Michael Saylor's Firm, Strategy (MSTR), (formerly Microstrategy) is just days away from possibly making it into the S&P 500. Financial analyst Jeff Walton says there's a 91% chance the company will qualify by the end of Q2 2025, as long as Bitcoin stays above $95,240 through June 30.

Source: Jeff Walton X Handle

The S&P 500 is a ranking of the 500 largest United States-based publicly traded companies. There are rules which the companies must satisfy in order to secure their entry. Among them is the ability to demonstrate positive earnings in the past four quarters.

If BTC stays strong, the Michael Saylor company could end Q2 with enough profit to pass the earnings test.

Walton explained that Strategy’s huge Bitcoin holdings, 592,345 BTC as of June 22, will help boost its earnings if the currency stays above the critical $95,240 level. Any big price drop before June 30, though, could ruin its chances.

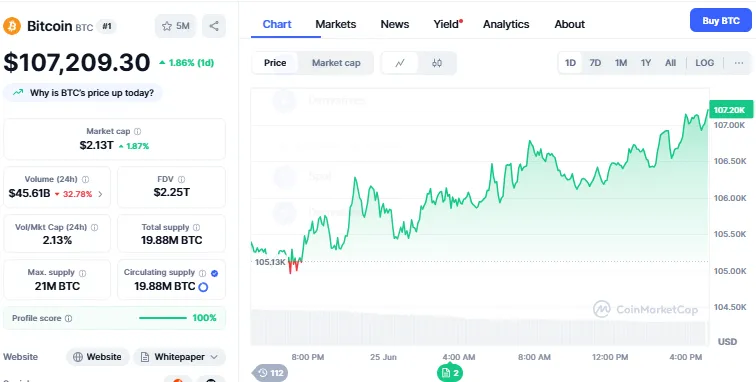

At the time of writing, Bitcoin is trading around $107,209, with an increase of 1.88% within the last 24 hours, giving the organisation some cushion above the danger zone. However, recent tensions between Iran and Israel briefly pushed Bitcoin below $100,000, showing how fast things can change.

Source: CoinMarketCap

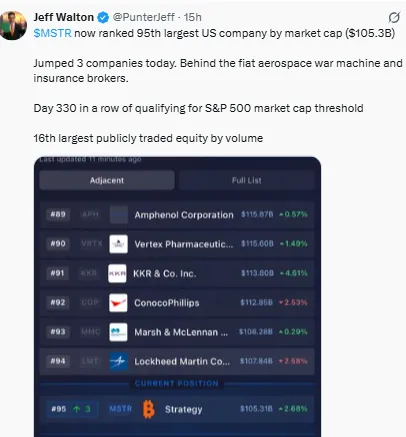

Strategy is currently the 98th largest U.S. public company, with a market cap of $102.5 billion. That’s down two spots from yesterday. The company has now met the market cap requirement for 329 days in a row, making it eligible in terms of size.

Source: Jeff Walton X Handle

It’s also the 13th most actively traded stock by volume, showing strong investor interest. Just last week, the company added 245 more BTC for $26 million, buying each coin at around $105,856. Michael Saylor firm Strategy’s Bitcoin portfolio has returned a 19.2% gain year-to-date in 2025.

Source: Michael Saylor Portfolio Tracker

If Strategy were added to the S&P 500, it would be the second crypto-related company to be added this year. In May, Coinbase made buzz after qualifying itself to the S&P 500, which many viewed as a win for the crypto community. Strategy could also experience a massive increase in the MSTR stock price after entering S&P.

Crypto advocates point to such times as the ones in which the space becomes accepted in mainstream finance. Michael Saylor, one of the biggest Bitcoin proponents, has wagered huge bets on Bitcoin becoming core to his company's strategy, and it is working so far.

With only a few days left in the quarter, all eyes are on the price of BTC. in case the coin remains in the price range above $95K, Strategy could become a part of the most significant stock index in the United States. This would give increases in publicity, new investors and credibility to the company of Michael Saylor and the crypto market in general.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.