The Mutuum Finance presale is showing strong momentum as early-stage investors continue searching for the best crypto presale 2026 opportunities. With a total supply of 4 billion tokens, the project has already raised $20.60 million, reflecting growing demand across each presale phase. Currently priced at $0.04, MUTM has attracted over 19,000+ holders, and 16% of the tokens allocated in the ongoing phase are already sold, while still remaining discounted compared to upcoming phases.

As decentralized finance (DeFi) continues to expand, lending and borrowing protocols are becoming a key pillar of the ecosystem. The Mutuum Finance presale focuses on real utility rather than hype, emphasizing structured tokenomics, strong security, and long-term ecosystem growth. This utility-driven approach positions the project as a competitive contender in the evolving 2026 crypto presale market.

Mutuum Finance is a decentralized lending and borrowing protocol. It offers both P2C (peer-to-contract) and P2P (peer-to-peer) models. Users can supply assets and earn interest. They can also borrow assets by depositing collateral. The system uses an overcollateralized model to reduce risk.

The native token, MUTM, powers the system. It supports rewards and helps maintain platform stability. The design avoids heavy governance layers, which keeps the system simple and user-focused. Mutuum supports different asset types, from stablecoins to meme tokens. The platform focuses on safety, easy use, and strong risk control.

Peer-to-Contract (P2C) Lending

Users deposit crypto into shared liquidity pools. Borrowers access funds by locking collateral. Smart contracts manage the full process. This makes lending automatic and transparent.

Peer-to-Peer (P2P) Lending

Mutuum also allows direct lending between users. This gives more flexibility. Lenders and borrowers can set custom terms. It also supports assets that may not fit into pool models.

Flexible Interest Rates

Borrowers can choose between variable rates and stable rates. Variable rates change based on market demand. Stable rates help users plan repayments. This option helps manage risk during market swings.

Non-Custodial Security

Mutuum is fully non-custodial. Users always control their funds. Smart contracts handle transactions. There is no central authority holding user assets.

Passive Income & Buyback Model

The MUTM token includes a revenue-based buyback system. This is designed to reward users and support long-term demand. It also aligns token growth with platform activity.

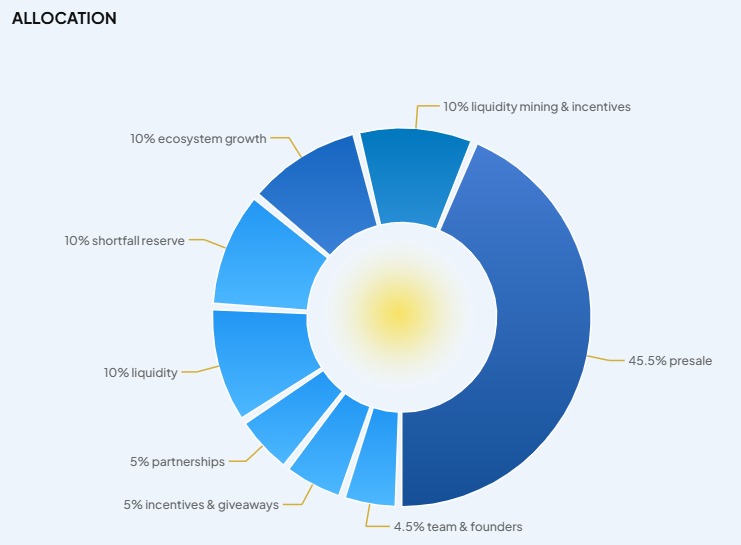

Mutuum Finance Tokenomics explains how the MUTM token supply is structured. It supports the decentralized lending ecosystem and ensures balanced growth.

Total Supply: 4,000,000,000 MUTM

Token Distribution

45.5% (1.82B) – Presale

10% (400M) – Liquidity (locked for stability)

10% (400M) – Security & Shortfall Reserve

10% (400M) – Liquidity Mining & Incentives

10% (400M) – Ecosystem Growth & Developer Rewards

5% (200M) – Partnerships

5% (200M) – Community Incentives & Giveaways

4.5% (180M) – Team & Founders

Source:- Mutuum Finance Whitepaper

This allocation gives strong priority to community ownership. It also keeps enough tokens for security, growth, and future development. The Mutuum finance presale allocation shows that early participants play a key role in the ecosystem.

Phase 1 – Introducing Mutuum

This phase starts with the Mutuum finance presale launch. It includes marketing campaigns and community giveaways. A smart contract audit is conducted. The project lists on tracking platforms. Educational content is released. An AI helpdesk is set up. A legal and compliance team is formed.

Phase 2 – Building Mutuum

Core smart contracts are developed. The DApp front-end and back-end are built. Advanced features and analytics tools are added. Risk settings are refined. Internal and external code audits continue.

Phase 3 – Finalizing Mutuum

A testnet demo is launched. A bug reporting system is introduced. Final audits are completed. Documentation is finalized. The team prepares for exchange listing and regulatory alignment. The Mutuum finance presale concludes in this phase.

Phase 4 – Delivering Mutuum

The live platform launches. MUTM is listed on exchanges. Token claims are activated. A bug bounty program begins. Institutional partnerships are formed. Multi-chain expansion and feature upgrades follow. The team grows to support long-term operations.

Buying MUTM tokens in the Mutuum Finance presale is simple. Follow these steps carefully:

Step 1 – Set Up a Wallet

Download a crypto wallet like MetaMask or Trust Wallet.

Create your wallet and store your seed phrase safely.

Fund your wallet with a supported coin such as ETH.

Step 2 – Connect & Buy

Visit the official Mutuum Finance website.

Connect your wallet.

Choose your payment currency.

Enter the amount of MUTM you want to buy.

Click “Buy Now” and confirm the transaction. Gas fees may apply.

Step 3 – View Your Purchase

After confirmation, your MUTM balance will show in the presale dashboard.

If it does not update instantly, wait a few minutes or refresh.

Step 4 – Claim Your Tokens

Once the presale ends, connect your wallet again.

Claim your MUTM tokens directly from the website.

Always use the official website. Never share your private keys or seed phrase with anyone.

Many crypto presales promise high returns. But not all have strong fundamentals.

The Mutuum finance presale stands out because:

It focuses on real DeFi utility.

It includes structured tokenomics.

It offers both P2C and P2P models.

It supports community ownership.

In 2026, investors are becoming more careful. They prefer projects with long-term vision instead of short-term hype. That is why many see this as a potential best crypto presale candidate.

The lending sector in DeFi continues to grow. Platforms that offer security, flexibility, and sustainable rewards may have strong future potential.

This content is for informational and educational purposes only. It is not financial, investment, or legal advice. Participating in any crypto presale, including the Mutuum Finance presale, carries high risk. Crypto markets are volatile, and you may lose your capital.

Always do your own research (DYOR) and consult a licensed financial advisor before investing. Never invest more than you can afford to lose.

Deepak Choudhary is a solid two years of writing experience and crypto enthusiast. He writes about blockchain games, Telegram games, and tap-to-earn platform. Like his audience, he writes with clarity, simplicity, and lots of useful tips in his articles. He helps those unfamiliar with various aspects of crypto world in a very simple way. He also provides regular updates on the fast growing world of blockchain, with great articles covering current and expected trends and guides. His writings on crypto games as well as crypto earning apps on Telegram are quite useful and informative for people novice and experienced. His aim is to help more people explore and profit from Web3 ecosystem.