blogs on investment, finance, cryptocurrency, and the future of blockchain.

Sourabh is an explorer. When not writing, he can be found wandering through nature or journaling at a coffee shop. You can connect with Sourabh on Twitter and LinkedIn at (user name) or read out his blogs on (blog page link)

6 months ago

🙃🙃🙃🙃🙃